Question: This statement pertains to the following 2 questions Suppose Eagle Mines and HudBay Minerals have identical assets --identical cash flows with the same riskiness. Eagle

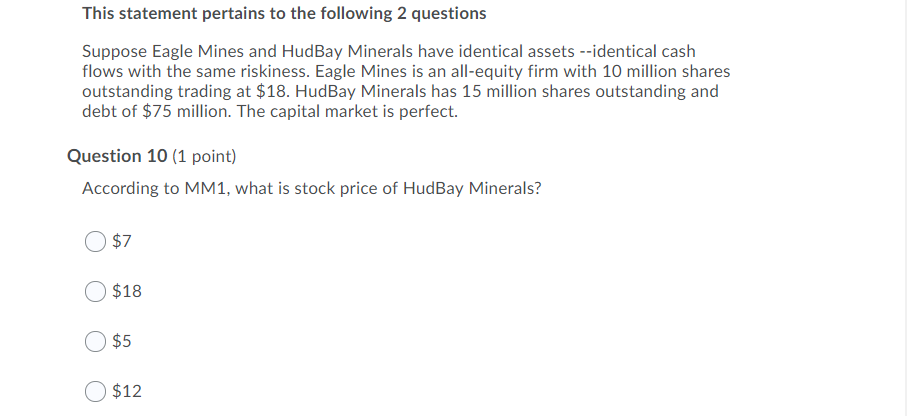

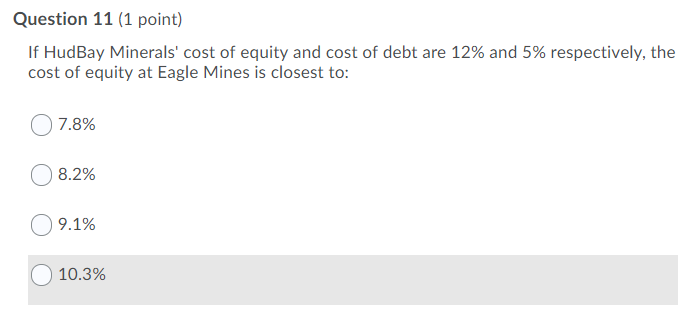

This statement pertains to the following 2 questions Suppose Eagle Mines and HudBay Minerals have identical assets --identical cash flows with the same riskiness. Eagle Mines is an all-equity firm with 10 million shares outstanding trading at $18. HudBay Minerals has 15 million shares outstanding and debt of $75 million. The capital market is perfect. Question 10 (1 point) According to MM1, what is stock price of HudBay Minerals? $7 $18 O $5 O $12 Question 11 (1 point) If HudBay Minerals' cost of equity and cost of debt are 12% and 5% respectively, the cost of equity at Eagle Mines is closest to: 07.8% 08.2% 09.1% 10.3%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock