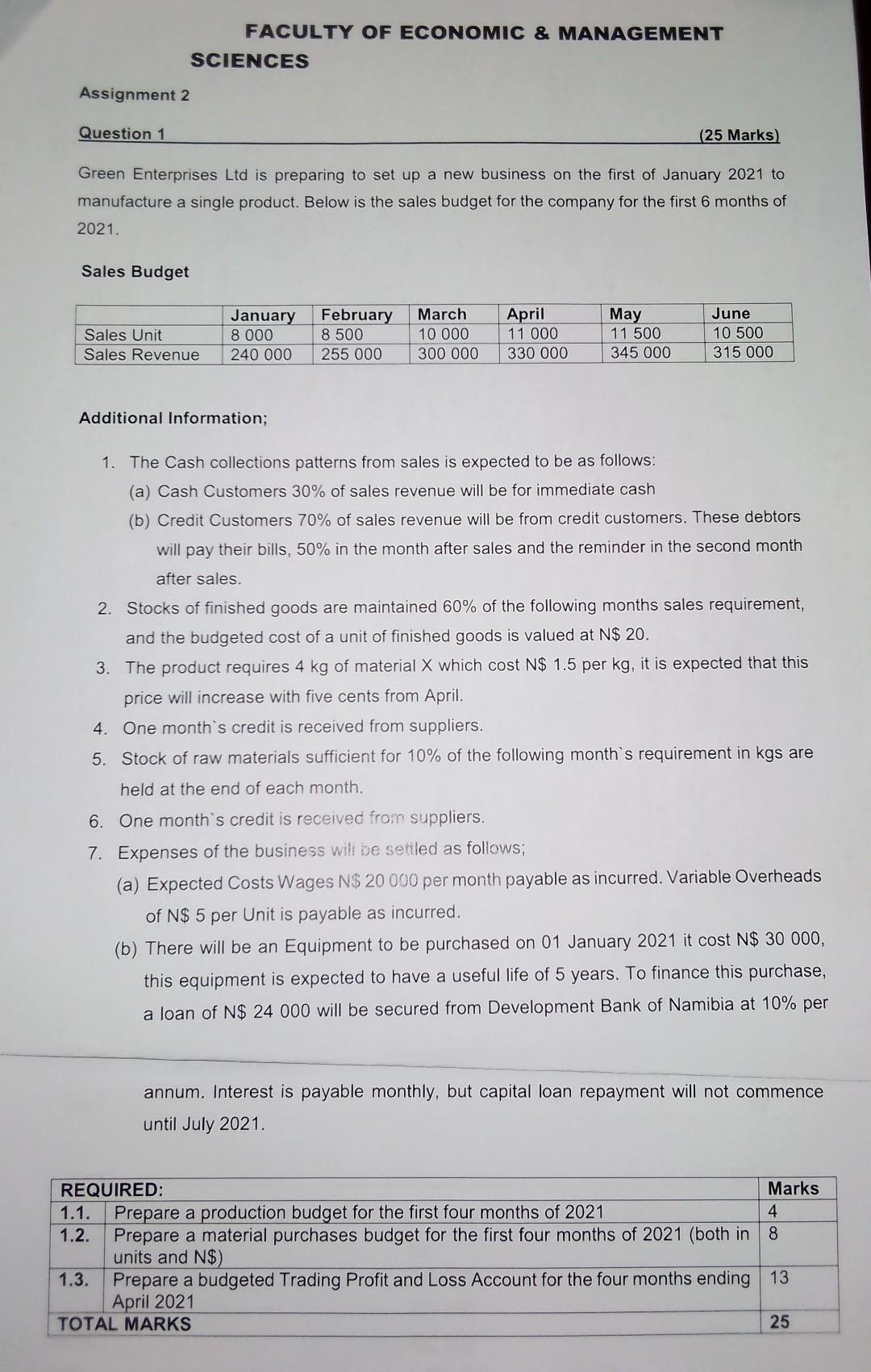

Question: FACULTY OF ECONOMIC & MANAGEMENT SCIENCES Assignment 2 Question 1 (25 Marks) Green Enterprises Ltd is preparing to set up a new business on the

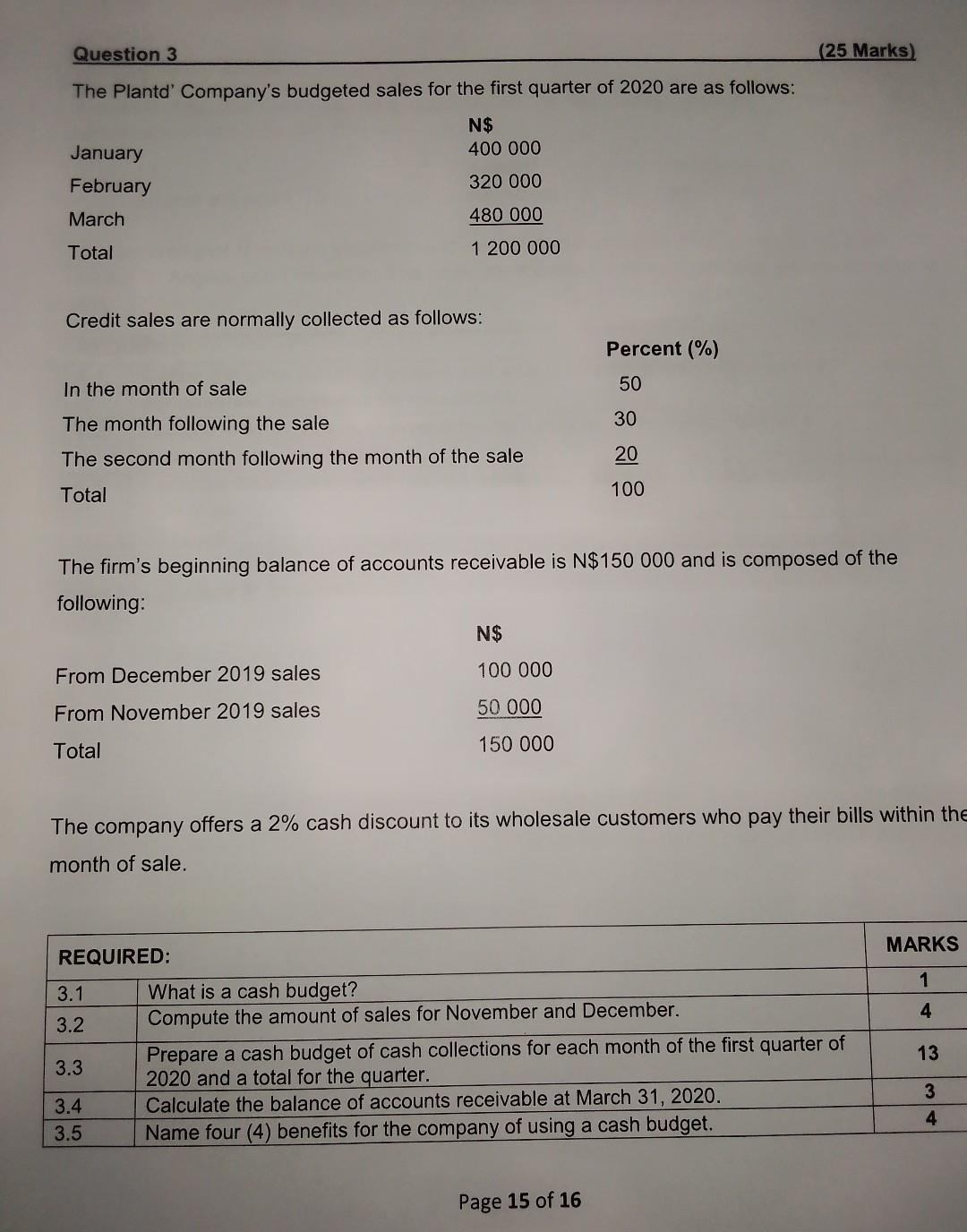

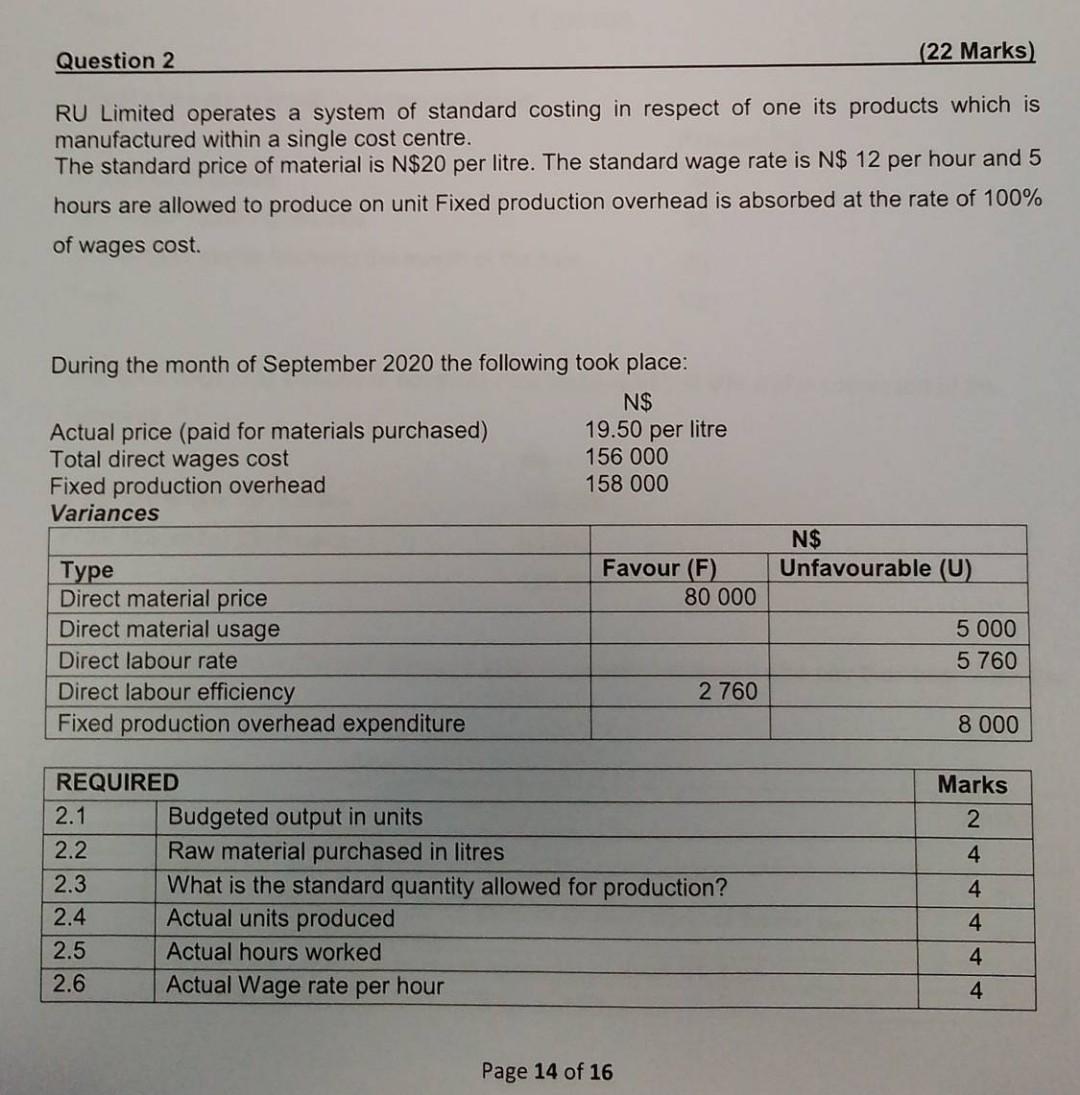

FACULTY OF ECONOMIC & MANAGEMENT SCIENCES Assignment 2 Question 1 (25 Marks) Green Enterprises Ltd is preparing to set up a new business on the first of January 2021 to manufacture a single product. Below is the sales budget for the company for the first 6 months of 2021. Sales Budget Sales Unit Sales Revenue January 8 000 240 000 February 8 500 255 000 March 10 000 300 000 April 11 000 330 000 May 11 500 345 000 June 10 500 315 000 Additional Information; 1. The Cash collections patterns from sales is expected to be as follows: (a) Cash Customers 30% of sales revenue will be for immediate cash (b) Credit Customers 70% of sales revenue will be from credit customers. These debtors will pay their bills, 50% in the month after sales and the reminder in the second month after sales. 2. Stocks of finished goods are maintained 60% of the following months sales requirement, and the budgeted cost of a unit of finished goods is valued at N$ 20. 3. The product requires 4 kg of material X which cost N$ 1.5 per kg, it is expected that this price will increase with five cents from April. 4. One month's credit is received from suppliers. 5. Stock of raw materials sufficient for 10% of the following month's requirement in kgs are held at the end of each month. 6. One month's credit is received from suppliers. 7. Expenses of the business will be settled as follows; (a) Expected Costs Wages N$ 20 000 per month payable as incurred. Variable Overheads of N$ 5 per Unit is payable as incurred. (b) There will be an Equipment to be purchased on 01 January 2021 it cost N$ 30 000, this equipment is expected to have a useful life of 5 years. To finance this purchase, a loan of N$ 24 000 will be secured from Development Bank of Namibia at 10% per annum. Interest is payable monthly, but capital loan repayment will not commence until July 2021. REQUIRED: Marks 1.1. Prepare a production budget for the first four months of 2021 4 1.2. Prepare a material purchases budget for the first four months of 2021 (both in 8 units and N$) 1.3. Prepare a budgeted Trading Profit and Loss Account for the four months ending 13 April 2021 TOTAL MARKS 25 Question 3 (25 Marks) The Plantd' Company's budgeted sales for the first quarter of 2020 are as follows: N$ 400 000 January February March 320 000 480 000 1 200 000 Total Credit sales are normally collected as follows: Percent (%) In the month of sale 50 30 The month following the sale The second month following the month of the sale Total 20 100 The firm's beginning balance of accounts receivable is N$150 000 and is composed of the following: N$ From December 2019 sales 100 000 From November 2019 sales 50 000 Total 150 000 The company offers a 2% cash discount to its wholesale customers who pay their bills within the month of sale. MARKS REQUIRED: 1 3.1 4 3.2 13 3.3 What is a cash budget? Compute the amount of sales for November and December. Prepare a cash budget of cash collections for each month of the first quarter of 2020 and a total for the quarter. Calculate the balance of accounts receivable at March 31, 2020. Name four (4) benefits for the company of using a cash budget. 3 3.4 3.5 4 Page 15 of 16 Question 2 (22 Marks RU Limited operates a system of standard costing in respect of one its products which is manufactured within a single cost centre. The standard price of material is N$20 per litre. The standard wage rate is N$ 12 per hour and 5 hours are allowed to produce on unit Fixed production overhead is absorbed at the rate of 100% of wages cost. During the month of September 2020 the following took place: N$ Actual price (paid for materials purchased) 19.50 per litre Total direct wages cost 156 000 Fixed production overhead 158 000 Variances Favour (F) 80 000 N$ Unfavourable (U) Type Direct material price Direct material usage Direct labour rate Direct labour efficiency Fixed production overhead expenditure 5 000 5 760 2 760 8 000 Marks 2 4 REQUIRED 2.1 Budgeted output in units 2.2 Raw material purchased in litres 2.3 What is the standard quantity allowed for production? 2.4 Actual units produced 2.5 Actual hours worked 2.6 Actual Wage rate per hour 4 4 4 4 Page 14 of 16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts