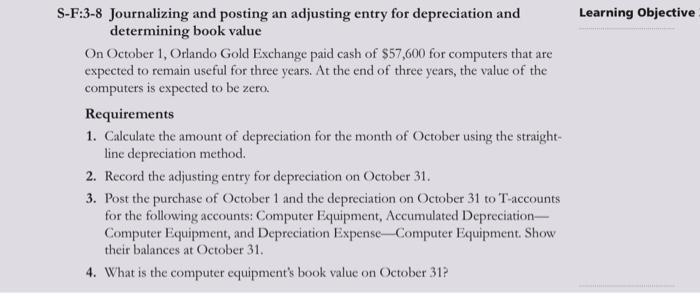

Question: -F:3-8 Journalizing and posting an adjusting entry for depreciation and determining book value On October 1, Orlando Gold Exchange paid cash of $57,600 for computers

-F:3-8 Journalizing and posting an adjusting entry for depreciation and determining book value On October 1, Orlando Gold Exchange paid cash of $57,600 for computers that are expected to remain useful for three years. At the end of three years, the value of the computers is expected to be zero. Requirements 1. Calculate the amount of depreciation for the month of October using the straightline depreciation method. 2. Record the adjusting entry for depreciation on Oetober 31 . 3. Post the purchase of October 1 and the depreciation on October 31 to T-accounts for the following accounts: Computer Equipment, Accumulated DepreciationComputer Equipment, and Depreciation Expense-Computer Equipment. Show their balances at October 31. 4. What is the computer equipment's book value on October 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts