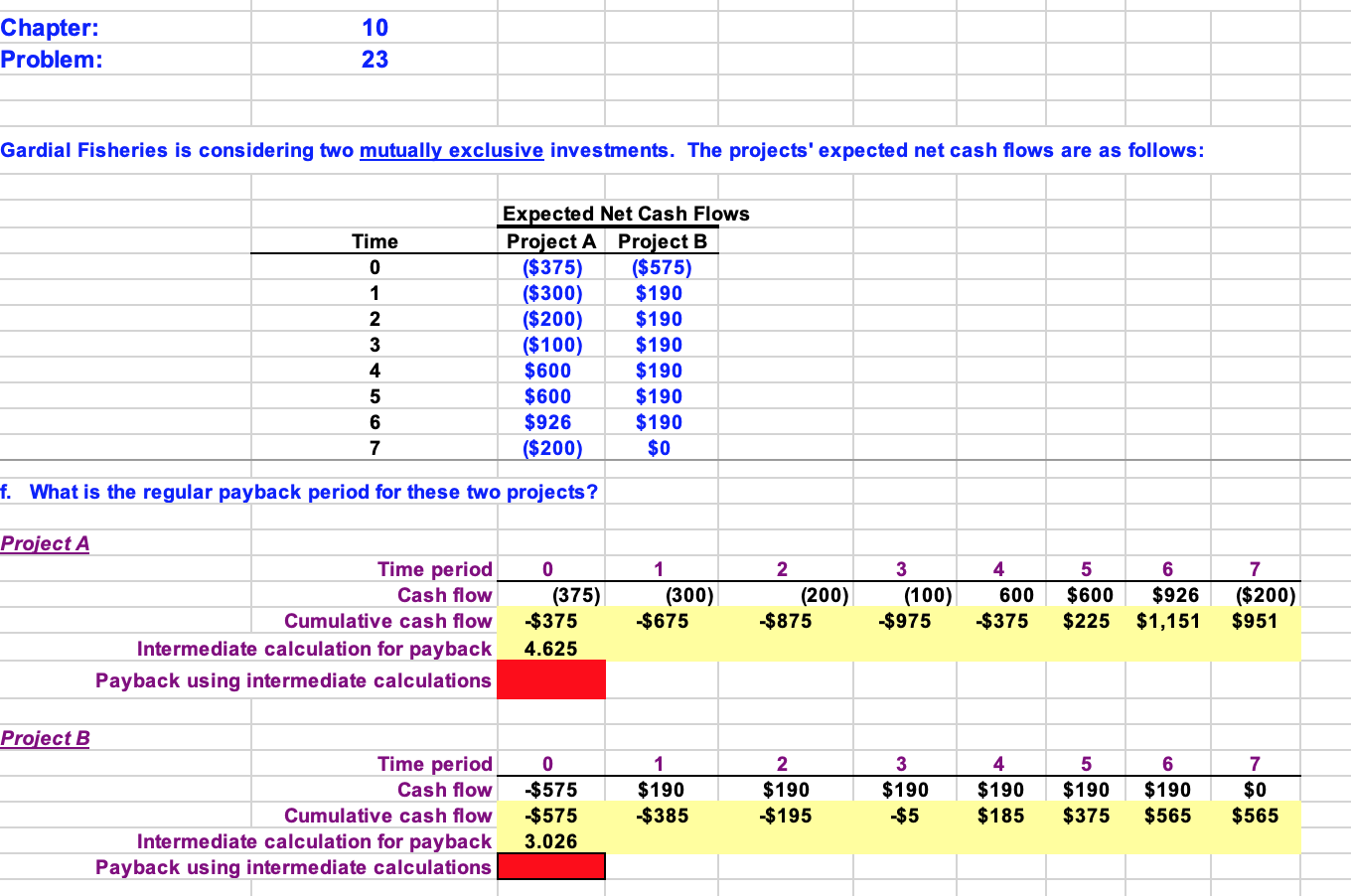

Question: Needing help with the Excel formulas for the cells in read please. 10 Chapter: Problem: 23 Gardial Fisheries is considering two mutually exclusive investments. The

Needing help with the Excel formulas for the cells in read please.

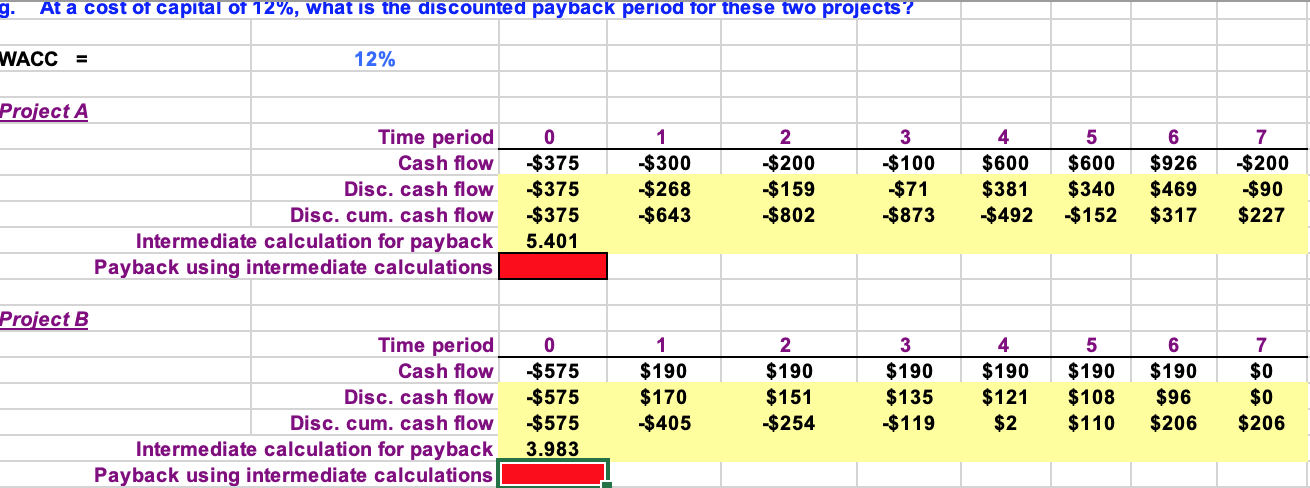

Needing help with the Excel formulas for the cells in read please.

10 Chapter: Problem: 23 Gardial Fisheries is considering two mutually exclusive investments. The projects' expected net cash flows are as follows: Time Expected Net Cash Flows Project A Project B ($375) ($575) ($300) $190 ($200) $190 ($100) $190 $600 $190 $600 $190 $926 $190 ($200) $0 3 4 f. What is the regular payback period for these two projects? Project A Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 0 (375) $375 4.625 1 (300) $675 2 (200) $875 3 (100) $975 4 600 $375 5 $600 $225 6 $926 $1,151 7 ($200) $951 Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations 0 $575 $575 3.026 1 $190 $385 2 $190 $195 3 $190 $5 4 $190 $185 5 $190 $375 6 $190 $565 7 $0 $565 g. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC = 12% Project A Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations 0 $375 $375 $375 5.401 1 $300 -$268 $643 2 $200 $159 $802 #: 3 $100 $71 -$873 4 $600 $381 $492 5 $600 $340 $152 6 $926 $469 $317 7 $200 $90 $227 Project B Time period Cash flow Disc. cash flow Disc. cum. cash flow Intermediate calculation for payback Payback using intermediate calculations 0 $575 $575 $575 3.983 1 $190 $170 -$405 2 $190 $151 $254 3 $190 $135 $119 4 $190 $121 $2 5 $190 $108 $110 6 $190 $96 $206 7 $0 $0 $206

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts