Question: Explain why these are different and how the sectors in which these companies operate affect these differences. In the green box underneath, please comment on

Explain why these are different and how the sectors in which these companies operate affect these differences.

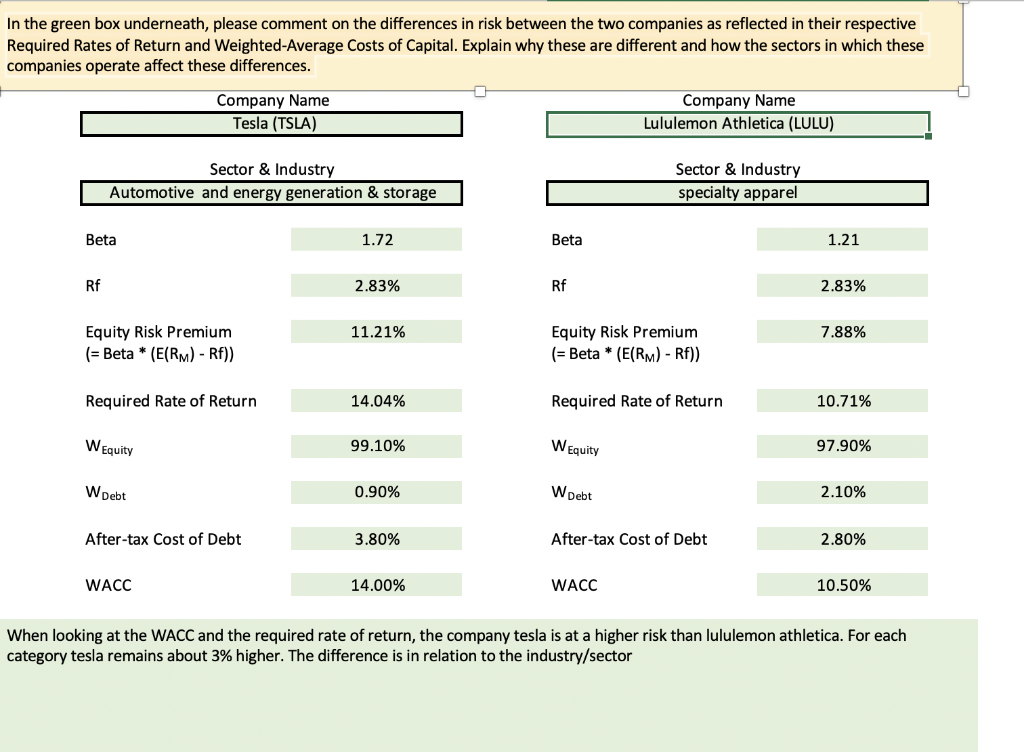

In the green box underneath, please comment on the differences in risk between the two companies as reflected in their respective Required Rates of Return and Weighted-Average Costs of Capital. Explain why these are different and how the sectors in which these companies operate affect these differences. Company Name Tesla (TSLA) Company Name Lululemon Athletica (LULU) Sector & Industry Automotive and energy generation & storage Sector & Industry specialty apparel Beta 1.72 Beta 1.21 Rf 2.83% Rf 2.83% 11.21% 7.88% Equity Risk Premium (= Beta * (E(RM) - Rf)) Equity Risk Premium (= Beta * (E(RM) - Rf)) Required Rate of Return 14.04% Required Rate of Return 10.71% WEquity 99.10% WEquity 97.90% W Debt 0.90% WDebt 2.10% After-tax Cost of Debt 3.80% After-tax Cost of Debt 2.80% WACC 14.00% WACC 10.50% When looking at the WACC and the required rate of return, the company tesla is at a higher risk than lululemon athletica. For each category tesla remains about 3% higher. The difference is in relation to the industry/sector

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts