Question: Fall2018 1031/18 2. (8 points; 2 each) Answer the following multiple choice questions. a) Assume a two-country world: Country A and Country B. Which of

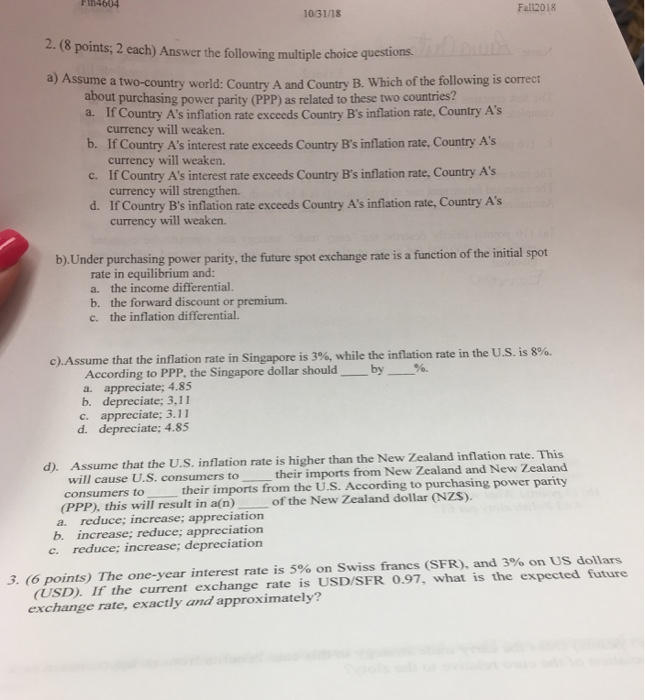

Fall2018 1031/18 2. (8 points; 2 each) Answer the following multiple choice questions. a) Assume a two-country world: Country A and Country B. Which of the following is correct purchasing power parity (PPP) as related to these two countries? a. If Country A's inflation rate exceeds Country B's inflation rate, Country A's about b. If Country A's interest rate exceeds Country B's inflation rate, Country A's c. If Country A's interest rate exceeds Country B's inflation rate, Country A's d. If Country B's inflation rate exceeds Country A's inflation rate, Country A's currency will weaken. currency will weaken. currency will strengthen. currency will weaken. b).Under purchasing power parity, the fiture spot exchange rate is a function of the initial spot rate in equilibrium and: a. the income differential. b. the forward discount or premium. c. the inflation differential. e).Assume that the inflation rate in Singapore is 3%, while the inflation rate in the US is 80%. % According to PPP, the Singapore dollar should-_ by a. appreciate; 4.85 b. depreciate; 3,11 c. appreciate; 3.11 d. depreciate; 4.85 d). Assume that the U.S. inflation rate is higher than the New Zealand inflation rate. This their imports from New Zealand and New Zealand will cause U.S. consumers to their imports from the U.S. According to purchasing power parity consumers to (PPP), this will result in a(n) of the New Zealand dollar (NZS). a. reduce; increase; appreciation b. increase; reduce; appreciation c. reduce; increase; depreciation (USD). If the current exchange rate is USD/SFR 0.97, what is the expected future exchange rate, exactly and approximately? 3. (6 points) The one-year interest rate is 5% on Swiss francs (SFR), and 300 on US dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts