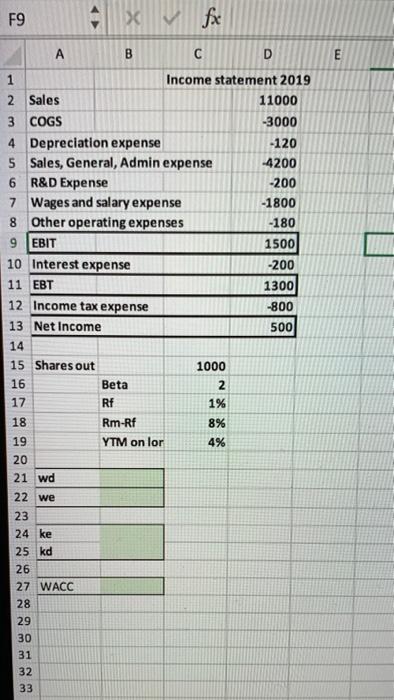

Question: F9 XV V fx A B D E 1 Income statement 2019 2 Sales 11000 3 COGS -3000 4 Depreciation expense -120 5 Sales, General,

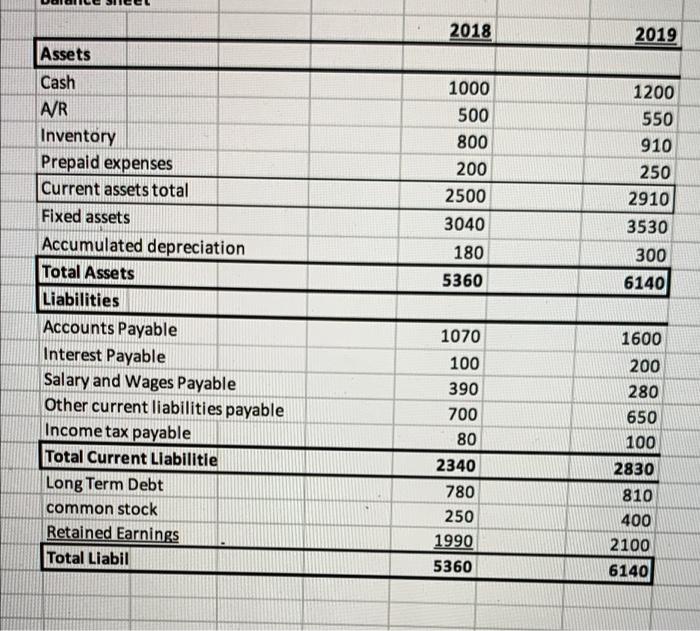

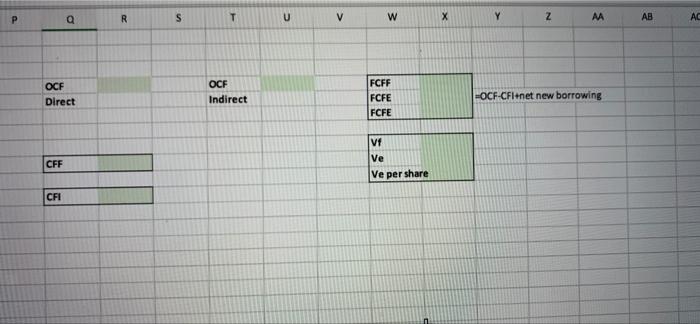

F9 XV V fx A B D E 1 Income statement 2019 2 Sales 11000 3 COGS -3000 4 Depreciation expense -120 5 Sales, General, Admin expense -4200 6 R&D Expense -200 7 Wages and salary expense -1800 8 Other operating expenses -180 9 EBIT 1500 10 Interest expense -200 11 EBT 1300 12 Income tax expense -800 13 Net Income 500 14 15 Shares out 1000 16 Beta 2 17 Rf 1% 18 Rm-Rf 8% 19 YTM on lor 4% 20 21 wd 22 we 0 23 NNNNN 24 ke 25 kd 26 27 WACC 28 29 31 32 33 OONM W 2018 2019 1000 500 800 200 2500 3040 180 5360 1200 550 910 250 2910 3530 300 6140 Assets Cash A/R Inventory Prepaid expenses Current assets total Fixed assets Accumulated depreciation Total Assets Liabilities Accounts Payable Interest Payable Salary and Wages Payable Other current liabilities payable Income tax payable Total Current Liabilitie Long Term Debt common stock Retained Earnings Total Liabil 1070 100 390 700 80 2340 780 250 1990 5360 1600 200 280 650 100 2830 810 400 2100 6140 P R a S T U V w Y N AB OCF Direct OCF Indirect FCFF FCFE FCFE =OCF-CFI net new borrowing CFF VE Ve Ve per share CFI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts