Question: Facebook is considering three vendors for purchasing a CRM system: Delphi Inc., CRM International, and Murray Analytics. The costs of the system are expected to

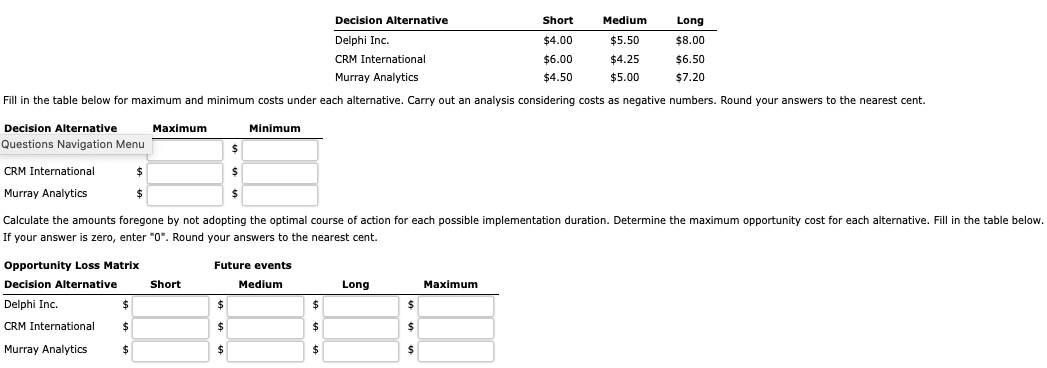

Facebook is considering three vendors for purchasing a CRM system: Delphi Inc., CRM International, and Murray Analytics. The costs of the system are expected to depend on the length of time required to implement the system, which depends on such factors as the amount of customization required, integration with legacy systems, resistance to change, and so on. Each vendor has different expertise in handling these things, which affect the cost. The costs (in millions of $) are shown below for short, medium, and long implementation durations. Use the Excel template Decision Analysis to identify what vendor to select.

FIND THE FOLLOWING QUESTION:

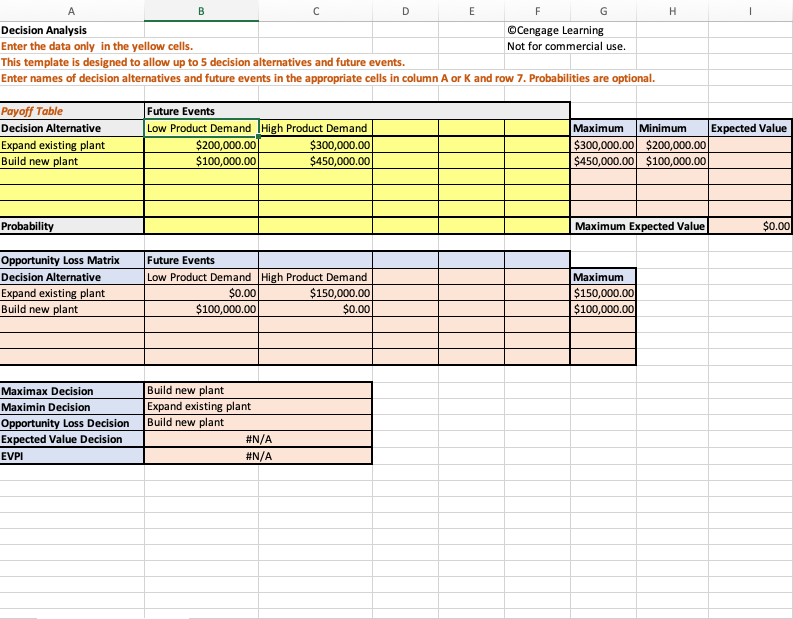

A B D E H F G Decision Analysis Cengage Learning Enter the data only in the yellow cells. Not for commercial use. This template is designed to allow up to 5 decision alternatives and future events. Enter names of decision alternatives and future events in the appropriate cells in column A or k and row 7. Probabilities are optional. Payoff Table Decision Alternative Expand existing plant Build new plant Future Events Low Product Demand High Product Demand $200,000.00 $300,000.00 $100,000.00 $450,000.00 Maximum Minimum Expected Value $300,000.00 $200,000.00 $450,000.00 $100,000.00 Probability Maximum Expected Value $0.00 Opportunity Loss Matrix Decision Alternative Expand existing plant Build new plant Future Events Low Product Demand High Product Demand $0.00 $150,000.00 $100,000.00 $0.00 Maximum $150,000.00 $100,000.00 Maximax Decision Maximin Decision Opportunity Loss Decision Expected Value Decision EVPI Build new plant Expand existing plant Build new plant #N/A #N/A $4.00 Decision Alternative Short Medium Long Delphi Inc. $5.50 $8.00 CRM International $6.00 $4.25 $6.50 Murray Analytics $4.50 $5.00 $7.20 Fill in the table below for maximum and minimum costs under each alternative. Carry out an analysis considering costs as negative numbers. Round your answers to the nearest cent. Maximum Minimum Decision Alternative Questions Navigation Menu $ $ $ CRM International Murray Analytics $ $ Calculate the amounts foregone by not adopting the optimal course of action for each possible implementation duration. Determine the maximum opportunity cost for each alternative. Fill in the table below. If your answer is zero, enter "0". Round your answers to the nearest cent. Future events Medium Short Long Maximum Opportunity Loss Matrix Decision Alternative Delphi Inc. $ CRM International $ $ Murray Analytics $ A B D E H F G Decision Analysis Cengage Learning Enter the data only in the yellow cells. Not for commercial use. This template is designed to allow up to 5 decision alternatives and future events. Enter names of decision alternatives and future events in the appropriate cells in column A or k and row 7. Probabilities are optional. Payoff Table Decision Alternative Expand existing plant Build new plant Future Events Low Product Demand High Product Demand $200,000.00 $300,000.00 $100,000.00 $450,000.00 Maximum Minimum Expected Value $300,000.00 $200,000.00 $450,000.00 $100,000.00 Probability Maximum Expected Value $0.00 Opportunity Loss Matrix Decision Alternative Expand existing plant Build new plant Future Events Low Product Demand High Product Demand $0.00 $150,000.00 $100,000.00 $0.00 Maximum $150,000.00 $100,000.00 Maximax Decision Maximin Decision Opportunity Loss Decision Expected Value Decision EVPI Build new plant Expand existing plant Build new plant #N/A #N/A $4.00 Decision Alternative Short Medium Long Delphi Inc. $5.50 $8.00 CRM International $6.00 $4.25 $6.50 Murray Analytics $4.50 $5.00 $7.20 Fill in the table below for maximum and minimum costs under each alternative. Carry out an analysis considering costs as negative numbers. Round your answers to the nearest cent. Maximum Minimum Decision Alternative Questions Navigation Menu $ $ $ CRM International Murray Analytics $ $ Calculate the amounts foregone by not adopting the optimal course of action for each possible implementation duration. Determine the maximum opportunity cost for each alternative. Fill in the table below. If your answer is zero, enter "0". Round your answers to the nearest cent. Future events Medium Short Long Maximum Opportunity Loss Matrix Decision Alternative Delphi Inc. $ CRM International $ $ Murray Analytics $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts