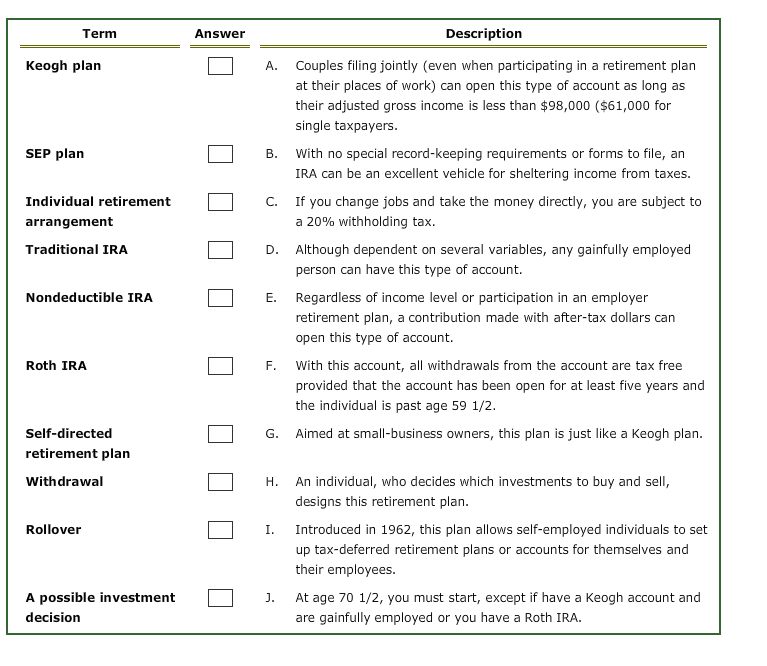

Question: Term Keogh plan SEP plan Individual retirement arrangement Traditional IRA Nondeductible IRA Roth IRA Self-directed retirement plan Withdrawal Rollover A possible investment decision Answer

Term Keogh plan SEP plan Individual retirement arrangement Traditional IRA Nondeductible IRA Roth IRA Self-directed retirement plan Withdrawal Rollover A possible investment decision Answer A. B. C. D. E. F. G. H. Description Couples filing jointly (even when participating in a retirement plan at their places of work) can open this type of account as long as their adjusted gross income is less than $98,000 ($61,000 for single taxpayers. With no special record-keeping requirements or forms to file, an IRA can be an excellent vehicle for sheltering income from taxes. If you change jobs and take the money directly, you are subject to a 20% withholding tax. Although dependent on several variables, any gainfully employed person can have this type of account. Regardless of income level or participation in an employer retirement plan, a contribution made with aftertax dollars can open this type of account. With this account, all withdrawals from the account are tax free provided that the account has been open for at least five years and the individual is past age 59 1/2. Aimed at small-business owners, this plan is just like a Keogh plan. An individual, who decides which investments to buy and sell, designs this retirement plan. Introduced in 1962, this plan allows self-employed individuals to set up tax-deferred retirement plans or accounts for themselves and their employees. At age 70 1/2, you must start, except if have a Keogh account and are gainfully employed or you have a Roth IRA.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts