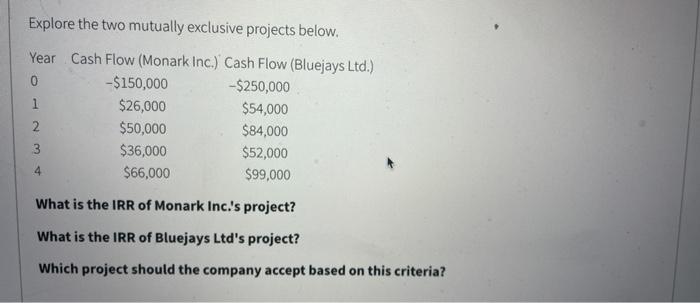

Question: Explore the two mutually exclusive projects below. Year Cash Flow (Monark Inc.) Cash Flow (Bluejays Ltd.) 0 -$150,000 -$250,000 1 $26,000 $54,000 2 $50,000 $84,000

Explore the two mutually exclusive projects below. Year Cash Flow (Monark Inc.) Cash Flow (Bluejays Ltd.) 0 -$150,000 -$250,000 1 $26,000 $54,000 2 $50,000 $84,000 $36,000 $52,000 $66,000 $99,000 4 What is the IRR of Monark Inc.'s project? What is the IRR of Bluejays Ltd's project? Which project should the company accept based on this criteria

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts