Question: f. (3 marks) Based on information as in Table 1, suppose you have purchased 200 shares of HSHK previously at a cost of $2.90 per

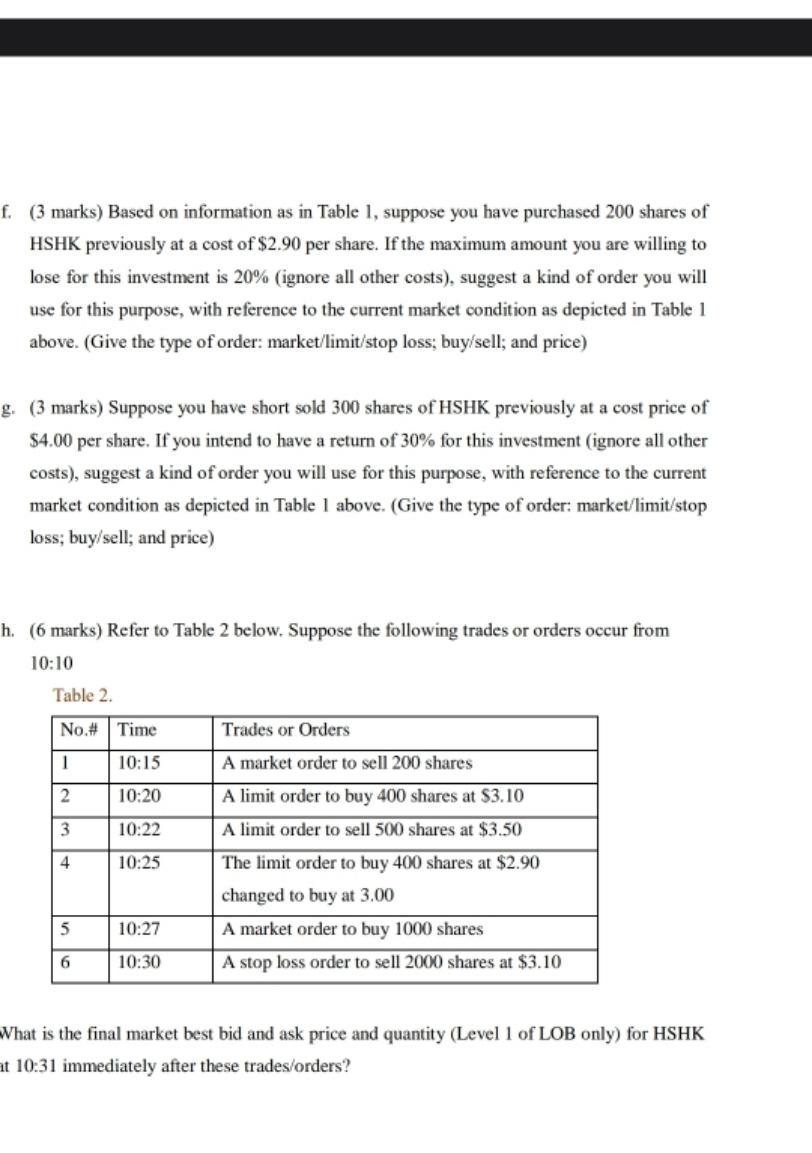

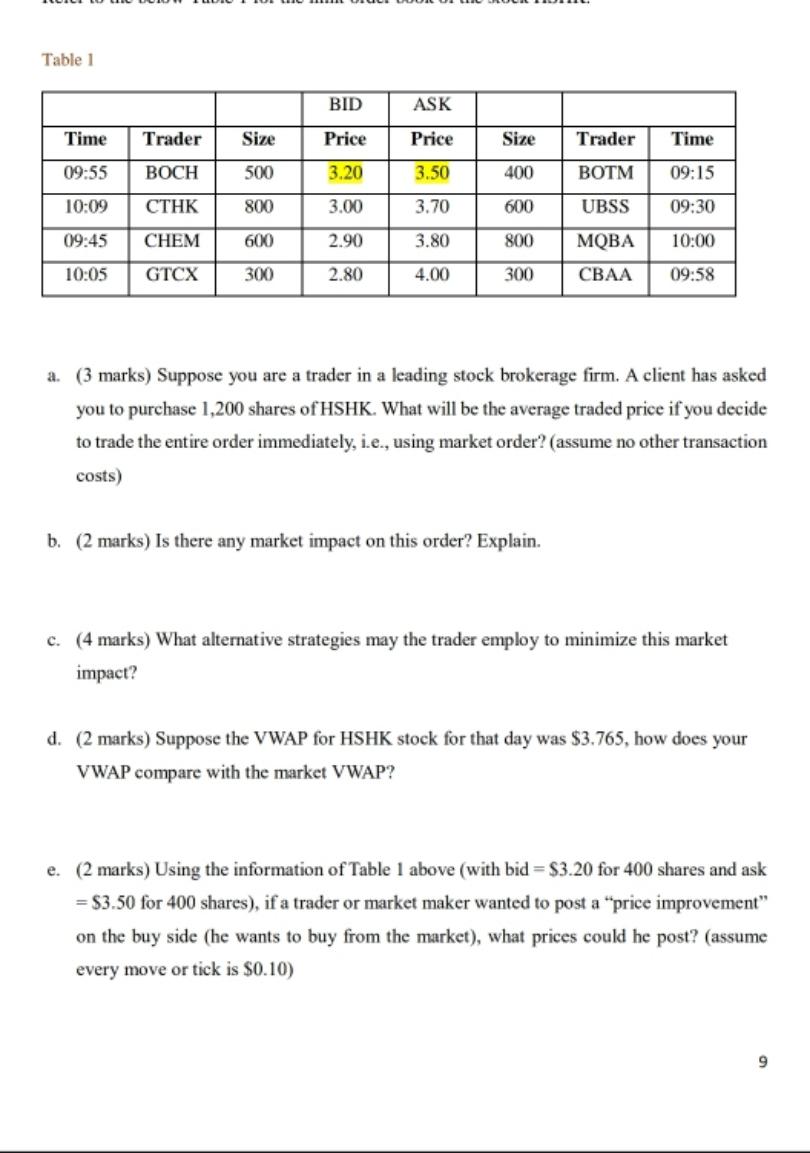

f. (3 marks) Based on information as in Table 1, suppose you have purchased 200 shares of HSHK previously at a cost of $2.90 per share. If the maximum amount you are willing to lose for this investment is 20% (ignore all other costs), suggest a kind of order you will use for this purpose, with reference to the current market condition as depicted in Table 1 above. (Give the type of order: market/limit/stop loss; buy/sell; and price) g. ( 3 marks) Suppose you have short sold 300 shares of HSHK previously at a cost price of $4.00 per share. If you intend to have a return of 30% for this investment (ignore all other costs), suggest a kind of order you will use for this purpose, with reference to the current market condition as depicted in Table 1 above. (Give the type of order: market/limit/stop loss; buy/sell; and price) h. (6 marks) Refer to Table 2 below. Suppose the following trades or orders occur from 10:10 Table 2. What is the final market best bid and ask price and quantity (Level 1 of LOB only) for HSHK 10:31 immediately after these trades/orders? Table 1 a. (3 marks) Suppose you are a trader in a leading stock brokerage firm. A client has asked you to purchase 1,200 shares of HSHK. What will be the average traded price if you decide to trade the entire order immediately, i.e., using market order? (assume no other transaction costs) b. (2 marks) Is there any market impact on this order? Explain. c. (4 marks) What alternative strategies may the trader employ to minimize this market impact? d. (2 marks) Suppose the VWAP for HSHK stock for that day was $3.765, how does your VWAP compare with the market VWAP? e. ( 2 marks) Using the information of Table 1 above (with bid =$3.20 for 400 shares and ask =$3.50 for 400 shares), if a trader or market maker wanted to post a "price improvement" on the buy side (he wants to buy from the market), what prices could he post? (assume every move or tick is $0.10 ) f. (3 marks) Based on information as in Table 1, suppose you have purchased 200 shares of HSHK previously at a cost of $2.90 per share. If the maximum amount you are willing to lose for this investment is 20% (ignore all other costs), suggest a kind of order you will use for this purpose, with reference to the current market condition as depicted in Table 1 above. (Give the type of order: market/limit/stop loss; buy/sell; and price) g. ( 3 marks) Suppose you have short sold 300 shares of HSHK previously at a cost price of $4.00 per share. If you intend to have a return of 30% for this investment (ignore all other costs), suggest a kind of order you will use for this purpose, with reference to the current market condition as depicted in Table 1 above. (Give the type of order: market/limit/stop loss; buy/sell; and price) h. (6 marks) Refer to Table 2 below. Suppose the following trades or orders occur from 10:10 Table 2. What is the final market best bid and ask price and quantity (Level 1 of LOB only) for HSHK 10:31 immediately after these trades/orders? Table 1 a. (3 marks) Suppose you are a trader in a leading stock brokerage firm. A client has asked you to purchase 1,200 shares of HSHK. What will be the average traded price if you decide to trade the entire order immediately, i.e., using market order? (assume no other transaction costs) b. (2 marks) Is there any market impact on this order? Explain. c. (4 marks) What alternative strategies may the trader employ to minimize this market impact? d. (2 marks) Suppose the VWAP for HSHK stock for that day was $3.765, how does your VWAP compare with the market VWAP? e. ( 2 marks) Using the information of Table 1 above (with bid =$3.20 for 400 shares and ask =$3.50 for 400 shares), if a trader or market maker wanted to post a "price improvement" on the buy side (he wants to buy from the market), what prices could he post? (assume every move or tick is $0.10 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts