Question: (f) What will the equilibrium bid and ask prices be at time t=0 (i.e. before the market maker makes any trades)? Continue to assume that

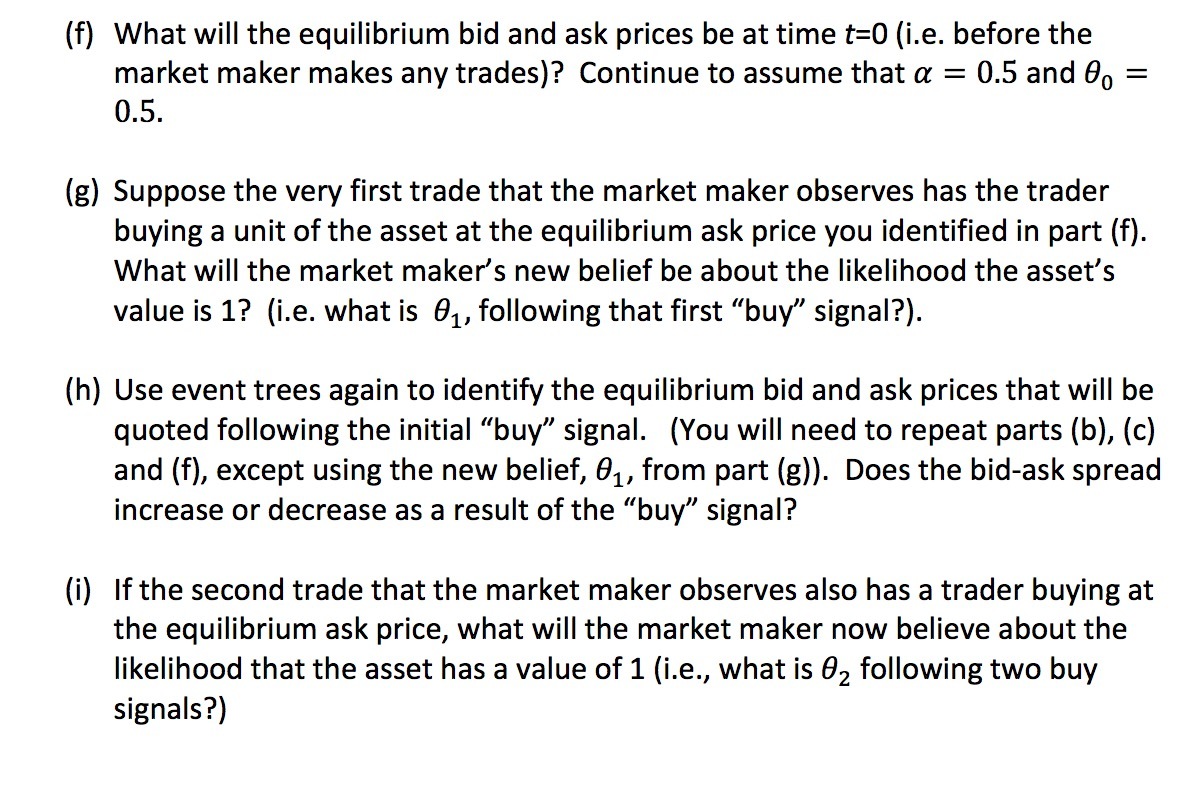

(f) What will the equilibrium bid and ask prices be at time t=0 (i.e. before the market maker makes any trades)? Continue to assume that a: = 0.5 and 90 = 0.5. (g) Suppose the very first trade that the market maker observes has the trader buying a unit of the asset at the equilibrium ask price you identified in part (f). What will the market maker's new belief be about the likelihood the asset's value is 1? (Le. what is 91, following that first \"buy\" signal?). (h) Use event trees again to identify the equilibrium bid and ask prices that will be quoted following the initial \"buy\" signal. (You will need to repeat parts (b), (c) and (f), except using the new belief, 91, from part (g)). Does the bid-ask spread increase or decrease as a result of the "buy" signal? (i) ifthe second trade that the market maker observes also has a trader buying at the equilibrium ask price, what will the market maker now believe about the likelihood that the asset has a value of 1 (i.e., what is 92 following two buy signals?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts