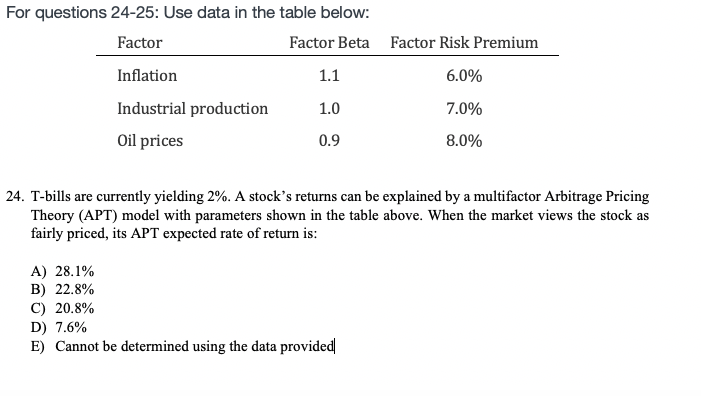

Question: Factor Risk Premium For questions 24-25: Use data in the table below: Factor Factor Beta Inflation 1.1 Industrial production 1.0 Oil prices 0.9 6.0% 7.0%

Factor Risk Premium For questions 24-25: Use data in the table below: Factor Factor Beta Inflation 1.1 Industrial production 1.0 Oil prices 0.9 6.0% 7.0% 8.0% 24. T-bills are currently yielding 2%. A stocks returns can be explained by a multifactor Arbitrage Pricing Theory (APT) model with parameters shown in the table above. When the market views the stock as fairly priced, its APT expected rate of return is: A) 28.1% B) 22.8% C) 20.8% D) 7.6% E) Cannot be determined using the data provided

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts