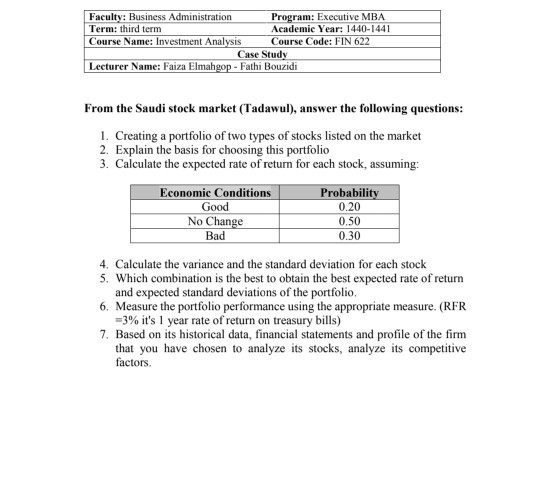

Question: Faculty: Business Administration Program: Executive MBA Term: third term Academic Year: 1440-1441 Course Name: Investment Analysis Course Code: FIN 622 Case Study Lecturer Name: Faiza

Faculty: Business Administration Program: Executive MBA Term: third term Academic Year: 1440-1441 Course Name: Investment Analysis Course Code: FIN 622 Case Study Lecturer Name: Faiza Elmahop - Fathi Bouzidi From the Saudi stock market (Tadawul), answer the following questions: 1. Creating a portfolio of two types of stocks listed on the market 2. Explain the basis for choosing this portfolio 3. Calculate the expected rate of return for each stock, assuming Economic Conditions Good No Change Bad Probability 0.20 0.50 0.30 4. Calculate the variance and the standard deviation for each stock 5. Which combination is the best to obtain the best expected rate of return and expected standard deviations of the portfolio Measure the portfolio performance using the appropriate measure. (RER -3% it's 1 year rate of return on treasury bills) 7. Based on its historical data, financial statements and profile of the firm that you have chosen to analyze its stocks, analyze its competitive factors, Faculty: Business Administration Program: Executive MBA Term: third term Academic Year: 1440-1441 Course Name: Investment Analysis Course Code: FIN 622 Case Study Lecturer Name: Faiza Elmahop - Fathi Bouzidi From the Saudi stock market (Tadawul), answer the following questions: 1. Creating a portfolio of two types of stocks listed on the market 2. Explain the basis for choosing this portfolio 3. Calculate the expected rate of return for each stock, assuming Economic Conditions Good No Change Bad Probability 0.20 0.50 0.30 4. Calculate the variance and the standard deviation for each stock 5. Which combination is the best to obtain the best expected rate of return and expected standard deviations of the portfolio Measure the portfolio performance using the appropriate measure. (RER -3% it's 1 year rate of return on treasury bills) 7. Based on its historical data, financial statements and profile of the firm that you have chosen to analyze its stocks, analyze its competitive factors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts