Question: Face value=100, Please keep at least 6 decimal digits. Thanks!!! a Assume the term structure of interest rates is flat and consider a 1-factor model

Face value=100,

Face value=100,

Please keep at least 6 decimal digits. Thanks!!!

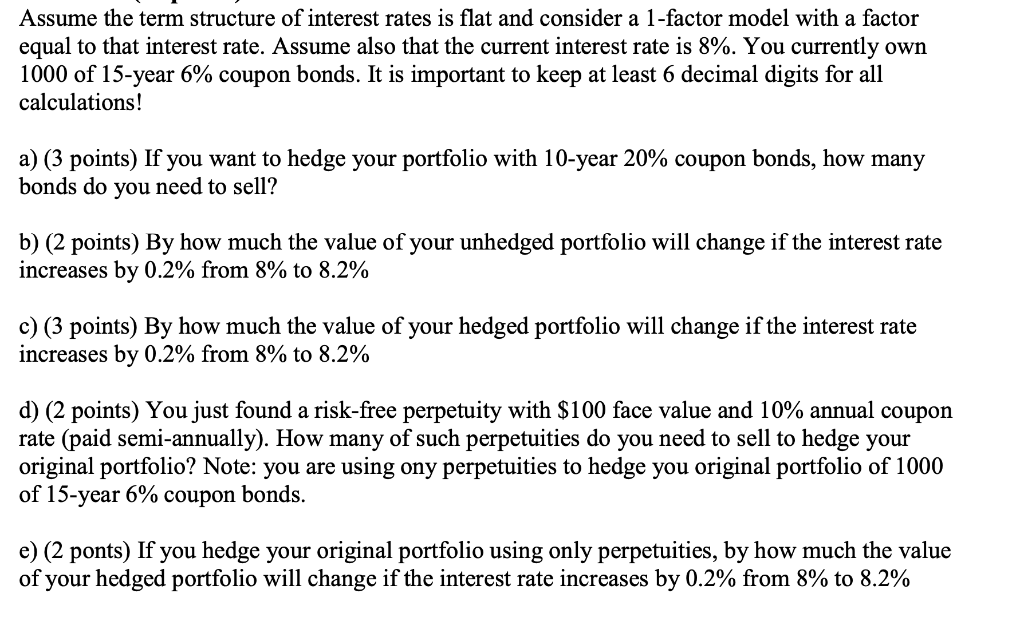

a Assume the term structure of interest rates is flat and consider a 1-factor model with a factor equal to that interest rate. Assume also that the current interest rate is 8%. You currently own 1000 of 15-year 6% coupon bonds. It is important to keep at least 6 decimal digits for all calculations! a) (3 points) If you want to hedge your portfolio with 10-year 20% coupon bonds, how many bonds do you need to sell? b) (2 points) By how much the value of your unhedged portfolio will change if the interest rate increases by 0.2% from 8% to 8.2% c) (3 points) By how much the value of your hedged portfolio will change if the interest rate increases by 0.2% from 8% to 8.2% d) (2 points) You just found a risk-free perpetuity with $100 face value and 10% annual coupon rate (paid semi-annually). How many of such perpetuities do you need to sell to hedge your original portfolio? Note: you are using ony perpetuities to hedge you original portfolio of 1000 of 15-year 6% coupon bonds. e) (2 ponts) If you hedge your original portfolio using only perpetuities, by how much the value of your hedged portfolio will change if the interest rate increases by 0.2% from 8% to 8.2% a Assume the term structure of interest rates is flat and consider a 1-factor model with a factor equal to that interest rate. Assume also that the current interest rate is 8%. You currently own 1000 of 15-year 6% coupon bonds. It is important to keep at least 6 decimal digits for all calculations! a) (3 points) If you want to hedge your portfolio with 10-year 20% coupon bonds, how many bonds do you need to sell? b) (2 points) By how much the value of your unhedged portfolio will change if the interest rate increases by 0.2% from 8% to 8.2% c) (3 points) By how much the value of your hedged portfolio will change if the interest rate increases by 0.2% from 8% to 8.2% d) (2 points) You just found a risk-free perpetuity with $100 face value and 10% annual coupon rate (paid semi-annually). How many of such perpetuities do you need to sell to hedge your original portfolio? Note: you are using ony perpetuities to hedge you original portfolio of 1000 of 15-year 6% coupon bonds. e) (2 ponts) If you hedge your original portfolio using only perpetuities, by how much the value of your hedged portfolio will change if the interest rate increases by 0.2% from 8% to 8.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts