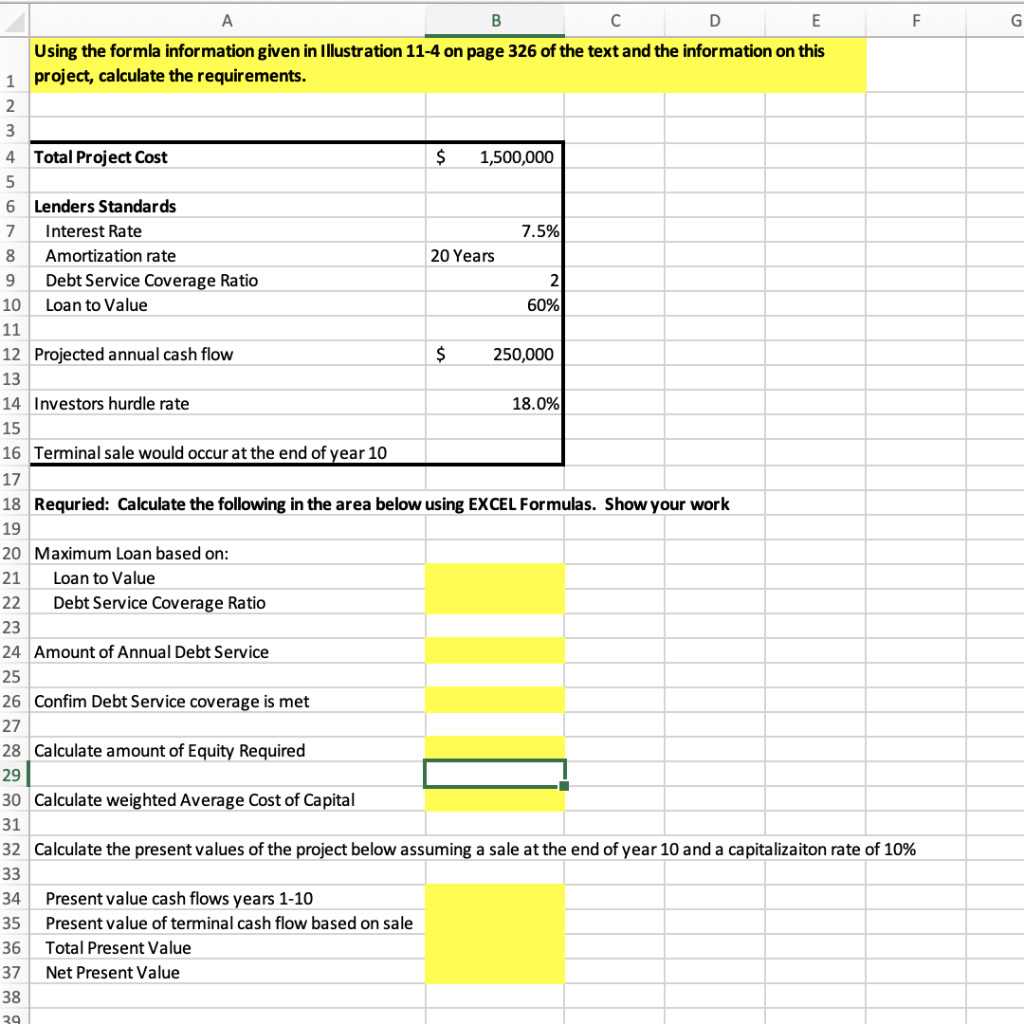

Question: F G A B D E Using the formla information given in Illustration 11-4 on page 326 of the text and the information on this

F G A B D E Using the formla information given in Illustration 11-4 on page 326 of the text and the information on this 1 project, calculate the requirements. 2 3 4 Total Project Cost $ 1,500,000 5 6 Lenders Standards 7 Interest Rate 7.5% 8 Amortization rate 20 Years 9 Debt Service Coverage Ratio 2 10 Loan to Value 60% 11 12 Projected annual cash flow $ 250,000 13 14 Investors hurdle rate 18.0% 15 16 Terminal sale would occur at the end of year 10 17 18 Requried: Calculate the following in the area below using EXCEL Formulas. Show your work 19 20 Maximum loan based on: 21 Loan to Value 22 Debt Service Coverage Ratio 23 24 Amount of Annual Debt Service 25 26 Confim Debt Service coverage is met 27 28 Calculate amount of Equity Required 29 30 Calculate weighted Average Cost of Capital 31 32 Calculate the present values of the project below assuming a sale at the end of year 10 and a capitalizaiton rate of 10% 33 34 Present value cash flows years 1-10 35 Present value of terminal cash flow based on sale 36 Total Present Value 37 Net Present Value 38 39 F G A B D E Using the formla information given in Illustration 11-4 on page 326 of the text and the information on this 1 project, calculate the requirements. 2 3 4 Total Project Cost $ 1,500,000 5 6 Lenders Standards 7 Interest Rate 7.5% 8 Amortization rate 20 Years 9 Debt Service Coverage Ratio 2 10 Loan to Value 60% 11 12 Projected annual cash flow $ 250,000 13 14 Investors hurdle rate 18.0% 15 16 Terminal sale would occur at the end of year 10 17 18 Requried: Calculate the following in the area below using EXCEL Formulas. Show your work 19 20 Maximum loan based on: 21 Loan to Value 22 Debt Service Coverage Ratio 23 24 Amount of Annual Debt Service 25 26 Confim Debt Service coverage is met 27 28 Calculate amount of Equity Required 29 30 Calculate weighted Average Cost of Capital 31 32 Calculate the present values of the project below assuming a sale at the end of year 10 and a capitalizaiton rate of 10% 33 34 Present value cash flows years 1-10 35 Present value of terminal cash flow based on sale 36 Total Present Value 37 Net Present Value 38 39

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts