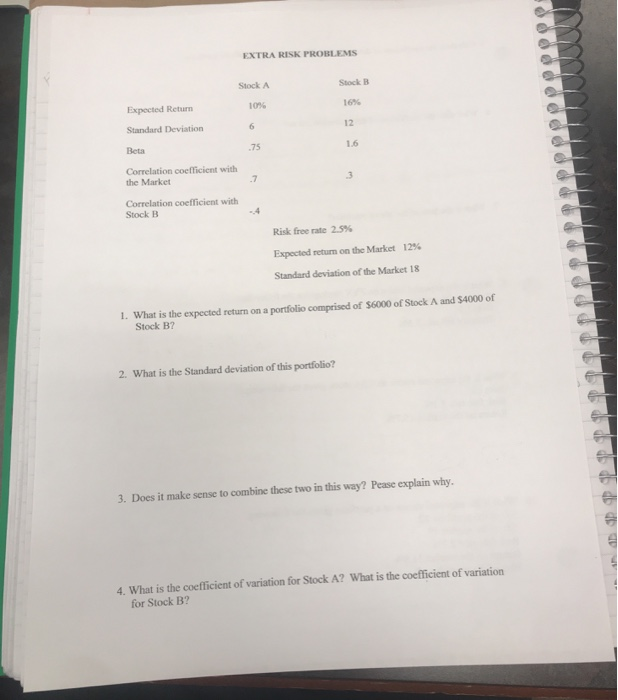

Question: EXTRA RISK PROBLEMS Stock A Stock B Expected Return 10% 1 Standard Deviation Beta Correlation coefficient with the Market Correlation coefficient with Stock B Risk

EXTRA RISK PROBLEMS Stock A Stock B Expected Return 10% 1 Standard Deviation Beta Correlation coefficient with the Market Correlation coefficient with Stock B Risk free rate 25% Expected return on the Market 12% Standard deviation of the Market 18 1. What is the expected return on a portfolio comprised of $6000 of Stock A and S4000 of Stock B? 2. What is the Standard deviation of this portfolio? 3. Does it make sense to combine these two in this way? Pease explain why. 4. What is the coefficient of variation for Stock A? What is the coefficient of variation for Stock B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts