Question: please solve the problem step by step and calculate the right answers for me. Thanks, will upvote if the answers are correct. Problem 3. (20

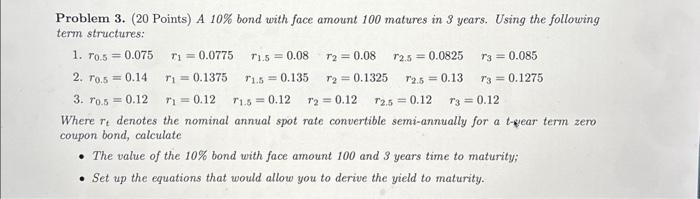

Problem 3. (20 Points) A 10% bond with face amount 100 matures in 3 years. Using the following term structures: 1. r0.5=0.075r1=0.0775r1.5=0.08r2=0.08r2.5=0.0825r3=0.085 2. r0.5=0.14r1=0.1375r1.5=0.135r2=0.1325r2.5=0.13r3=0.1275 3. r0.5=0.12r1=0.12r1.5=0.12r2=0.12r2.5=0.12r3=0.12 Where rt denotes the nominal annual spot rate convertible semi-annually for a t-pear term zero coupon bond, calculate - The value of the 10% bond with face amount 100 and $ years time to maturity; - Set up the equations that would allow you to derive the yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts