Question: Moving to another question will save this response Question 25 If Nico Corporation has annual purchases of $10,230 and accounts payable of $1,815, the average

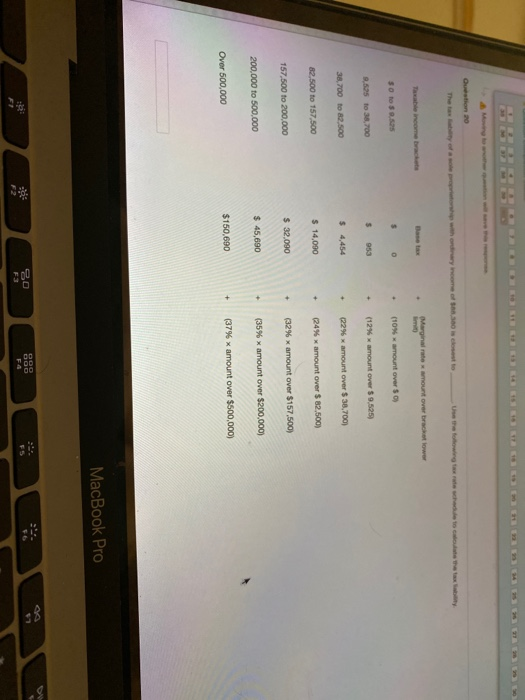

Moving to another question will save this response Question 25 If Nico Corporation has annual purchases of $10,230 and accounts payable of $1,815, the average payment period is Please write answer upto two decimals places. If your answer is 10.6534, write 10.65 only) L A Moving to another question will save this response. MacBook Pro DOO OOO 0 F3 FI F2 % $ # 5 0 4 3 2 Moving to another question will save this response Question 25 If Nico Corporation has annual purchases of $10,230 and accounts payable of $1,815, the average payment period is Please write answer upto two decimals places. If your answer is 10.6534, write 10.65 only) L A Moving to another question will save this response. MacBook Pro DOO OOO 0 F3 FI F2 % $ # 4 5 0 3 2 Moving to another question will save this response. Question 24 If Nico Corporation has cost of goods sold of $18,509 and inventory of $1,501, the average age of inventory is Please write answer upto two decimals places. (if your answer is 10.6534, write 10.65 only) 5 A Moving to another question will save this response. MacBook P Bo DOO DOO F4 F3 F2 % $ # 5 0 re 4 3 2 Moving to another question will save this response Question 23 A venture capitalist is considering investing in a very risky, early stage startup. Compared to investments that the VC might make in less risky companies the VC will pay less for the equity it receives and it will demand a greater share of the startup's equity the VC will pay more for the equity it receives and it will demand a greater share of the startup's equity the VC will pay more for the equity it receives and it will be willing to take a smaller share of the startup's equity the VC will pay less for the equity it receives and it will be willing to take a larger share of the startup's equity A Moving to another question will save this response. MacBook Pro OOO 30 GOO esc F1 F2 & # 3 $ 4 7 V 3 5 0 1 2 Moving to another question will save this response Question 22 As the financial leverage multiplier increases, this may result in a decrease in the net profit margin and return on investment, due to the increase in interest expense as debt increases a decrease in the net profit margin and return on investment, due to the decrease in interest expense as debt decreases an increase in the net profit margin and return on investment, due to the increase in interest expense as debt increases an increase in the net profit margin and return on investment, due to the decrease in interest expense as debt decreases 1 A Moving to another question will save this response. MacBook Pro 000 DOO 55 MacBook Pro T R E G c S D B N X C command MacBook Pro . * 2 R / * \ G F c \ D * S N C V X Z b Question 10 ory income 300 Marginal teamount over bracket lower mo 50 to $ 0 (10% amount over $0) 9.5.25 to 38,700 $ 953 (12% amount over $9.525) 38,700 to 82.500 $ 4,454 (22%x amount over $ 38,700) 82.500 to 157,500 $ 14,000 (24% x amount over $82,500) 157.500 to 200.000 $ 32.090 (32% x amount over $157,500) 200,000 to 500,000 $ 45,690 (35% x amount over $200,000) Over 500,000 $150.690 (37% x amount over $500,000) MacBook Pro DOO 20 FA F2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts