Question: FALL 2019 FINANCE 400 CASE II PROJECT ANALYSIS ASSIGNMENT REV 1 Collegiate Costumes is considering adding a mini-robotic mascot line to its product mix, and

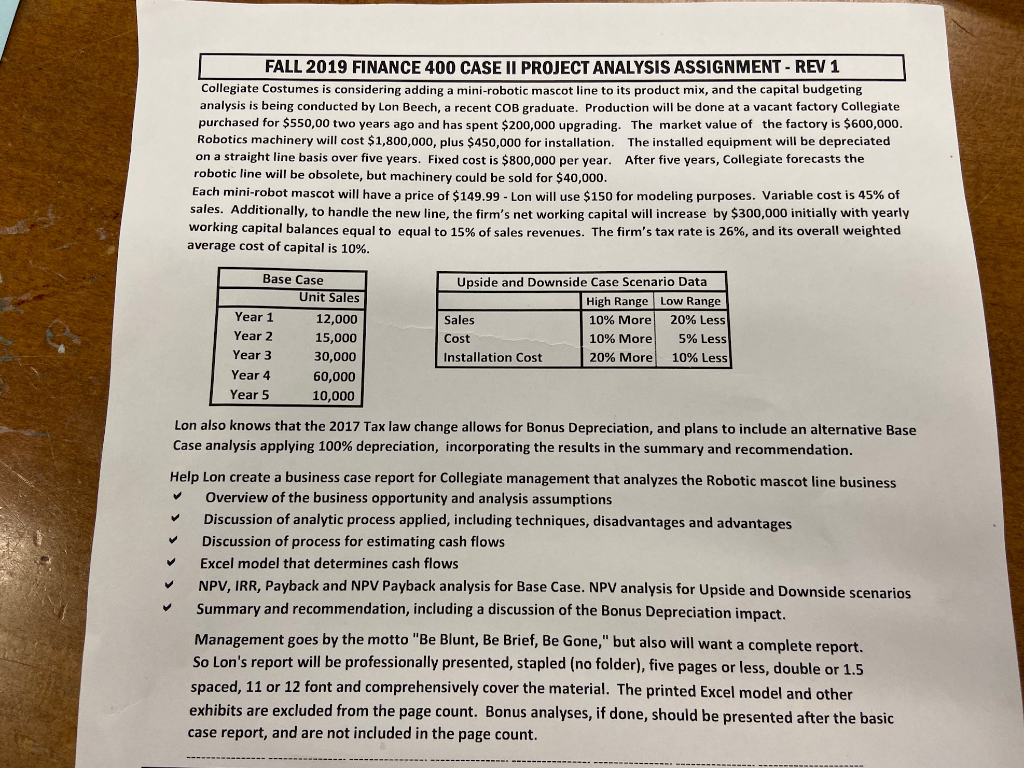

FALL 2019 FINANCE 400 CASE II PROJECT ANALYSIS ASSIGNMENT REV 1 Collegiate Costumes is considering adding a mini-robotic mascot line to its product mix, and the capital budgeting analysis is being conducted by Lon Beech, a recent COB graduate. Production will be done at a vacant factory Collegiate purchased for $550,00 two years ago and has spent $200,000 upgrading. The market value of the factory is $600,000. Robotics machinery will cost $1,800,000, plus $450,000 for installation. The installed equipment will be depreciated on a straight line basis over five years. Fixed cost is $800,000 per year. After five years, Collegiate forecasts the robotic line will be obsolete, but machinery could be sold for $40,000 Each mini-robot mascot will have a price of $149.99 - Lon will use $150 for modeling purposes. Variable cost is 45% of sales. Additionally, to handle the new line. the firm's net working capital will increase by $300,000 initially with yearly working capital balances equal to equal to 15% of sales revenues. The firm's tax rate is 26%, and its overall weighted average cost of capital is 10% Base Case Upside and Downside Case Scenario Data Unit Sales High Range Low Range 10% More 20% Less 10% More 20% More Year 1 12,000 Sales Year 2 5% Less 10% Less 15,000 Cost Year 3 30,000 Installation Cost Year 4 60,000 Year 5 10,000 Lon also knows that the 2017 Tax law change allows for Bonus Depreciation, and plans to include an alternative Base Case analysis applying 100% depreciation, incorporating the results in the summary and recommendation. Help Lon create a business case report for Collegiate management that analyzes the Robotic mascot line business Overview of the business opportunity and analysis assumptions Discussion of analytic process applied, including techniques, disadvantages and advantages V Discussion of process for estimating cash flows Excel model that determines cash flows NPV, IRR, Payback and NPV Payback analysis for Base Case. NPV analysis for Upside and Downside scenarios Summary and recommendation, including a discussion of the Bonus Depreciation impact. Management goes by the motto "Be Blunt, Be Brief, Be Gone," but also will want a complete report. So Lon's report will be professionally presented, stapled (no folder), five pages or less, double or 1.5 spaced, 11 or 12 font and comprehensively cover the material. The printed Excel model and other exhibits are excluded from the page count. Bonus analyses, if done, should be presented after the basic case report, and are not included in the page count. - FALL 2019 FINANCE 400 CASE II PROJECT ANALYSIS ASSIGNMENT REV 1 Collegiate Costumes is considering adding a mini-robotic mascot line to its product mix, and the capital budgeting analysis is being conducted by Lon Beech, a recent COB graduate. Production will be done at a vacant factory Collegiate purchased for $550,00 two years ago and has spent $200,000 upgrading. The market value of the factory is $600,000. Robotics machinery will cost $1,800,000, plus $450,000 for installation. The installed equipment will be depreciated on a straight line basis over five years. Fixed cost is $800,000 per year. After five years, Collegiate forecasts the robotic line will be obsolete, but machinery could be sold for $40,000 Each mini-robot mascot will have a price of $149.99 - Lon will use $150 for modeling purposes. Variable cost is 45% of sales. Additionally, to handle the new line. the firm's net working capital will increase by $300,000 initially with yearly working capital balances equal to equal to 15% of sales revenues. The firm's tax rate is 26%, and its overall weighted average cost of capital is 10% Base Case Upside and Downside Case Scenario Data Unit Sales High Range Low Range 10% More 20% Less 10% More 20% More Year 1 12,000 Sales Year 2 5% Less 10% Less 15,000 Cost Year 3 30,000 Installation Cost Year 4 60,000 Year 5 10,000 Lon also knows that the 2017 Tax law change allows for Bonus Depreciation, and plans to include an alternative Base Case analysis applying 100% depreciation, incorporating the results in the summary and recommendation. Help Lon create a business case report for Collegiate management that analyzes the Robotic mascot line business Overview of the business opportunity and analysis assumptions Discussion of analytic process applied, including techniques, disadvantages and advantages V Discussion of process for estimating cash flows Excel model that determines cash flows NPV, IRR, Payback and NPV Payback analysis for Base Case. NPV analysis for Upside and Downside scenarios Summary and recommendation, including a discussion of the Bonus Depreciation impact. Management goes by the motto "Be Blunt, Be Brief, Be Gone," but also will want a complete report. So Lon's report will be professionally presented, stapled (no folder), five pages or less, double or 1.5 spaced, 11 or 12 font and comprehensively cover the material. The printed Excel model and other exhibits are excluded from the page count. Bonus analyses, if done, should be presented after the basic case report, and are not included in the page count

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts