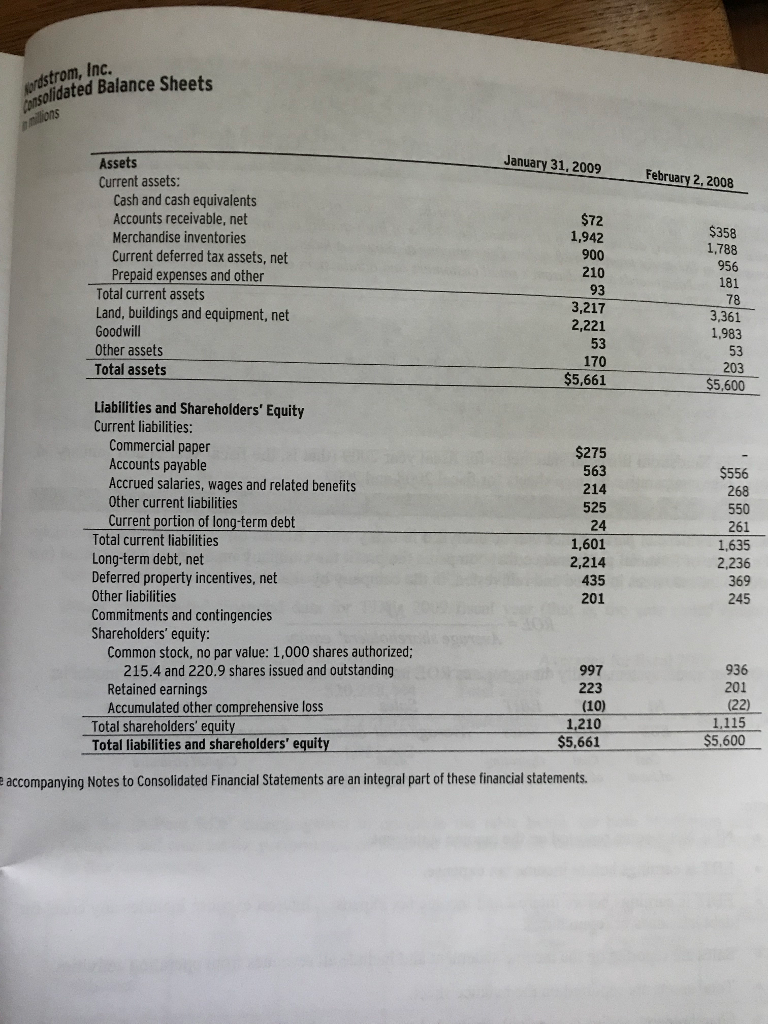

Question: F. Compute return on net operating assets (RNOA) for fiscal year 2009 and 2008. Be sure to use average net operating assets in the denominator.

F. Compute return on net operating assets (RNOA) for fiscal year 2009 and 2008. Be sure to use average net operating assets in the denominator.

Pease, answer questions F, G,H and I.

Please answer questions F, G, H and I (Cases in Financial Reporting 8e page 317 / Nordstrom Inc)

Please answer questions F, G, H and I (Cases in Financial Reporting 8e page 317 / Nordstrom Inc)

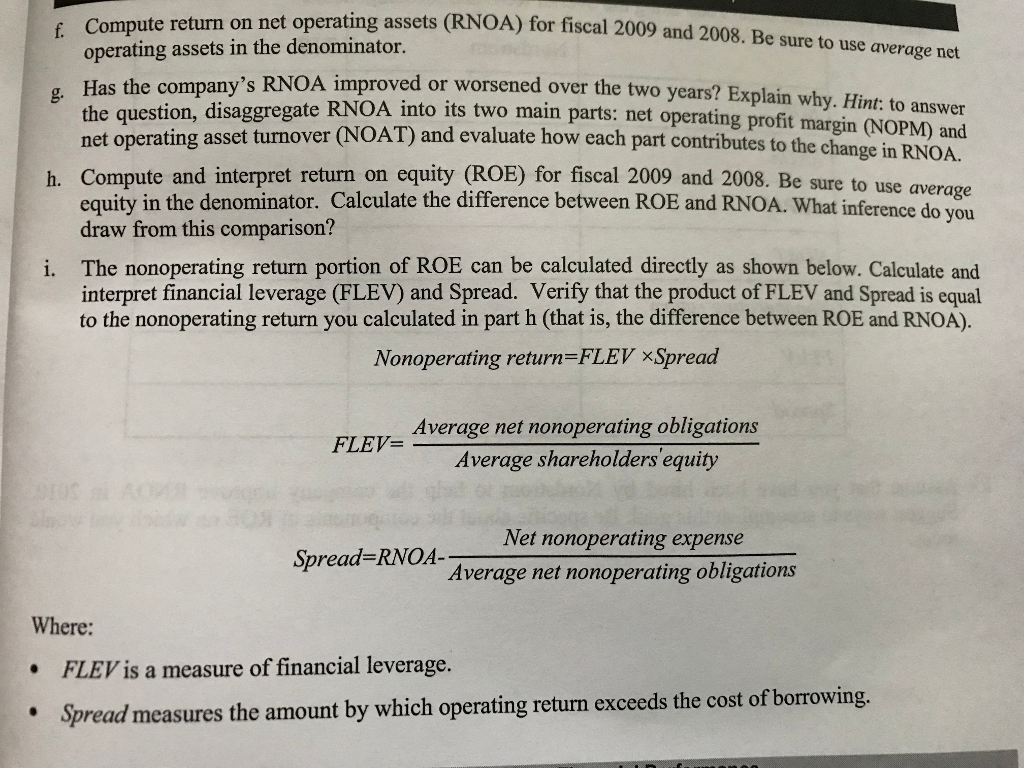

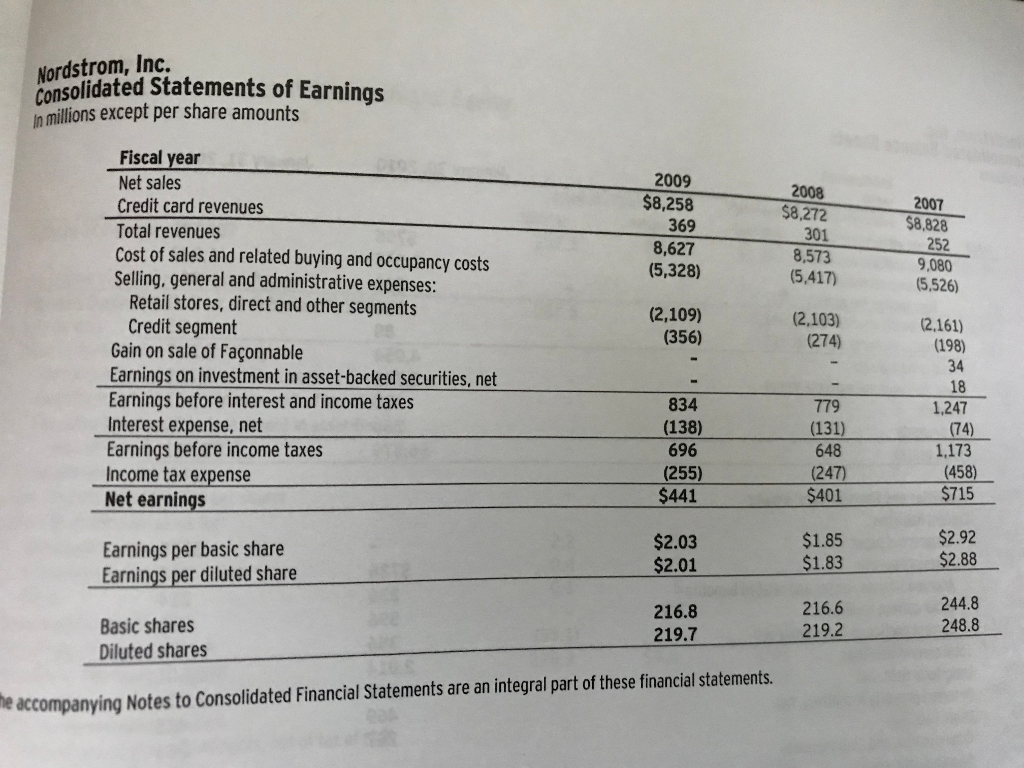

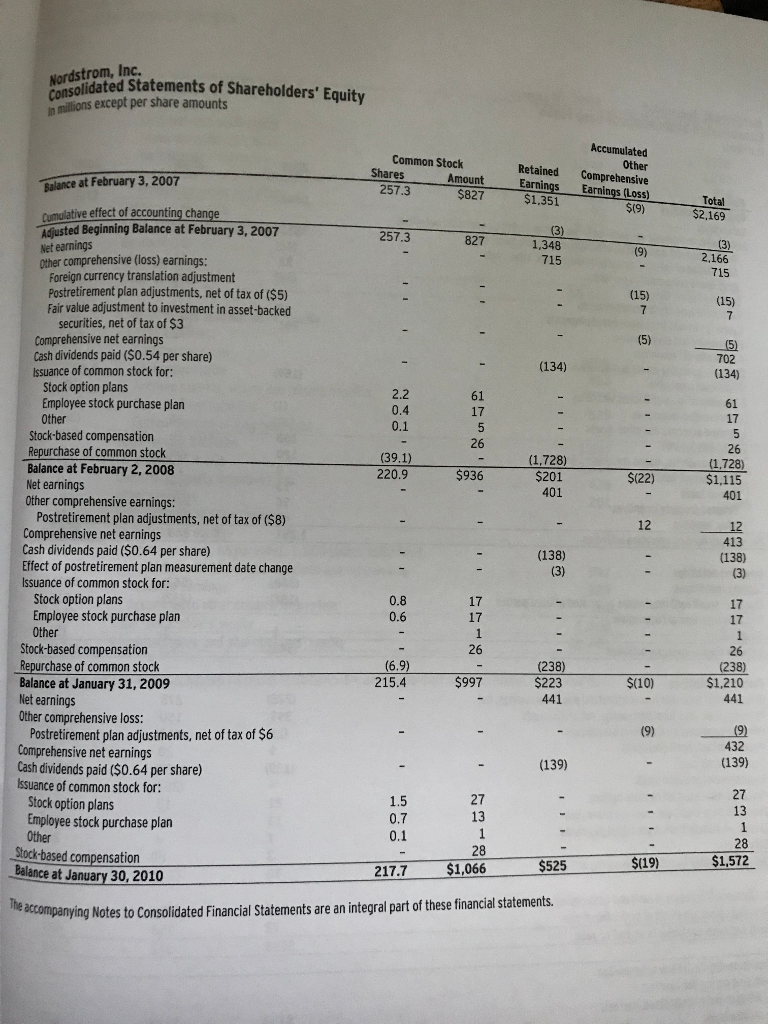

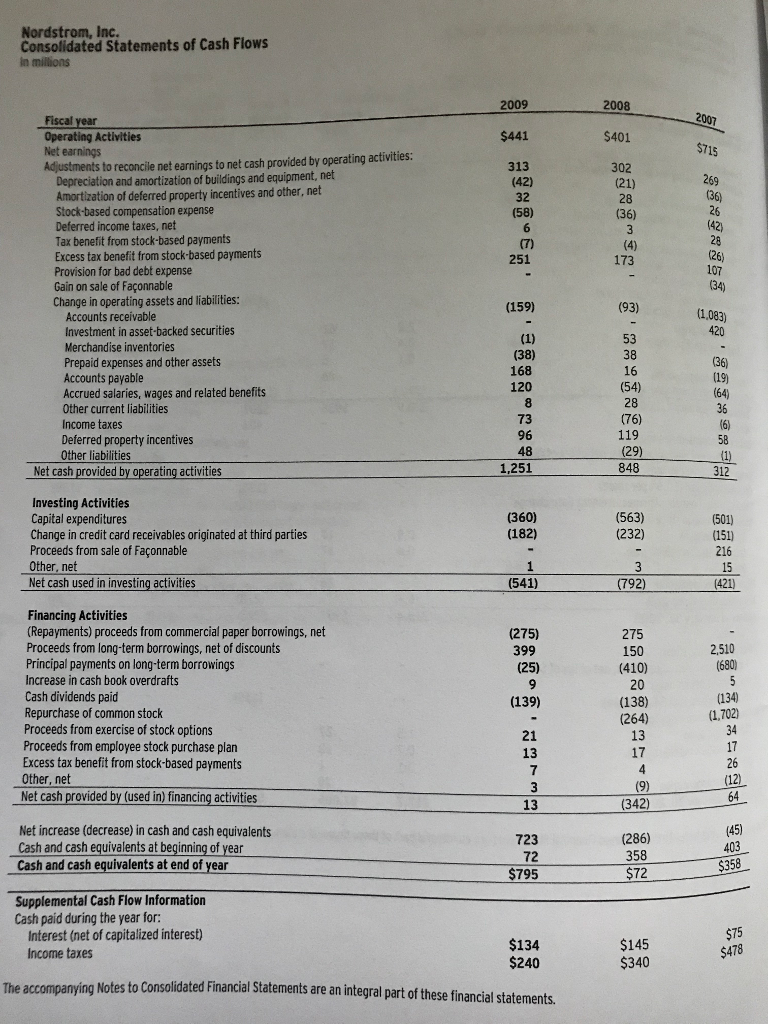

f Compute return on net operating assets (RNOA) for fiscal 2009 and 2008. Be sure to use average net operating assets in the denominator. ny's RNOA improved or worsened over the two years? Explain why. Hint: to answer NOA into its two main parts: net operating profit margin (NOPM) and NOAT) and evaluate how each part contributes to the change in RNOA. g. Has the compa the question, disaggregate R net operating asset turnover h. Compute and interpret return on equity (ROE) for fiscal 2009 and 2008. Be sure to use average you equity in the denominator. Calculate the difference between ROE and RNOA. What inference do draw from this comparison? The nonoperating return portion of ROE can be calculated directly as shown below. Calculate and interpret financial leverage (FLEV) and Spread. Verify that the product of FLEV and Spread is equal to the nonoperating return you calculated in part h (that is, the difference between ROE and RNOA). i. Nonoperating return FLEV xSpread Average net nonoperating obligations Average shareholders' equity FLEV= Net nonoperating expense Average net nonoperating obligations Spread-RNOA Where: FLEV is a measure of financial leverage. Spread measures the amount by which operating return exceeds the cost of borrowing. f Compute return on net operating assets (RNOA) for fiscal 2009 and 2008. Be sure to use average net operating assets in the denominator. ny's RNOA improved or worsened over the two years? Explain why. Hint: to answer NOA into its two main parts: net operating profit margin (NOPM) and NOAT) and evaluate how each part contributes to the change in RNOA. g. Has the compa the question, disaggregate R net operating asset turnover h. Compute and interpret return on equity (ROE) for fiscal 2009 and 2008. Be sure to use average you equity in the denominator. Calculate the difference between ROE and RNOA. What inference do draw from this comparison? The nonoperating return portion of ROE can be calculated directly as shown below. Calculate and interpret financial leverage (FLEV) and Spread. Verify that the product of FLEV and Spread is equal to the nonoperating return you calculated in part h (that is, the difference between ROE and RNOA). i. Nonoperating return FLEV xSpread Average net nonoperating obligations Average shareholders' equity FLEV= Net nonoperating expense Average net nonoperating obligations Spread-RNOA Where: FLEV is a measure of financial leverage. Spread measures the amount by which operating return exceeds the cost of borrowing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts