Question: Expressed in formula Question 2 (32 marks) Jenny has $200,000 to invest and is considering the merits of two securities. He is interested in the

Expressed in formula

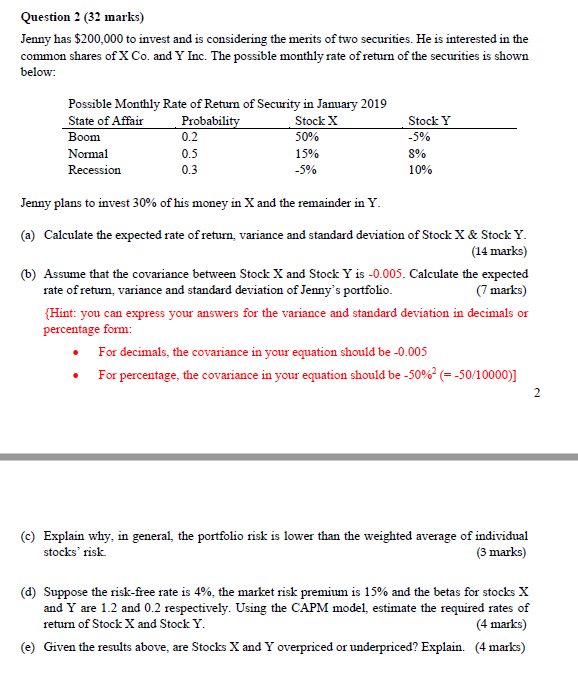

Question 2 (32 marks) Jenny has $200,000 to invest and is considering the merits of two securities. He is interested in the common shares of X Co. and Y Inc. The possible monthly rate of return of the securities is shown below: Possible Monthly Rate of Return of Security in January 2019 State of Affair Probability Stock X Boom 0.2 50% Normal 15% Recession -5% Stock Y -5% 8% 10% 0.3 Jenny plans to invest 30% of his money in X and the remainder in Y. (a) Calculate the expected rate of return. variance and standard deviation of Stock X & Stock Y. (14 marks) (6) Assume that the covariance between Stock X and Stock Y is -0.005. Calculate the expected rate of return, variance and standard deviation of Jenny's portfolio. (7 marks) (Hint: you can express your answers for the variance and standard deviation in decimals or percentage form: For decimals, the covariance in your equation should be -0.005 For percentage, the covariance in your equation should be -50% (=-50/10000)] (c) Explain why, in general, the portfolio risk is lower than the weighted average of individual stocks' risk (3 marks) (d) Suppose the risk-free rate is 4%, the market risk premium is 15% and the betas for stocks X and Y are 1.2 and 0.2 respectively. Using the CAPM model, estimate the required rates of return of Stock X and Stock Y. (4 marks) (e) Given the results above, are Stocks X and Y overpriced or underpriced? Explain. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts