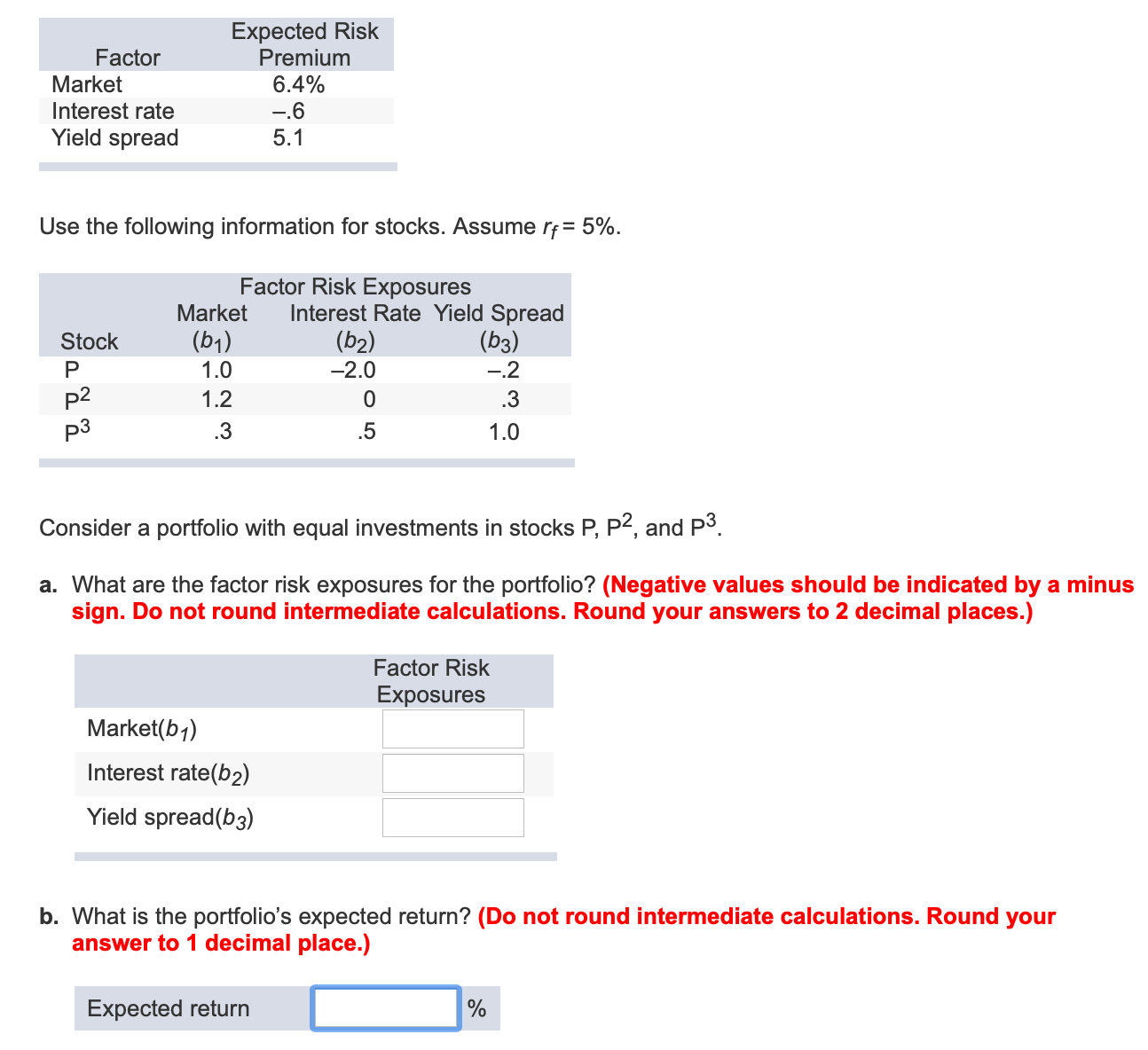

Question: Factor Market Interest rate Yield spread Expected Risk Premium 6.4% -.6 5.1 Use the following information for stocks. Assume rf= 5%. Stock Factor Risk Exposures

Factor Market Interest rate Yield spread Expected Risk Premium 6.4% -.6 5.1 Use the following information for stocks. Assume rf= 5%. Stock Factor Risk Exposures Market Interest Rate Yield Spread (61) (62) (63) 1.0 -2.0 -.2 1.2 0 .3 .3 .5 1.0 p2 p3 Consider a portfolio with equal investments in stocks P, P2, and P3. a. What are the factor risk exposures for the portfolio? (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places.) Factor Risk Exposures Market(b1) Interest rate(62) Yield spread(b3) b. What is the portfolio's expected return? (Do not round intermediate calculations. Round your answer to 1 decimal place.) Expected return %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts