Question: Question 2 (30 points) Consider au economy of overlapping generations in which people live for three periods. People are endowed with 100 units of

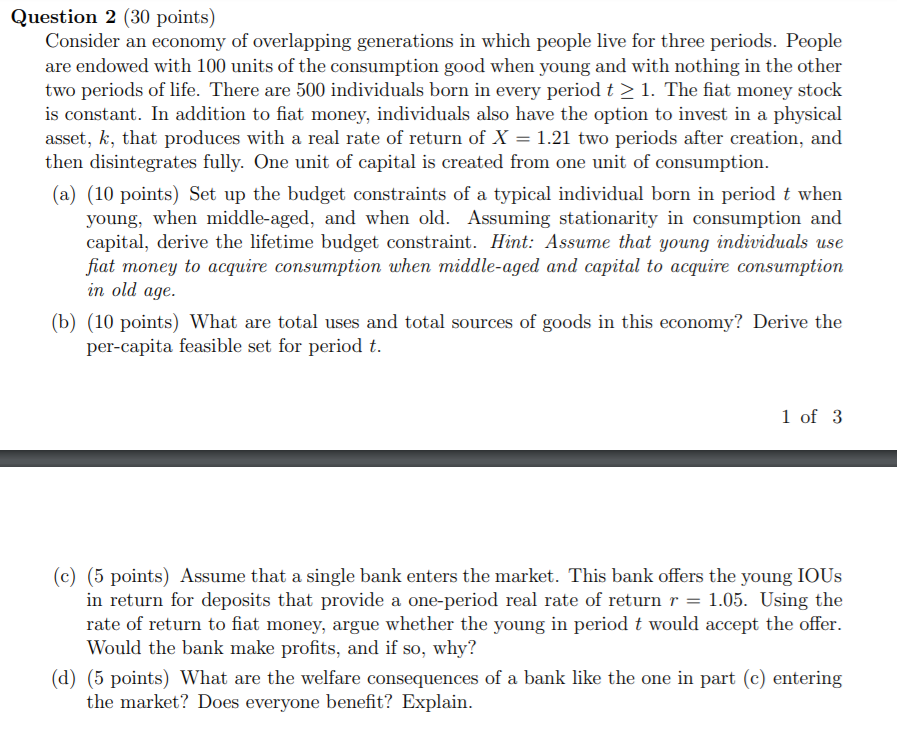

Question 2 (30 points) Consider au economy of overlapping generations in which people live for three periods. People are endowed with 100 units of the consumption good when young and with nothing in the other two periods of life. There are 500 individuals born in every period t > 1. The fiat money stock is constant. In addition to fiat money, individuals also have the option to invest in a physical asset, k, that produces with a real rate of return of X = 1.21 two periods after creation, and then disintegrates fully. One unit of capital is created from one unit of consumption. (a) (10 points) Set up the budget constraints of a typical individual born in period t when young, when middle-aged, and when old. Assuming stationarity in consumption and capital, derive the lifetime budget constraint. Hint: Assume that young individuals use fiat money to acquire consumption when middle-aged and capital to acquire consumption in old age. (b) (10 points) What are total uses and total sources of goods in this economy? Derive the per-capita feasible set for period t. 1 of 3 (c) (5 points) Assume that a single bank enters the market. This bank offers the young IOUs in return for deposits that provide a one-period real rate of return r = 1.05. Using the rate of return to fiat money, argue whether the young in period t would accept the offer. Would the bank make profits, and if so, why? (d) (5 points) What are the welfare consequences of a bank like the one in part (c) entering the market? Does everyone benefit? Explain.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts