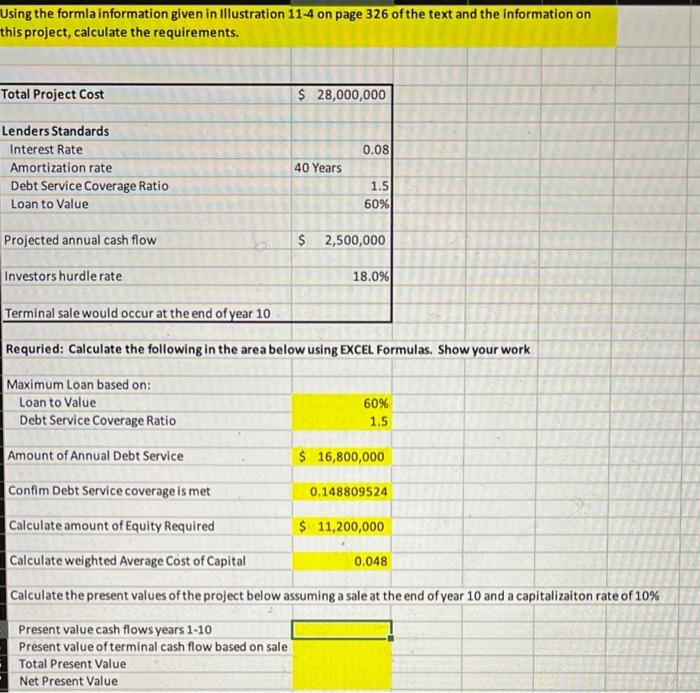

Question: need help with last four highlighted areas Using the formla information given in Illustration 11-4 on page 326 of the text and the information on

Using the formla information given in Illustration 11-4 on page 326 of the text and the information on this project, calculate the requirements. Total Project Cost $ 28,000,000 0.08 Lenders Standards Interest Rate Amortization rate Debt Service Coverage Ratio Loan to Value 40 Years 1.5 60% Projected annual cash flow $ 2,500,000 Investors hurdle rate 18.0% Terminal sale would occur at the end of year 10 Requried: Calculate the following in the area below using EXCEL Formulas. Show your work Maximum loan based on: Loan to Value Debt Service Coverage Ratio 60% 1.5 Amount of Annual Debt Service $ 16,800,000 Confim Debt Service coverage is met 0.148809524 Calculate amount of Equity Required $ 11,200,000 Calculate weighted Average Cost of Capital 0.048 Calculate the present values of the project below assuming a sale at the end of year 10 and a capitalizaiton rate of 10% Present value cash flows years 1-10 Present value of terminal cash flow based on sale Total Present Value Net Present Value Using the formla information given in Illustration 11-4 on page 326 of the text and the information on this project, calculate the requirements. Total Project Cost $ 28,000,000 0.08 Lenders Standards Interest Rate Amortization rate Debt Service Coverage Ratio Loan to Value 40 Years 1.5 60% Projected annual cash flow $ 2,500,000 Investors hurdle rate 18.0% Terminal sale would occur at the end of year 10 Requried: Calculate the following in the area below using EXCEL Formulas. Show your work Maximum loan based on: Loan to Value Debt Service Coverage Ratio 60% 1.5 Amount of Annual Debt Service $ 16,800,000 Confim Debt Service coverage is met 0.148809524 Calculate amount of Equity Required $ 11,200,000 Calculate weighted Average Cost of Capital 0.048 Calculate the present values of the project below assuming a sale at the end of year 10 and a capitalizaiton rate of 10% Present value cash flows years 1-10 Present value of terminal cash flow based on sale Total Present Value Net Present Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts