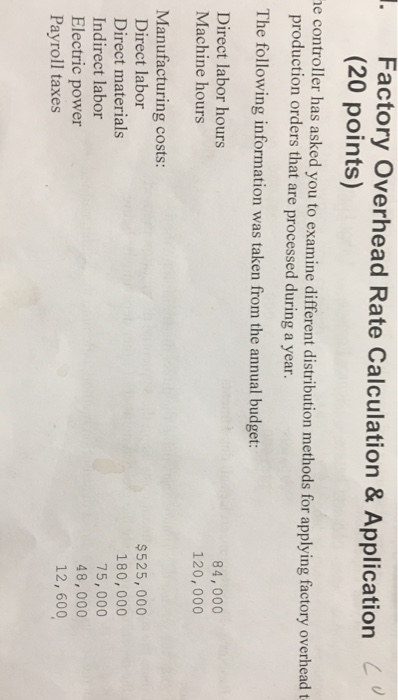

Question: Factory Overhead Rate Calculation & Application (20 points) e controller has asked you to examine different distribution methods for applying factory overhead t production orders

Factory Overhead Rate Calculation & Application (20 points) e controller has asked you to examine different distribution methods for applying factory overhead t production orders that are processed during a year. The following information was taken from the annual budget: Direct labor hours 84,000 120,000 Machine hours Manufacturing costs: Direct labor Direct materials Indirect labor Electric power Payroll taxes $525, 000 180,000 75,000 48,000 12,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts