Question: please answer both questions for a thumbs up On July 1, 2000, the New York Mets Teached an agreement with Bobby Bonilla to defer the

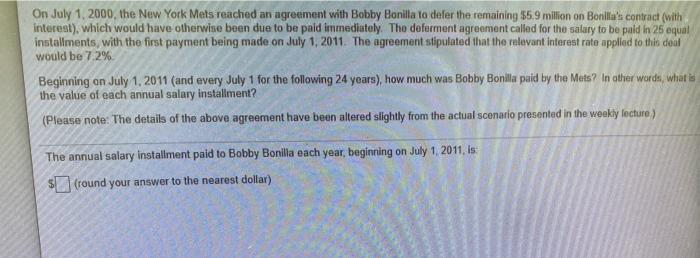

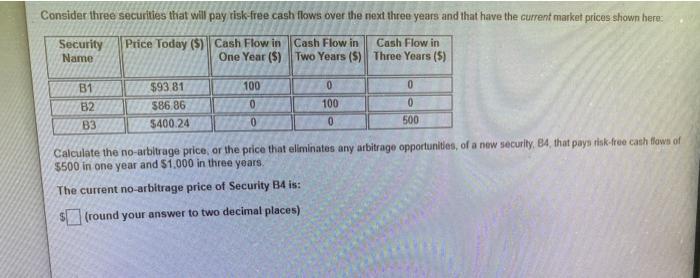

On July 1, 2000, the New York Mets Teached an agreement with Bobby Bonilla to defer the remaining $5.9 million on Bonilla's contract (with interest), which would have otherwise been due to be paid immediately. The deferment agreement called for the salary to be paid in 26 equal installments, with the first payment being made on July 1, 2011. The agreement stipulated that the relevant interest rate applied to this deal would be 7.2% Beginning on July 1, 2011 (and every July 1 for the following 24 years), how much was Bobby Bonilla paid by the Mets? In other words, what is the value of each annual salary installment? (Please note: The details of the above agreement have been altered slightly from the actual scenario presented in the wookly lecture) The annual salary installment paid to Bobby Bonilla each year, beginning on July 1, 2011. is: $(round your answer to the nearest dollar) Consider three securities that will pay risk-free cash flows over the next three years and that have the current market prices shown here: Security Name Price Today ($) Cash Flow in Cash Flow in Cash Flow in One Year (5) Two Years (5) Three Years (5) 100 0 B1 B2 $93 81 586.86 $400.24 0 0 100 0 0 0 500 B3 Calculate the no-arbitrage price or the price that eliminates any arbitrage opportunities, of a new security, B4, that pays risk-free cash flows of $500 in one year and $1.000 in three years. The current no-arbitrage price of Security B4 is: (round your answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts