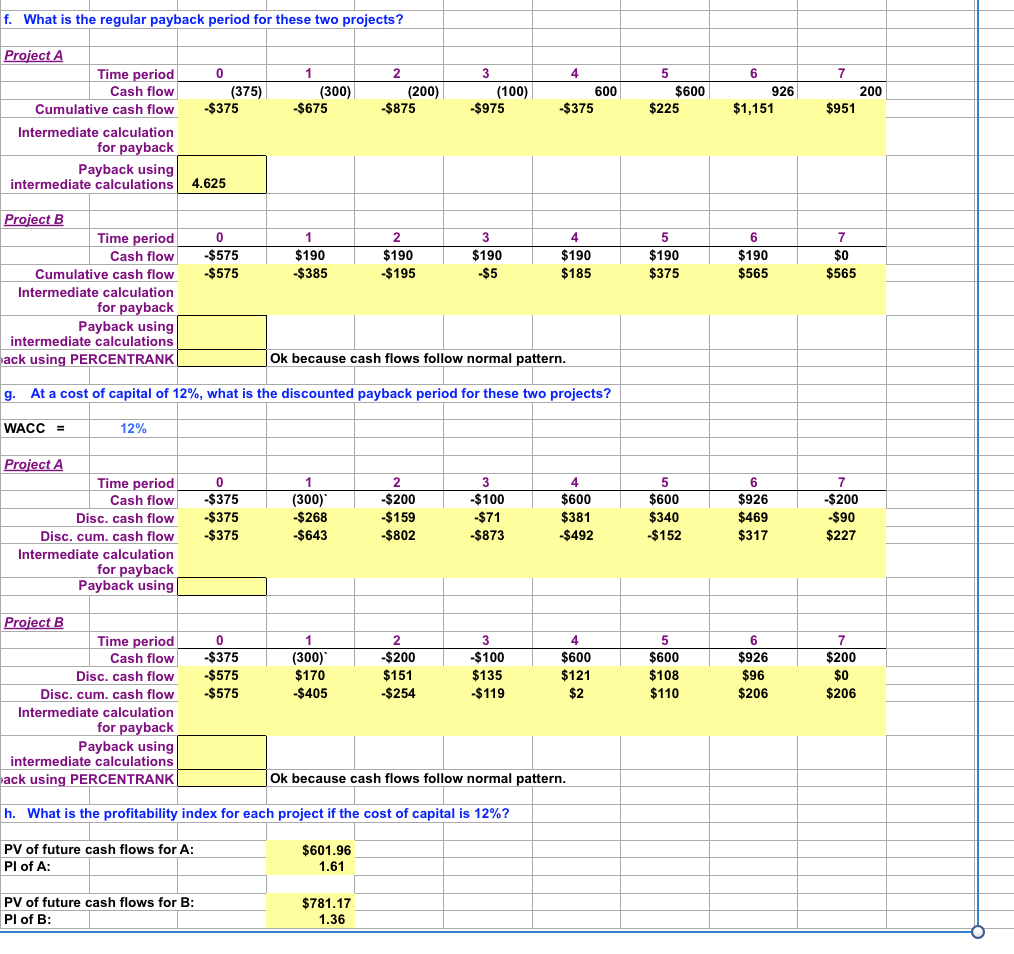

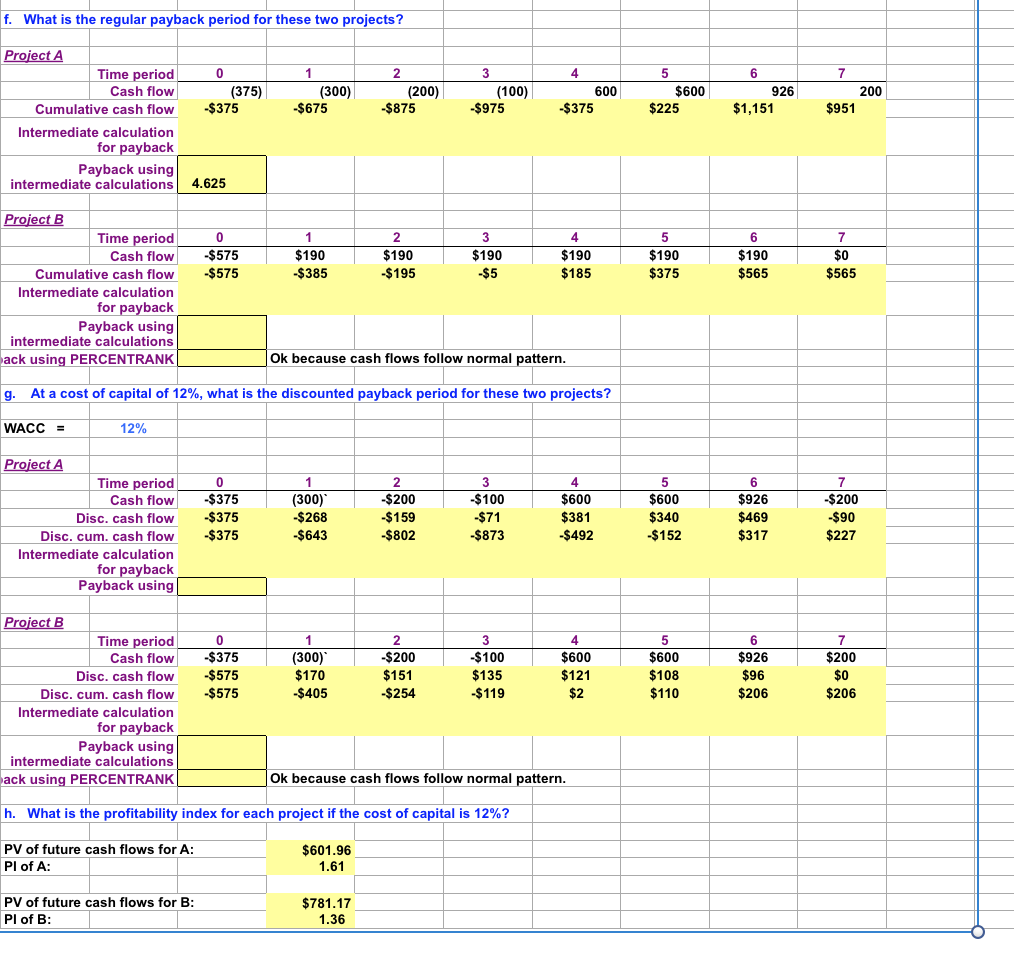

Question: f. What is the regular payback period for these two projects? 0 (375) -$375 1 (300) $675 2 (200) -$875 3 (100) $975 600 -$375

f. What is the regular payback period for these two projects? 0 (375) -$375 1 (300) $675 2 (200) -$875 3 (100) $975 600 -$375 5 $600 $225 926 $1,151 200 $951 Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 4.625 0 $575 2 $190 -$195 3 $190 $190 5 $190 $375 $190 $185 SO $190 $565 -$575 -$385 -$5 $565 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 6 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using 0 -$375 -$375 -$375 (300) -$268 $643 -$200 -$159 -$802 $100 -$71 -$873 $600 $381 -$492 5 $600 $340 -$152 $926 $469 $317 -$200 -$90 $227 2 $200 0 -$375 -$575 $575 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK (300) $170 -$405 -$200 $151 -$254 $100 $135 $ 119 $600 $121 $2 $600 $108 $110 6 $926 $96 $206 $0 $206 Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: Pl of A: $601.96 1.61 PV of future cash flows for B: Pl of B: $781.17 1.36 f. What is the regular payback period for these two projects? 0 (375) -$375 1 (300) $675 2 (200) -$875 3 (100) $975 600 -$375 5 $600 $225 926 $1,151 200 $951 Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 4.625 0 $575 2 $190 -$195 3 $190 $190 5 $190 $375 $190 $185 SO $190 $565 -$575 -$385 -$5 $565 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 6 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using 0 -$375 -$375 -$375 (300) -$268 $643 -$200 -$159 -$802 $100 -$71 -$873 $600 $381 -$492 5 $600 $340 -$152 $926 $469 $317 -$200 -$90 $227 2 $200 0 -$375 -$575 $575 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK (300) $170 -$405 -$200 $151 -$254 $100 $135 $ 119 $600 $121 $2 $600 $108 $110 6 $926 $96 $206 $0 $206 Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: Pl of A: $601.96 1.61 PV of future cash flows for B: Pl of B: $781.17 1.36 f. What is the regular payback period for these two projects? 0 1 2 3 4 7 56 $0 A (100) 600 600 926 (200) Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 0 1 2 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 0 1 2 3 4 5 6 7 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using 1 2 3 5 5 6 7 Project B Time period 0 Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: PI of A: PV of future cash flows for B: Pl of B: f. What is the regular payback period for these two projects? 0 (375) -$375 1 (300) $675 2 (200) -$875 3 (100) $975 600 -$375 5 $600 $225 926 $1,151 200 $951 Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 4.625 0 $575 2 $190 -$195 3 $190 $190 5 $190 $375 $190 $185 SO $190 $565 -$575 -$385 -$5 $565 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 6 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using 0 -$375 -$375 -$375 (300) -$268 $643 -$200 -$159 -$802 $100 -$71 -$873 $600 $381 -$492 5 $600 $340 -$152 $926 $469 $317 -$200 -$90 $227 2 $200 0 -$375 -$575 $575 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK (300) $170 -$405 -$200 $151 -$254 $100 $135 $ 119 $600 $121 $2 $600 $108 $110 6 $926 $96 $206 $0 $206 Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: Pl of A: $601.96 1.61 PV of future cash flows for B: Pl of B: $781.17 1.36 f. What is the regular payback period for these two projects? 0 (375) -$375 1 (300) $675 2 (200) -$875 3 (100) $975 600 -$375 5 $600 $225 926 $1,151 200 $951 Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 4.625 0 $575 2 $190 -$195 3 $190 $190 5 $190 $375 $190 $185 SO $190 $565 -$575 -$385 -$5 $565 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 6 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using 0 -$375 -$375 -$375 (300) -$268 $643 -$200 -$159 -$802 $100 -$71 -$873 $600 $381 -$492 5 $600 $340 -$152 $926 $469 $317 -$200 -$90 $227 2 $200 0 -$375 -$575 $575 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK (300) $170 -$405 -$200 $151 -$254 $100 $135 $ 119 $600 $121 $2 $600 $108 $110 6 $926 $96 $206 $0 $206 Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: Pl of A: $601.96 1.61 PV of future cash flows for B: Pl of B: $781.17 1.36 f. What is the regular payback period for these two projects? 0 1 2 3 4 7 56 $0 A (100) 600 600 926 (200) Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 0 1 2 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% 0 1 2 3 4 5 6 7 Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using 1 2 3 5 5 6 7 Project B Time period 0 Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations ack using PERCENTRANK Ok because cash flows follow normal pattern. h. What is the profitability index for each project if the cost of capital is 12%? PV of future cash flows for A: PI of A: PV of future cash flows for B: Pl of B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts