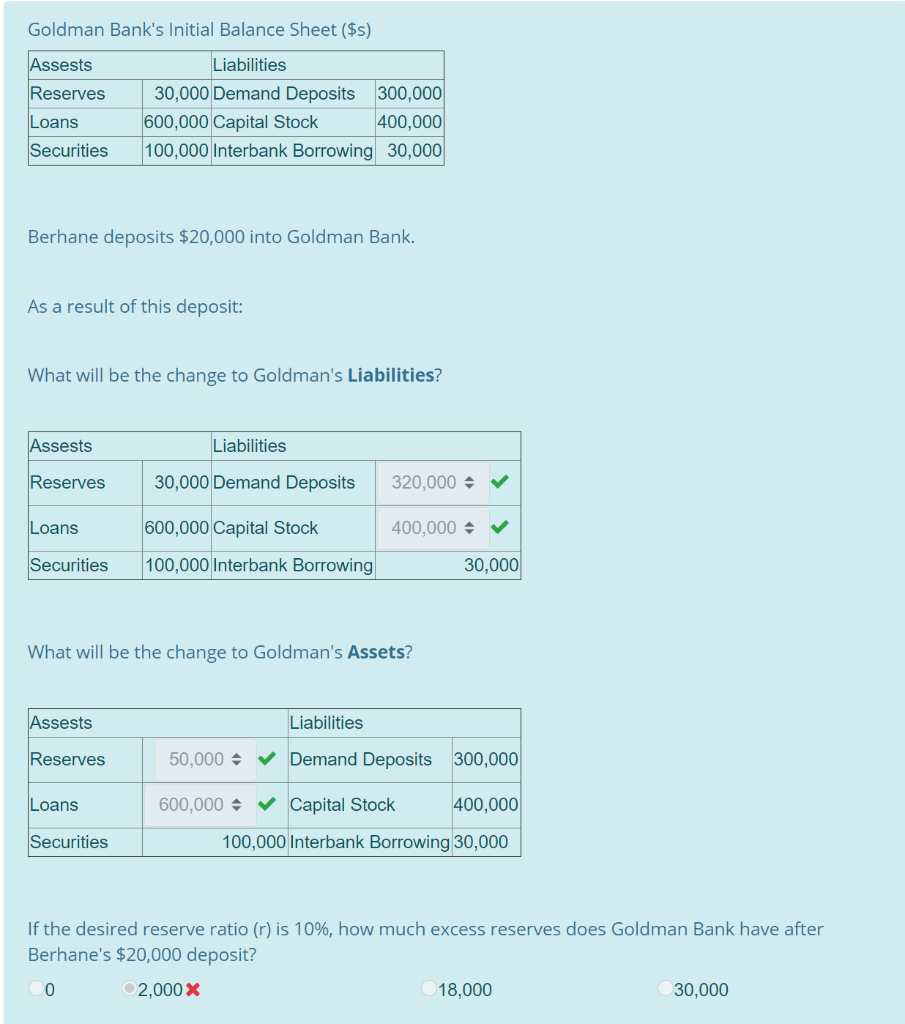

Question: explain your answer if possible Goldman Bank's Initial Balance Sheet($s) Assests Liabilities Reserves 30,000 Demand Deposits 300,000 Loans 600,000 Capital Stock 400,000 Securities 100,000 Interbank

explain your answer if possible

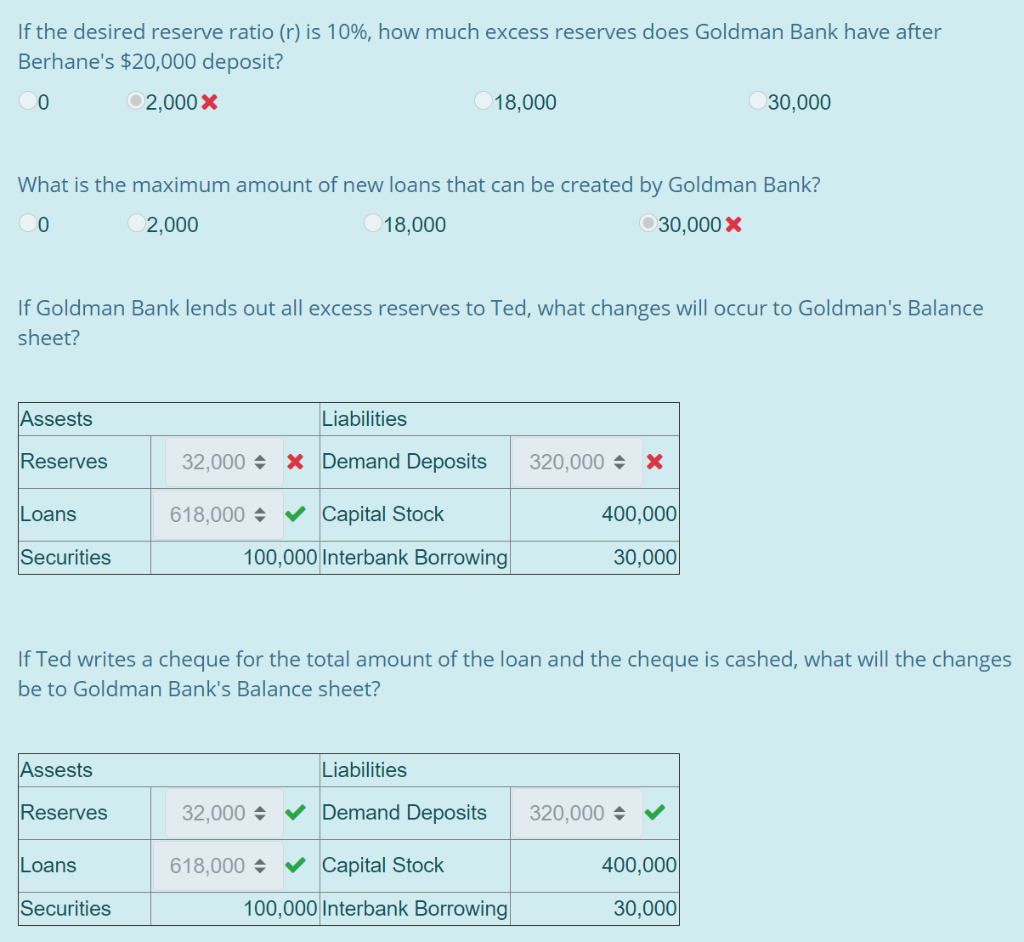

Goldman Bank's Initial Balance Sheet($s) Assests Liabilities Reserves 30,000 Demand Deposits 300,000 Loans 600,000 Capital Stock 400,000 Securities 100,000 Interbank Borrowing 30,000 Berhane deposits $20,000 into Goldman Bank. As a result of this deposit: What will be the change to Goldman's Liabilities? Assests Liabilities Reserves 30,000 Demand Deposits 320,000 Loans 600,000 Capital Stock 400,000 Securities 100,000 Interbank Borrowing 30,000 What will be the change to Goldman's Assets? Assests Liabilities Reserves 50,000 $ ~ Demand Deposits 300,000 Loans 600,000 $ ~ Capital Stock 400,000 100,000 Interbank Borrowing 30,000 Securities If the desired reserve ratio (n) is 10%, how much excess reserves does Goldman Bank have after Berhane's $20,000 deposit? 0 2,000 X 18,000 30,000 If the desired reserve ratio (r) is 10%, how much excess reserves does Goldman Bank have after Berhane's $20,000 deposit? 0 2,000 X 18,000 30,000 What is the maximum amount of new loans that can be created by Goldman Bank? 0 2,000 18,000 30,000 X If Goldman Bank lends out all excess reserves to Ted, what changes will occur to Goldman's Balance sheet? Assests Liabilities Reserves 32,000 X Demand Deposits 320,000 X Loans 618,000 $ ~ Capital Stock 400,000 Securities 100,000 Interbank Borrowing 30,000 If Ted writes a cheque for the total amount of the loan and the cheque is cashed, what will the changes be to Goldman Bank's Balance sheet? Assests Liabilities Reserves 32,000 $ ~ Demand Deposits 320,000 Loans 618,000 Capital Stock 400,000 Securities 100,000 Interbank Borrowing 30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts