Question: f-> Moving to another question will save this response. Moving to another question will save this response. Moving to another question will save this response.

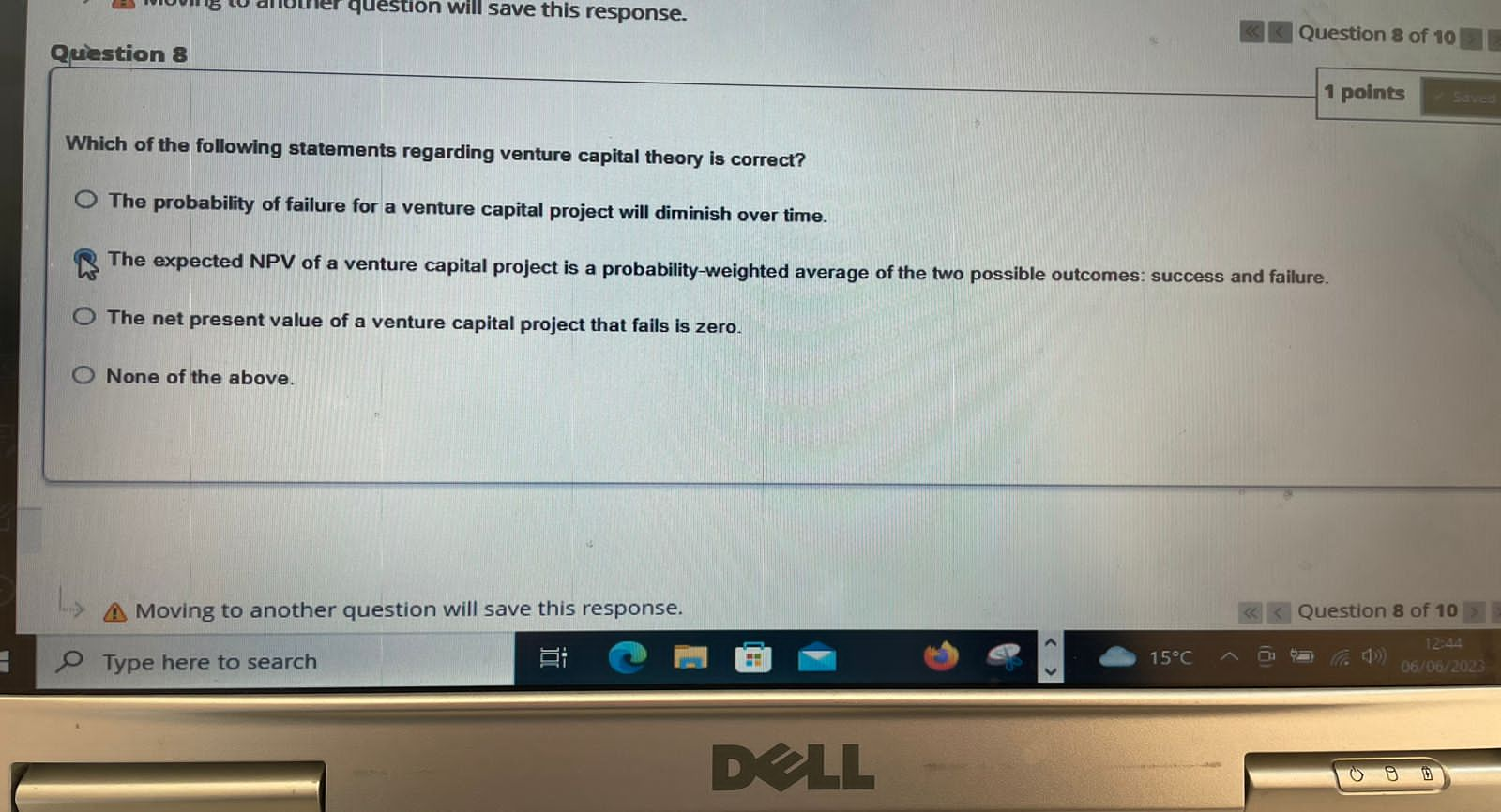

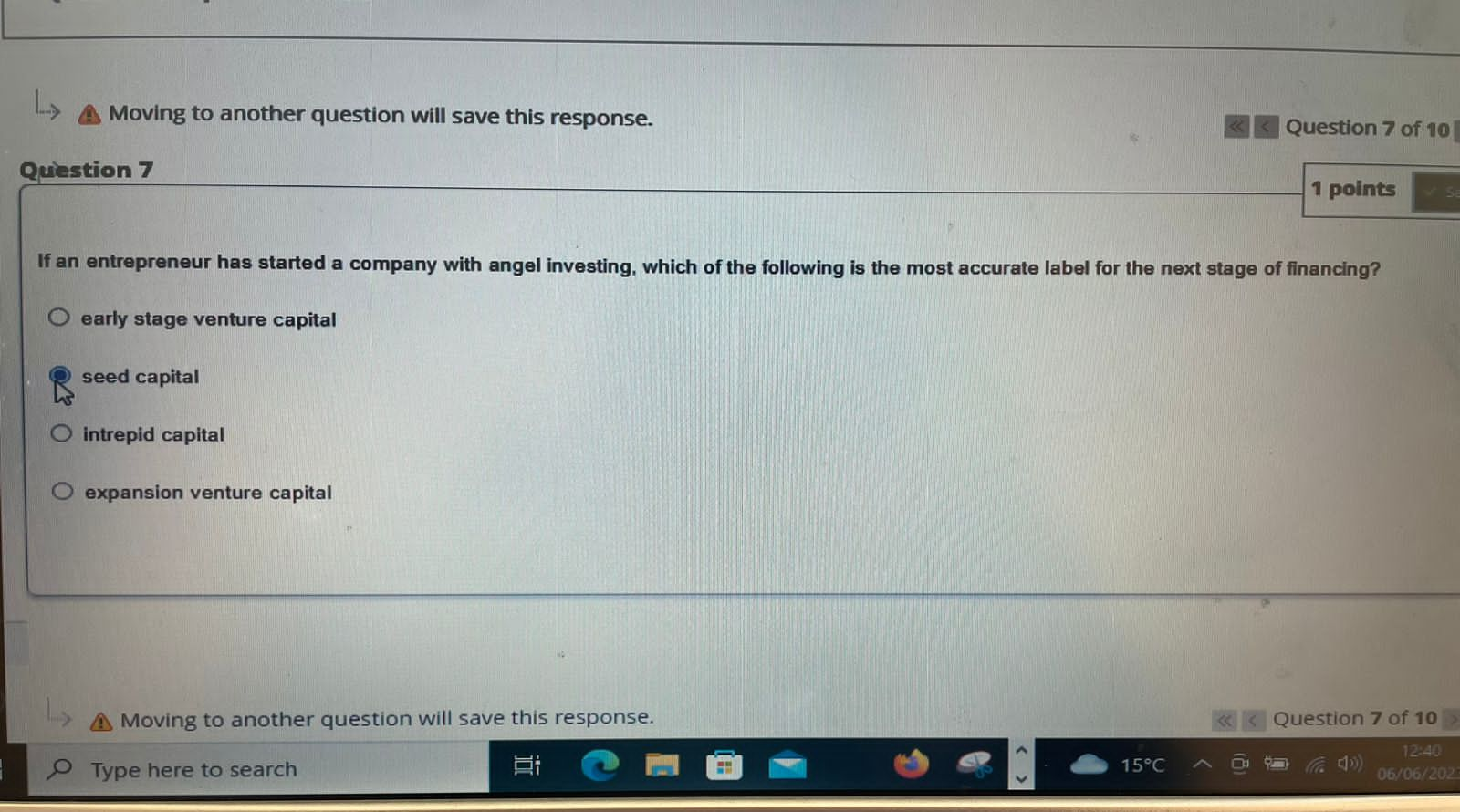

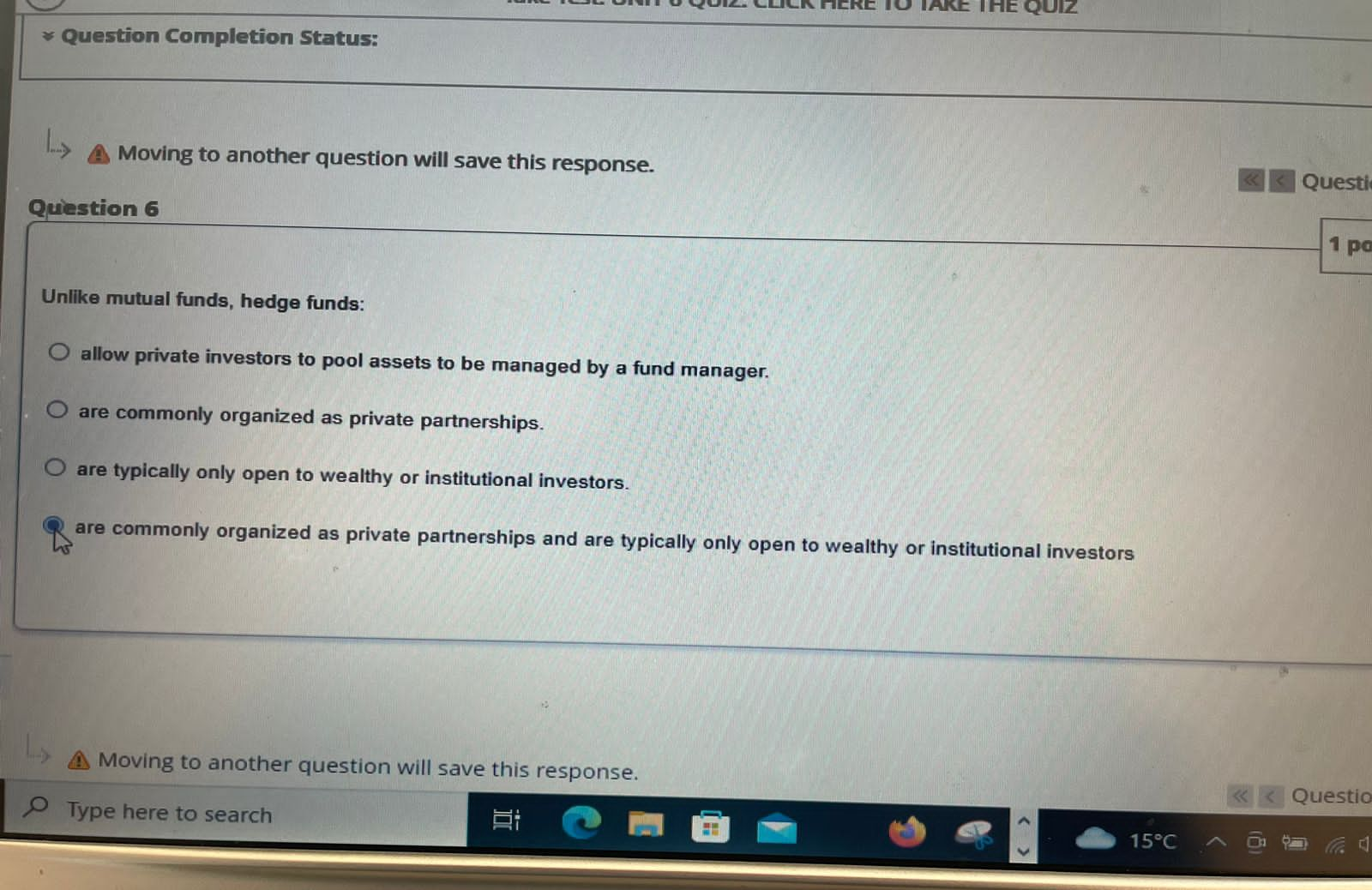

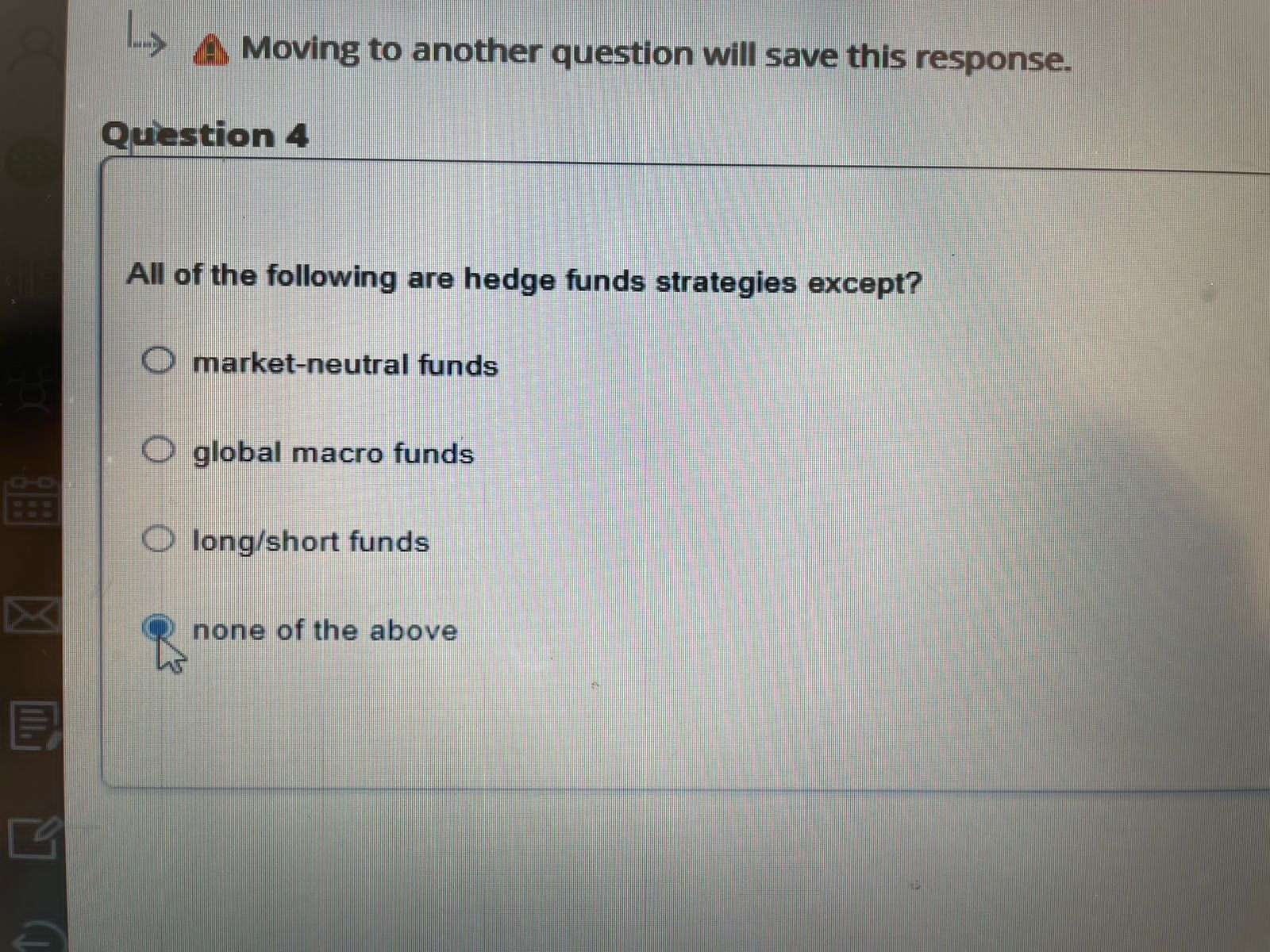

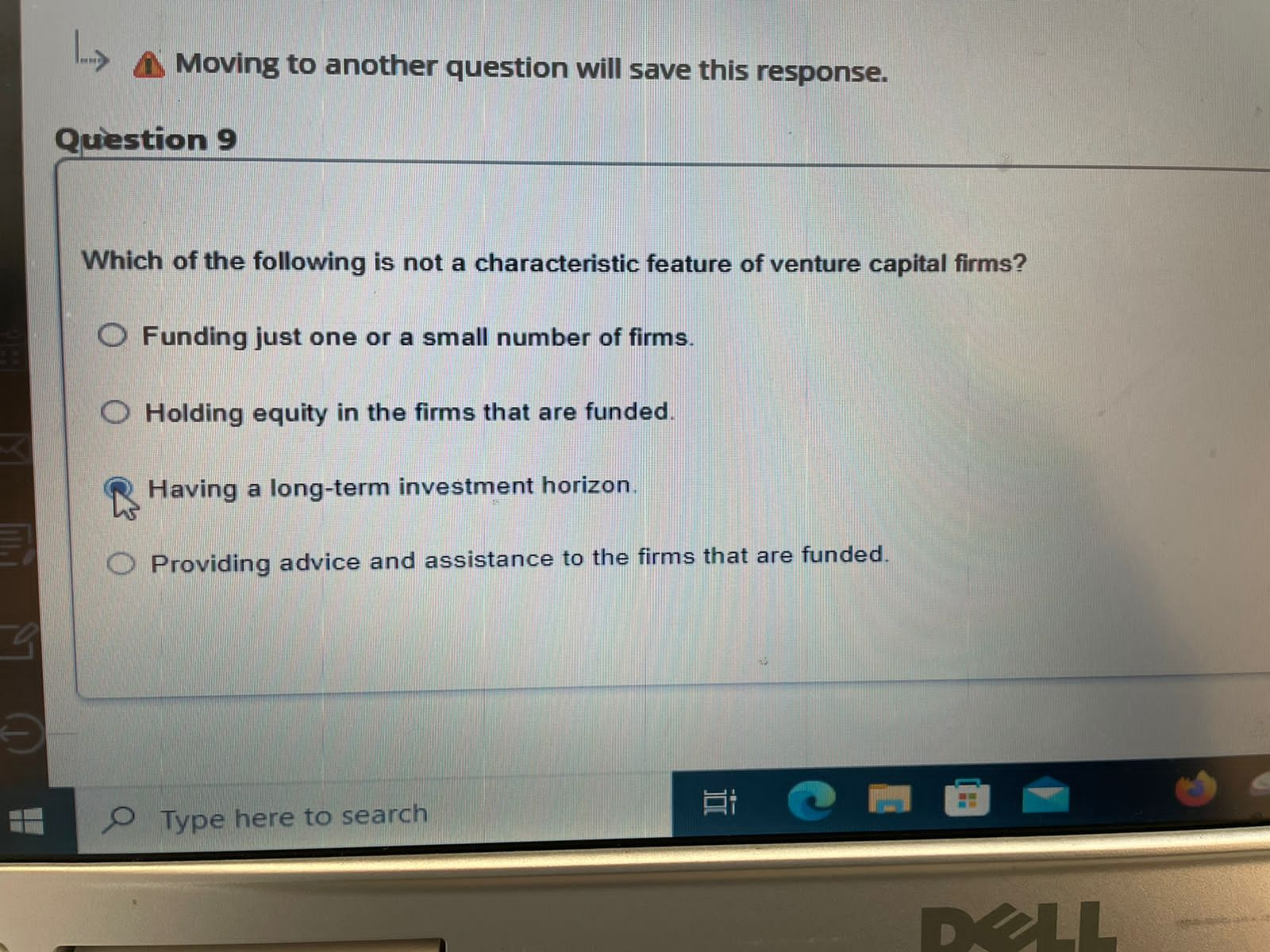

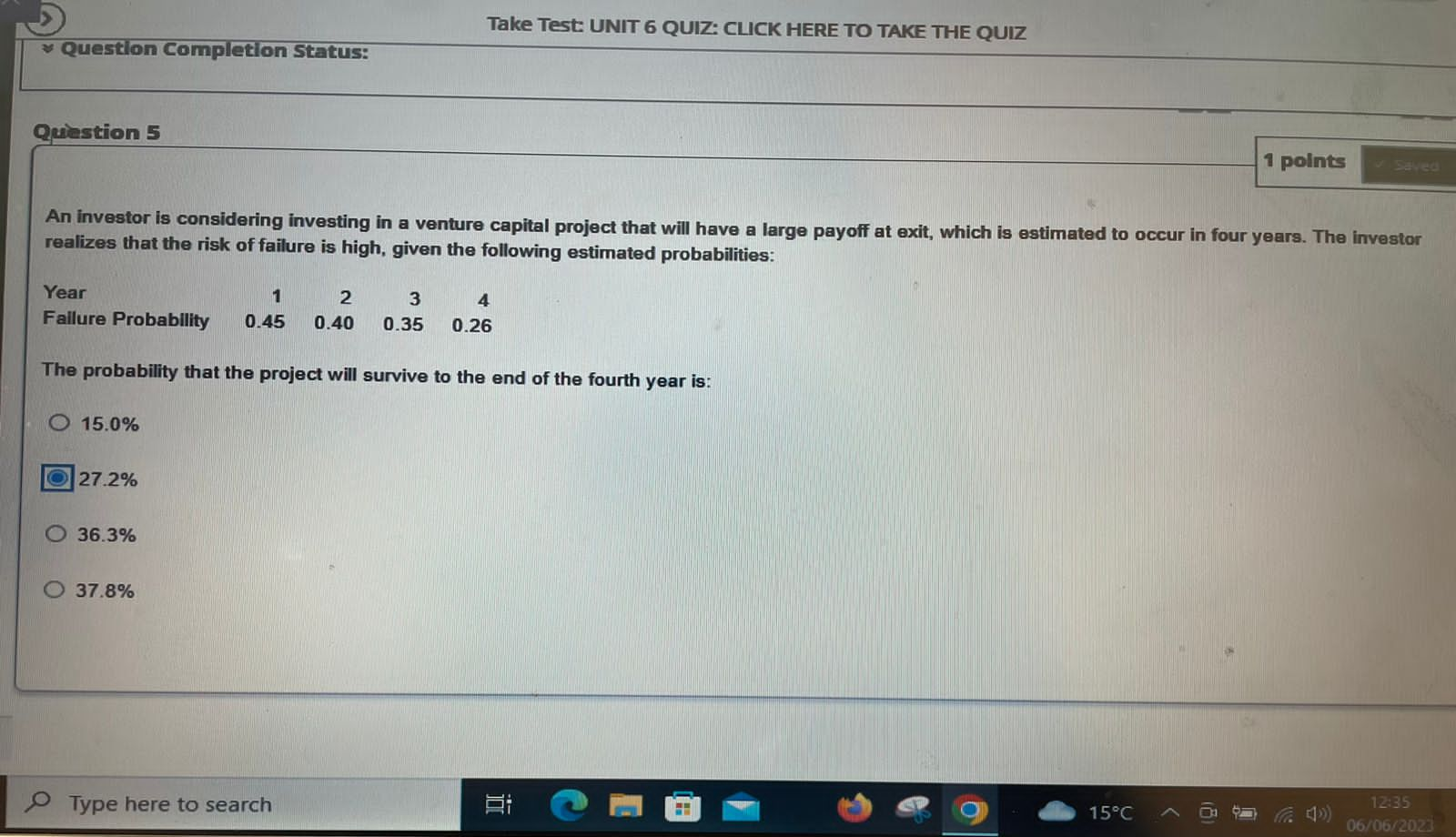

\f-> Moving to another question will save this response. Moving to another question will save this response. Moving to another question will save this response. Moving to another question will save this response. Moving to another question will save this response. Question 2 Which of the following is not among the most important factors in valuing a venture capital investment? Liquidity O Timing of exit Expected payoff at exit Likelihood of failure "Moving to another question will save this response Type here to search OFEN 9lu> Moving to another question will save this response. Question 1 Why is gold considered to be such a valuable commodity and alternative asset? O Allows investors to diversify against risks that affect all stock markets simultaneously O Central Banks regard Gold as monetary asset O It is considered to be liquid and its real value increases during periods of crises. All of the above A Moving to another question will save this response Type here to search 9Moving to another question will save this response. Question 3 Which of the following is most accurate with regards to mezzanine financing? O It is senior to debt represented by bank loans. R Mezzanine financing typically has an equity kicker. Return expectations to mezzanine funds is at about the same level as LBO funds. O Mezzanine financing tends to attract the most capital in a robust economy. A Moving to another question will save this response Type here to search 9.) Click Submit to complete this assessment. Question 10 Which of the following is NOT a way of investing in commodities? O Futures contract (most common) Stocks of companies producing the commodity Buy the commodity directly They are all ways of investing in commodities Click Submit to complete this assessment.) Moving to another question will save this response. Question 9 Which of the following is not a characteristic feature of venture capital firms? O Funding just one or a small number of firms. O Holding equity in the firms that are funded. Having a long-term investment horizon. Providing advice and assistance to the firms that are funded. Type here to search DELLTake Test: UNIT 6 QUIZ: CLICK HERE TO TAKE THE QUIZ Question Completion Status: Question 5 1 points Saved An investor is considering investing in a venture capital project that will have a large payoff at exit, which is estimated to occur in four years. The investor realizes that the risk of failure is high, given the following estimated probabilities: Year Failure Probability 0.45 0.40 0.35 0.26 The probability that the project will survive to the end of the fourth year is: 15.0% 27.2% 36.3% 37.8% 12:35 Type here to search 9 15 C 06/06/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts