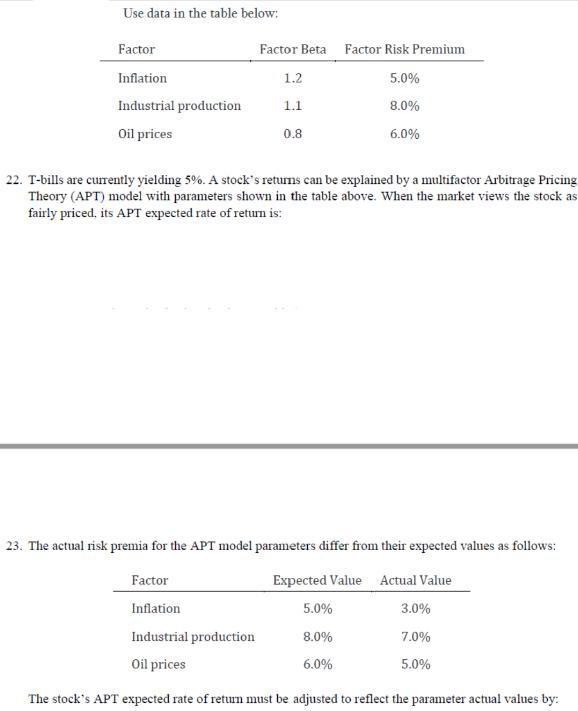

Question: Use data in the table below: Factor Inflation Industrial production. Oil prices Factor Beta Factor Risk Premium 5.0% 8.0% 6.0% 1.2 1.1 0.8 22.

Use data in the table below: Factor Inflation Industrial production. Oil prices Factor Beta Factor Risk Premium 5.0% 8.0% 6.0% 1.2 1.1 0.8 22. T-bills are currently yielding 5%. A stock's returns can be explained by a multifactor Arbitrage Pricing Theory (APT) model with parameters shown in the table above. When the market views the stock as fairly priced, its APT expected rate of return is: 23. The actual risk premia for the APT model parameters differ from their expected values as follows: Expected Value Actual Value 3.0% 7.0% 5.0% Factor Inflation Industrial production Oil prices The stock's APT expected rate of return must be adjusted to reflect the parameter actual values by: 5.0% 8.0% 6.0%

Step by Step Solution

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Based on the Arbitrage Pricing Theory APT model provided in the image we can calculate the expected ... View full answer

Get step-by-step solutions from verified subject matter experts