Question: Falcon Ltd has a choice of two projects - Project A and Project B. Project A requires an initial investment of $300,000, and will earn

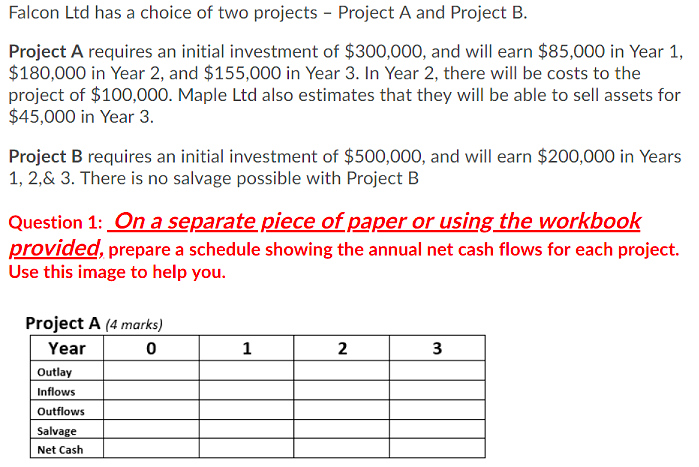

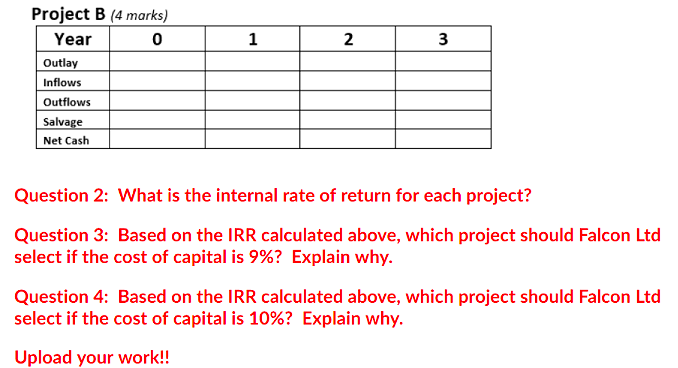

Falcon Ltd has a choice of two projects - Project A and Project B. Project A requires an initial investment of $300,000, and will earn $85,000 in Year 1, $180,000 in Year 2, and $155,000 in Year 3. In Year 2, there will be costs to the project of $100,000. Maple Ltd also estimates that they will be able to sell assets for $45,000 in Year 3. Project B requires an initial investment of $500,000, and will earn $200,000 in Years 1, 2,& 3. There is no salvage possible with Project B Question 1: On a separate piece of paper or using the workbook provided, prepare a schedule showing the annual net cash flows for each project. Use this image to help you. 1 2 3 Project A (4 marks) Year 0 Outlay Inflows Outflows Salvage Net Cash 1 2 3 3 Project B (4 marks) Year 0 Outlay Inflows Outflows Salvage Net Cash Question 2: What is the internal rate of return for each project? Question 3: Based on the IRR calculated above, which project should Falcon Ltd select if the cost of capital is 9%? Explain why. Question 4: Based on the IRR calculated above, which project should Falcon Ltd select if the cost of capital is 10%? Explain why. Upload your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts