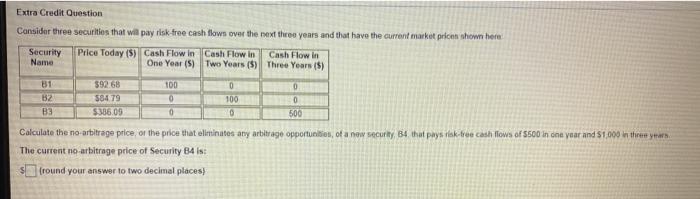

Question: Extra Credit Question Consider three securities that will pay risk-free cash flows over the next three years and that have the current market price shown

Extra Credit Question Consider three securities that will pay risk-free cash flows over the next three years and that have the current market price shown here Security Price Today (5) Cash Flow in Cash Flow in Cash Flow in Name One Year (5) Two Years (5) Three Years ($) 0 31 B2 B3 $92.68 58479 $336,05 100 0 0 100 0 0 500 Calculate the no arbitrage price of the price that eliminates any arbitrage opportunities, of a new security B4 that pays iskree cash lows of 5500 in one year and $1.000 in the year. The current no-arbitrage price of Security B4 is: (round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock