Question: Farah Company hired you to do a feasibility study of its new project, which involves buying new equipment. The base price is KD 108,000 and

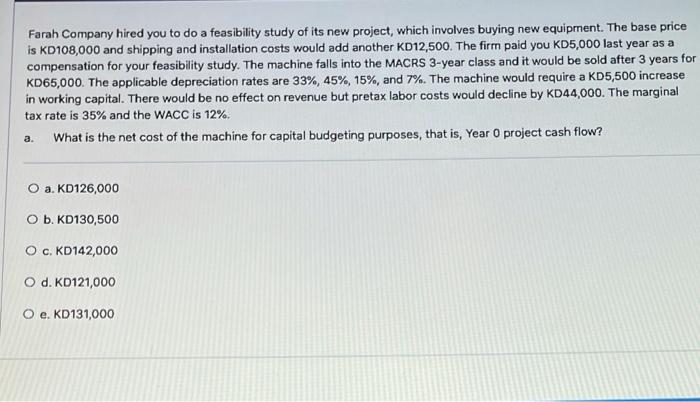

Farah Company hired you to do a feasibility study of its new project, which involves buying new equipment. The base price is KD 108,000 and shipping and installation costs would add another KD12,500. The firm paid you KD5,000 last year as a compensation for your feasibility study. The machine falls into the MACRS 3-year class and it would be sold after 3 years for KD65,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The machine would require a KD5,500 increase in working capital. There would be no effect on revenue but pretax labor costs would decline by KD44,000. The marginal tax rate is 35% and the WACC is 12%. What is the net cost of the machine for capital budgeting purposes, that is, Year O project cash flow? O a. KD126,000 O b. KD130,500 Oc. KD142,000 O d. KD121,000 O e. KD131,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts