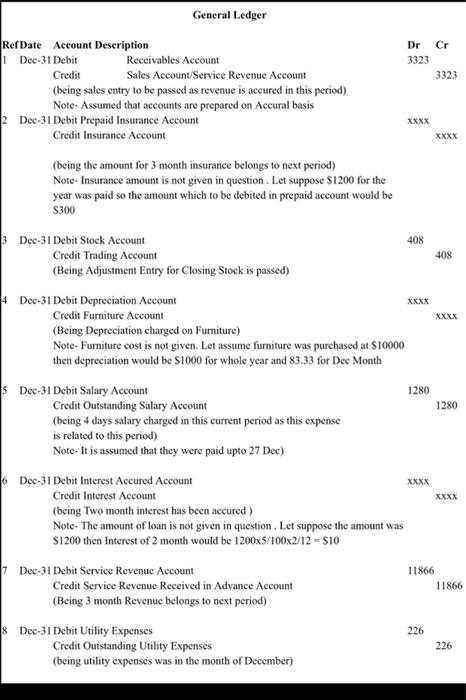

Question: Cr Dr 3323 3323 General Ledger RefDate Account Description 1 Dec-31 Debit Receivables Account Credit Sales Account/Service Revenue Account (being sales entry to be passed

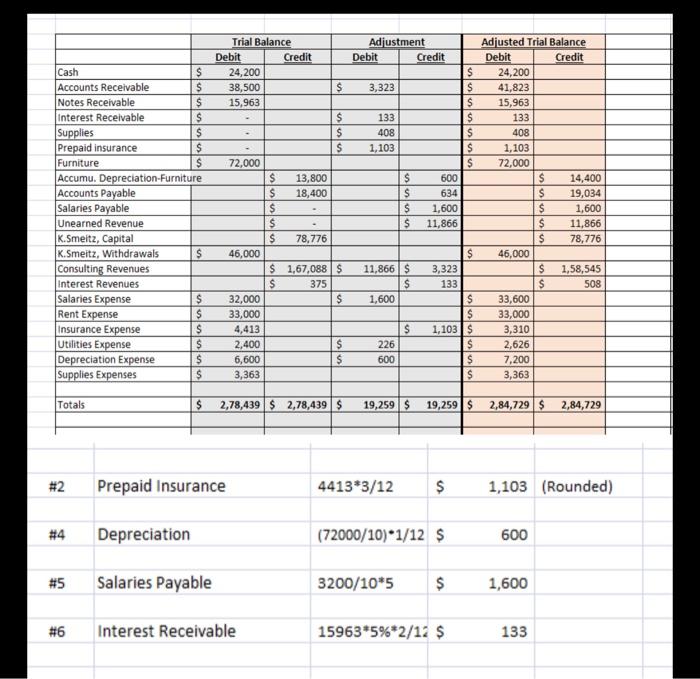

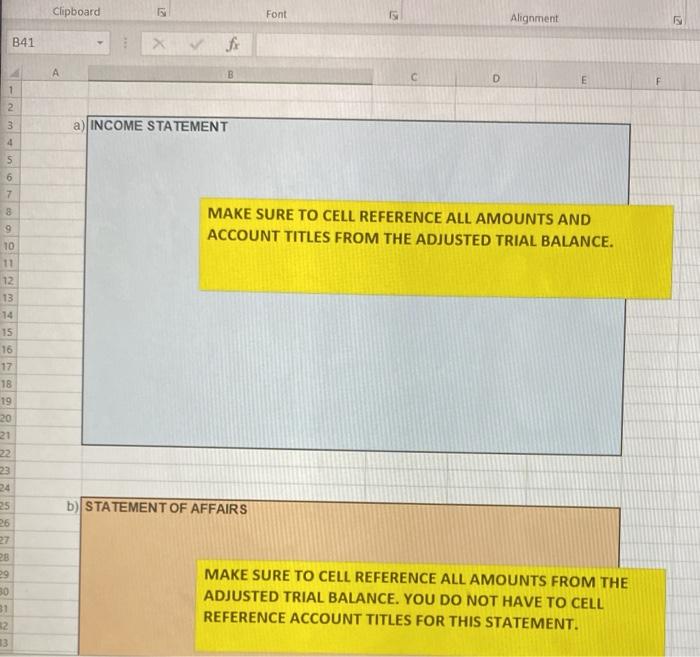

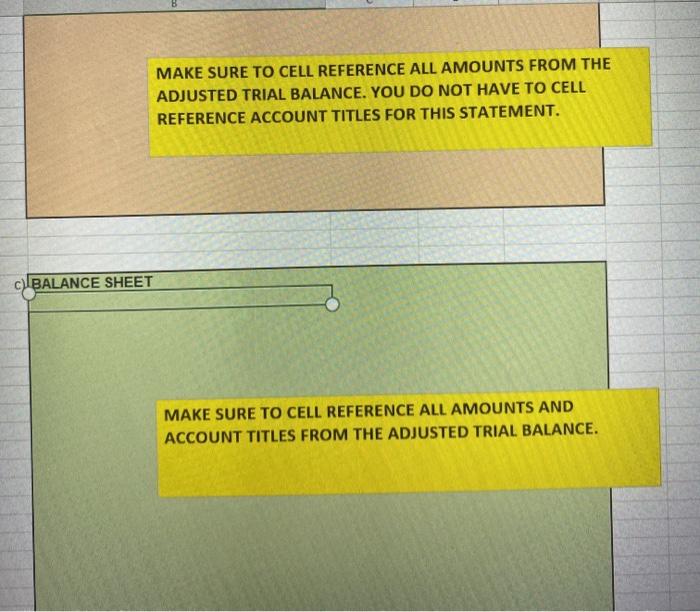

Cr Dr 3323 3323 General Ledger RefDate Account Description 1 Dec-31 Debit Receivables Account Credit Sales Account/Service Revenue Account (being sales entry to be passed as revenue is accured in this period) Note- Assumed that accounts are prepared on Accural basis 2 Dec-31 Debit Prepaid Insurance Account Credit Insurance Account (being the amount for 3 month insurance belongs to next period) Note- Insurance amount is not given in question. Let suppose S1200 for the year was paid so the amount which to be debited in prepaid account would be $300 XXXX XXXX 408 3 Dec-31 Debit Stock Account Credit Trading Account (Being Adjustment Entry for Closing Stock is passed) 408 XXXX 1280 4 Dec-31 Debit Depreciation Account XXXX Credit Furniture Account (Being Depreciation charged on Furniture) Note- Furniture cost is not given. Let assume furniture was purchased at $10000 then depreciation would be $1000 for whole year and 83.33 for Dec Month 5 Dec-31 Debit Salary Account 1280 Credit Outstanding Salary Account (being 4 days salary charged in this current period as this expense is related to this period) Note- It is assumed that they were paid upto 27 Dec) 6 Dec-31 Debit Interest Accured Account Credit Interest Account (being Two month interest has been aceured) Note- The amount of loan is not given in question. Let suppose the amount was S1200 then Interest of 2 month would be 1200x5/100x2/12 - $10 XXXX XXXX 11866 7 Dec-31 Debit Service Revenue Account Credit Service Revenue Received in Advance Account (Being 3 month Revenue belongs to next period) 11866 226 8 Dec-31 Debit Utility Expenses Credit Outstanding Utility Expenses (being utility expenses was in the month of December) 226 Adjustment Debit Credit Cash 3,323 133 408 1,103 $ $ $ $ $ $ $ $ Accounts Receivable $ Notes Receivable $ Interest Receivable $ Supplies $ Prepaid insurance $ Furniture $ Accumu. Depreciation-Furniture Accounts Payable Salaries Payable Unearned Revenue K.Smeitz, Capital K.Smeitz, Withdrawals $ Consulting Revenues Interest Revenues Salaries Expense $ Rent Expense $ Insurance Expense $ Utilities Expense $ Depreciation Expense $ Supplies Expenses $ Trial Balance Debit Credit 24,200 38,500 $ 15,963 $ $ $ 72,000 $ 13,800 $ 18,400 $ $ $ 78,776 46,000 $ 1,67,088 $ $ 375 32,000 $ 33,000 4,413 2,400 $ 6,600 $ 3,363 Us 600 634 1,600 11,866 Adjusted Trial Balance Debit Credit 24,200 41,823 15,963 133 408 1,103 72,000 $ 14,400 $ 19,034 $ 1,600 $ 11,866 $ 78,776 46,000 $ 1,58,545 S 508 33,600 33,000 3,310 2,626 7,200 3,363 11,866 $ $ 1,600 $ 3,323 133 $ $ 1,103 $ $ $ $ $ 226 600 Totals $ 2,78,439 $ 2,78,439 $ 19,259 $ 19,259 $ 2,84,729 $ 2,84,729 #2 Prepaid Insurance 4413*3/12 $ 1,103 (Rounded) #4 Depreciation (72000/10)*1/12 $ 600 #5 Salaries Payable 3200/10*5 $ $ 1,600 #6 Interest Receivable 15963*5%*2/12 $ 133 Clipboard Font Alignment 2 B41 A B C D E 1 2 3 a) INCOME STATEMENT 4 5 6 7 8 MAKE SURE TO CELL REFERENCE ALL AMOUNTS AND ACCOUNT TITLES FROM THE ADJUSTED TRIAL BALANCE. 10 11 12 13 14 15 16 17 18 19 20 21 24 25 b) STATEMENT OF AFFAIRS 26 29 30 31 52 13 MAKE SURE TO CELL REFERENCE ALL AMOUNTS FROM THE ADJUSTED TRIAL BALANCE. YOU DO NOT HAVE TO CELL REFERENCE ACCOUNT TITLES FOR THIS STATEMENT. MAKE SURE TO CELL REFERENCE ALL AMOUNTS FROM THE ADJUSTED TRIAL BALANCE. YOU DO NOT HAVE TO CELL REFERENCE ACCOUNT TITLES FOR THIS STATEMENT. c) BALANCE SHEET MAKE SURE TO CELL REFERENCE ALL AMOUNTS AND ACCOUNT TITLES FROM THE ADJUSTED TRIAL BALANCE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts