Question: The Adjusting Proce s3-8 Journalizing and posting an adjusting entry for depreciation and Learning Objective 3 determining book value On October 1, Orlando Gold Exchange

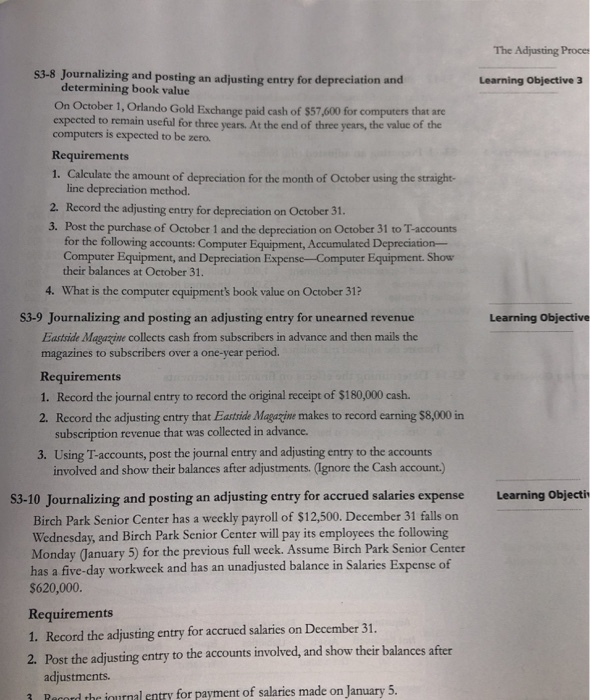

The Adjusting Proce s3-8 Journalizing and posting an adjusting entry for depreciation and Learning Objective 3 determining book value On October 1, Orlando Gold Exchange paid cash of $57,600 for computers that are expected to remain useful for three years. At the end of three years, the value of the computers is expected to be zero. Requirements 1. Calculate the amount of depreciation for the month of October using the straight- line depreciation method 2. Record the adjusting entry for depreciation on October 31. 3. Post the purchase of October 1 and the depreciation on October 31 to T-accounts for the following accounts: Computer Equipment, Accumulated Depreciation- Computer Equipment, and Depreciation Expense-Computer Equipment. Show their balances at October 31. 4. What is the computer equipment's book value on October 31? S3-9 Journalizing and posting an adjusting entry for unearned revenue Learning Objective Eastside Magazine collects cash from subscribers in advance and then mails the magazines to subscribers over a one-year period. Requirements 1. Record the journal entry to record the original receipt of $180,000 cash. 2. Record the adjusting entry that Eastside Magazine makes to record earning $8,000 in subscription revenue that was collected in advance. 3. Using T-accounts, post the journal entry and adjusting entry to the accounts involved and show their balances after adjustments. (ignore the Cash account.) $3-10 Journalizing and posting an adjusting entry for accrued salaries expense Learning Objecti Birch Park Senior Center has a weekly payroll of $12,500. December 31 falls orn Wednesday, and Birch Park Senior Center will pay its employees the following Monday January 5) for the previous full week. Assume Birch Park Senior Center has a five-day workweek and has an unadjusted balance in Salaries Expense of $620,000. Requirements 1. Record the adjusting entry for accrued salaries on December 31 2. Post the adjusting entry to the accounts involved, and show their balances after adjustments. 1 Rerord thr iournal entry for payment of salaries made on January 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts