Question: In the green box underneath, please comment on the differences in risk between the two companies as reflected in their respective Required Rates of Return

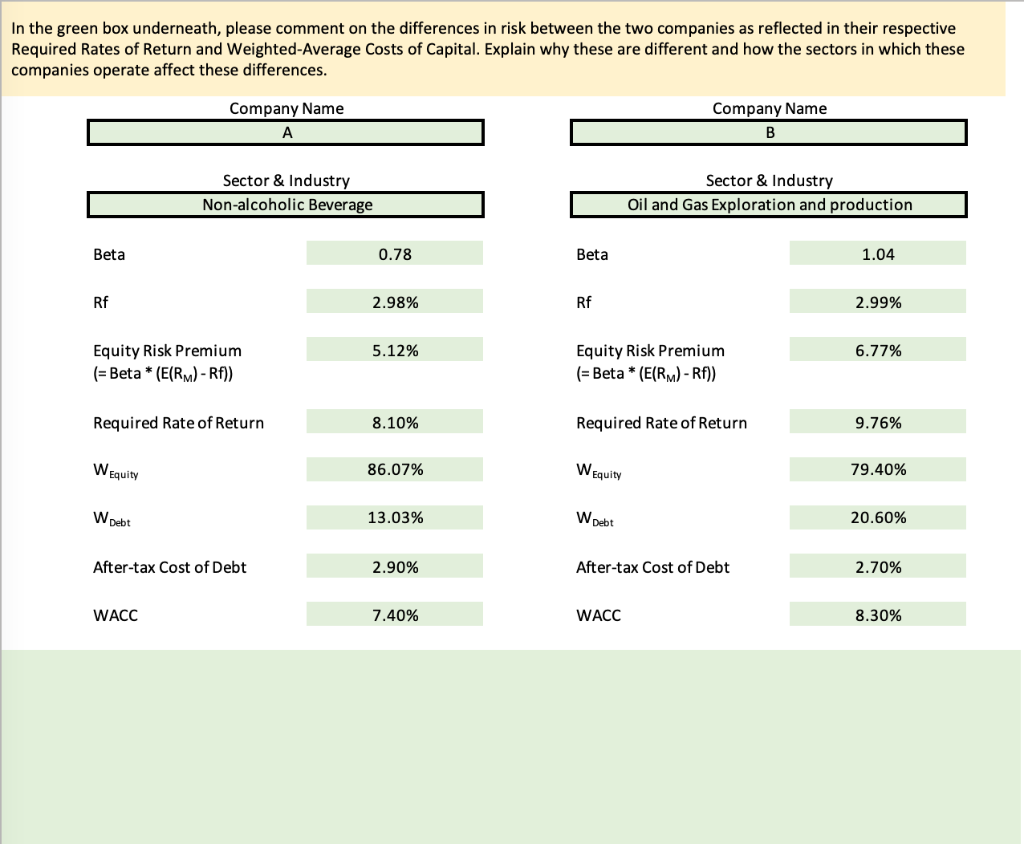

In the green box underneath, please comment on the differences in risk between the two companies as reflected in their respective Required Rates of Return and Weighted-Average Costs of Capital. Explain why these are different and how the sectors in which these companies operate affect these differences. Company Name A Company Name B Sector & Industry Non-alcoholic Beverage Sector & Industry Oil and Gas Exploration and production Beta 0.78 Beta 1.04 Rf 2.98% Rf 2.99% 5.12% 6.77% Equity Risk Premium (= Beta * (E(RM) - Rf)) Equity Risk Premium (= Beta * (E(RM) - Rf)) Required Rate of Return 8.10% Required Rate of Return 9.76% WEquity 86.07% WEquity 79.40% W Debt 13.03% W Debt 20.60% After-tax Cost of Debt 2.90% After-tax Cost of Debt 2.70% WACC 7.40% WACC 8.30% In the green box underneath, please comment on the differences in risk between the two companies as reflected in their respective Required Rates of Return and Weighted-Average Costs of Capital. Explain why these are different and how the sectors in which these companies operate affect these differences. Company Name A Company Name B Sector & Industry Non-alcoholic Beverage Sector & Industry Oil and Gas Exploration and production Beta 0.78 Beta 1.04 Rf 2.98% Rf 2.99% 5.12% 6.77% Equity Risk Premium (= Beta * (E(RM) - Rf)) Equity Risk Premium (= Beta * (E(RM) - Rf)) Required Rate of Return 8.10% Required Rate of Return 9.76% WEquity 86.07% WEquity 79.40% W Debt 13.03% W Debt 20.60% After-tax Cost of Debt 2.90% After-tax Cost of Debt 2.70% WACC 7.40% WACC 8.30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts