Question: Face value=100, Please keep at least 6 decimal digits. Thanks!!! A risk-free 1-year 6% coupon bond has YTM=9% while a risk-free 1-year 16% coupon bond

Face value=100,

Face value=100,

Please keep at least 6 decimal digits. Thanks!!!

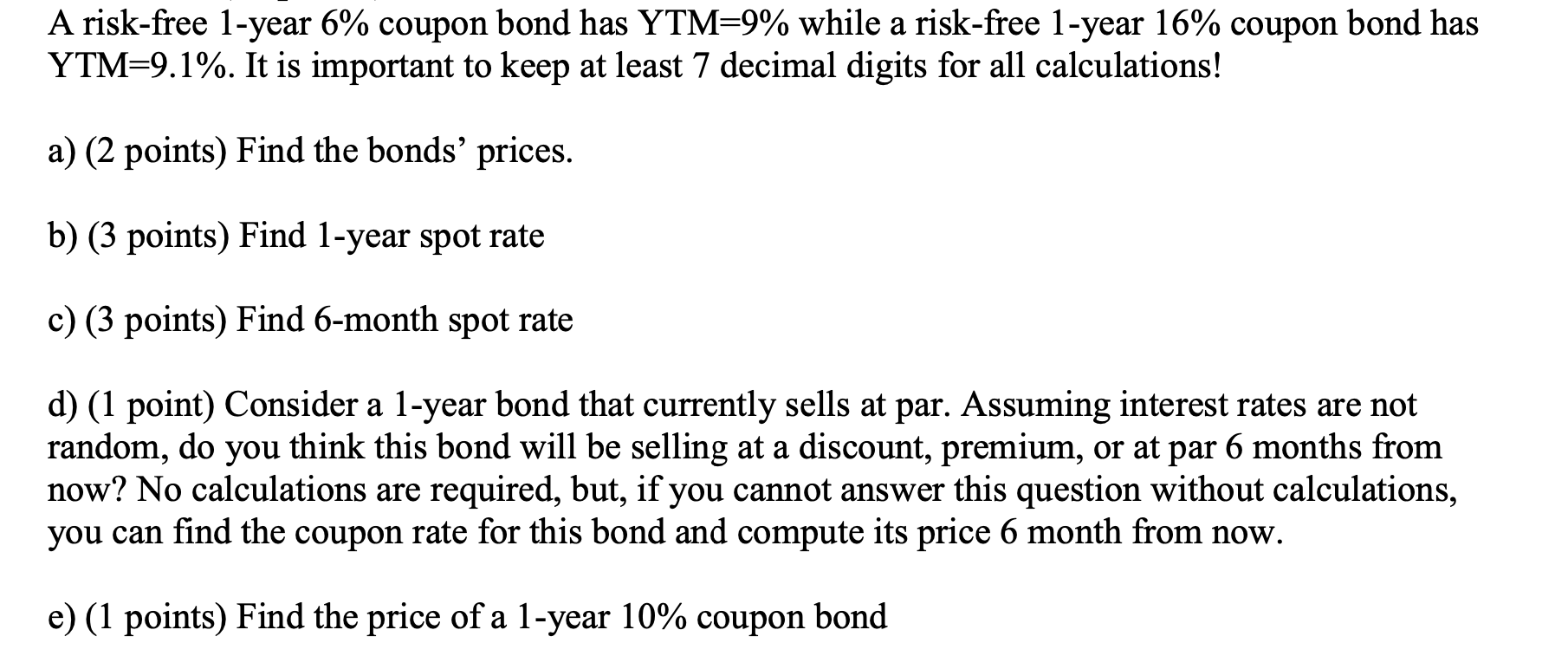

A risk-free 1-year 6% coupon bond has YTM=9% while a risk-free 1-year 16% coupon bond has YTM=9.1%. It is important to keep at least 7 decimal digits for all calculations! a) (2 points) Find the bonds' prices. b) (3 points) Find 1-year spot rate c) (3 points) Find 6-month spot rate d) (1 point) Consider a 1-year bond that currently sells at par. Assuming interest rates are not random, do you think this bond will be selling at a discount, premium, or at par 6 months from now? No calculations are required, but, if you cannot answer this question without calculations, you can find the coupon rate for this bond and compute its price 6 month from now. e) (1 points) Find the price of a 1-year 10% coupon bond A risk-free 1-year 6% coupon bond has YTM=9% while a risk-free 1-year 16% coupon bond has YTM=9.1%. It is important to keep at least 7 decimal digits for all calculations! a) (2 points) Find the bonds' prices. b) (3 points) Find 1-year spot rate c) (3 points) Find 6-month spot rate d) (1 point) Consider a 1-year bond that currently sells at par. Assuming interest rates are not random, do you think this bond will be selling at a discount, premium, or at par 6 months from now? No calculations are required, but, if you cannot answer this question without calculations, you can find the coupon rate for this bond and compute its price 6 month from now. e) (1 points) Find the price of a 1-year 10% coupon bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts