Question: - Farm Pride Foods Limited (ASX code: FRM) - Select Harvests Limited (ASX code: SHV) Analyse the ability of management to manage their fixed assets

- Farm Pride Foods Limited (ASX code: FRM)

- Select Harvests Limited (ASX code: SHV)

Analyse the ability of management to manage their fixed assets and total assets for each of the two companies in 2018 as compared to 2017. Use two Asset Management efficiency ratios to support your answer and explain any change in each companies ability to use their assets to generate sales. Note: ensure that you analyse in this question, not just describe the ratio values.

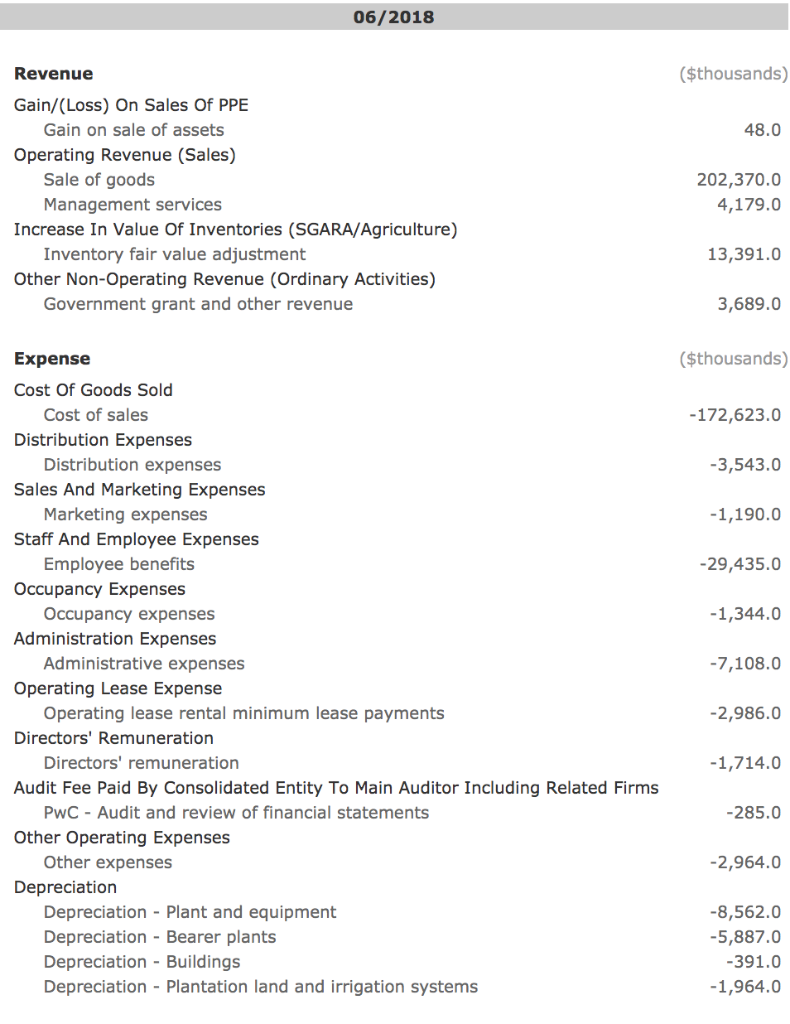

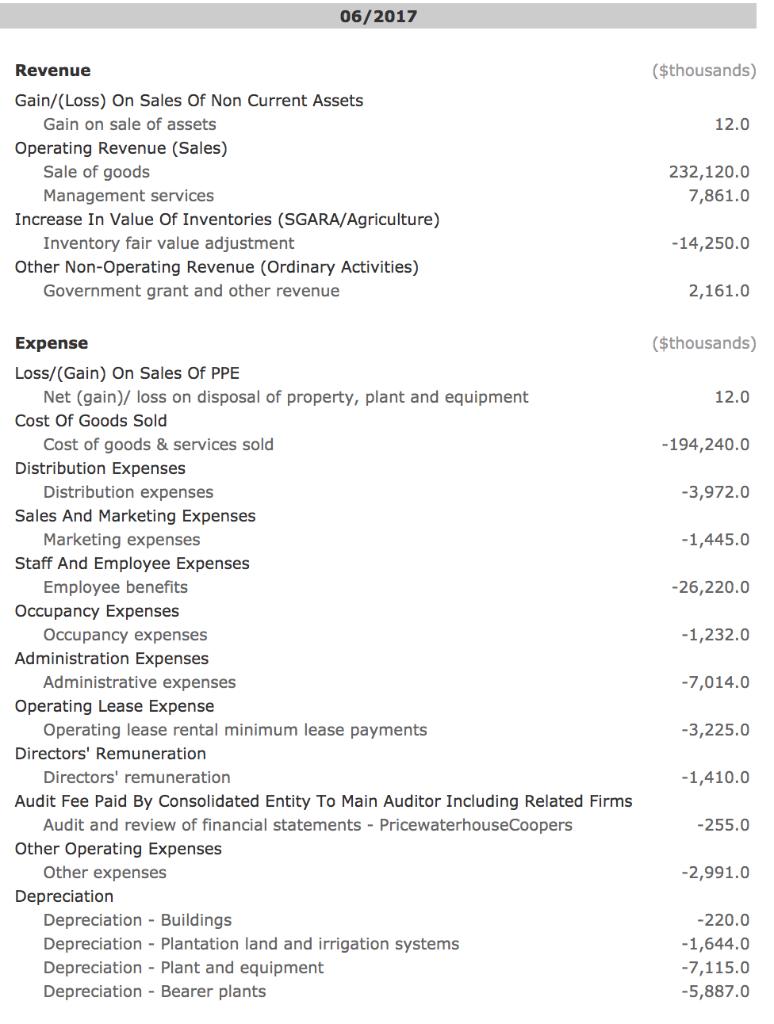

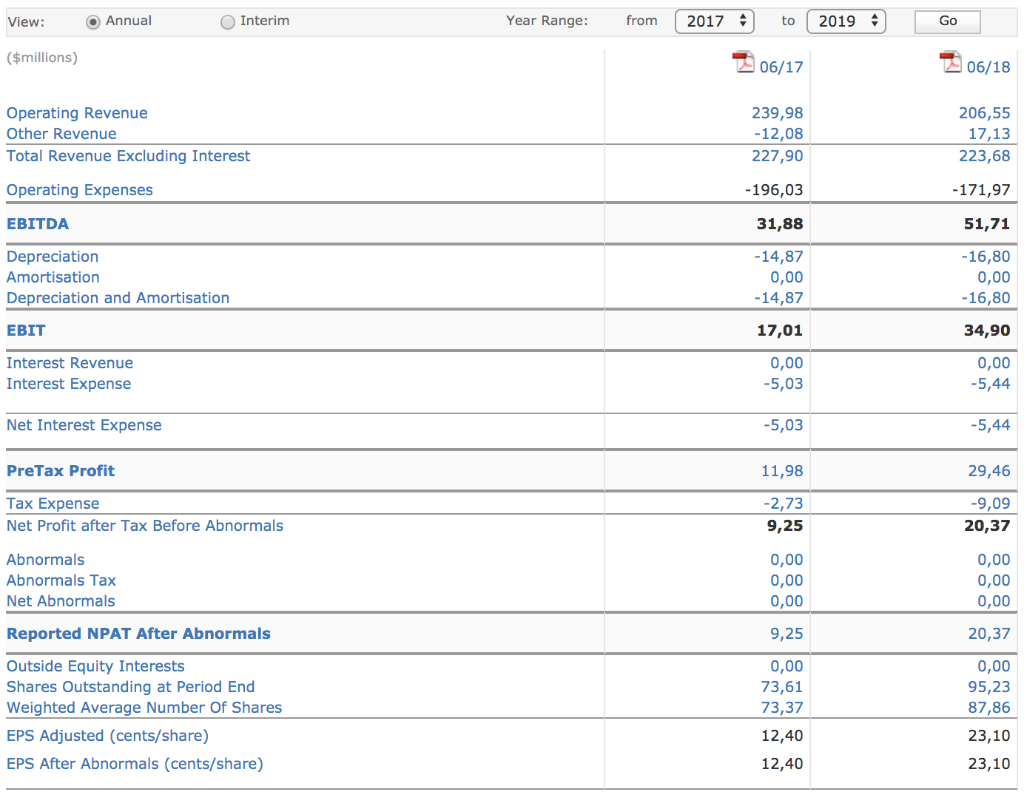

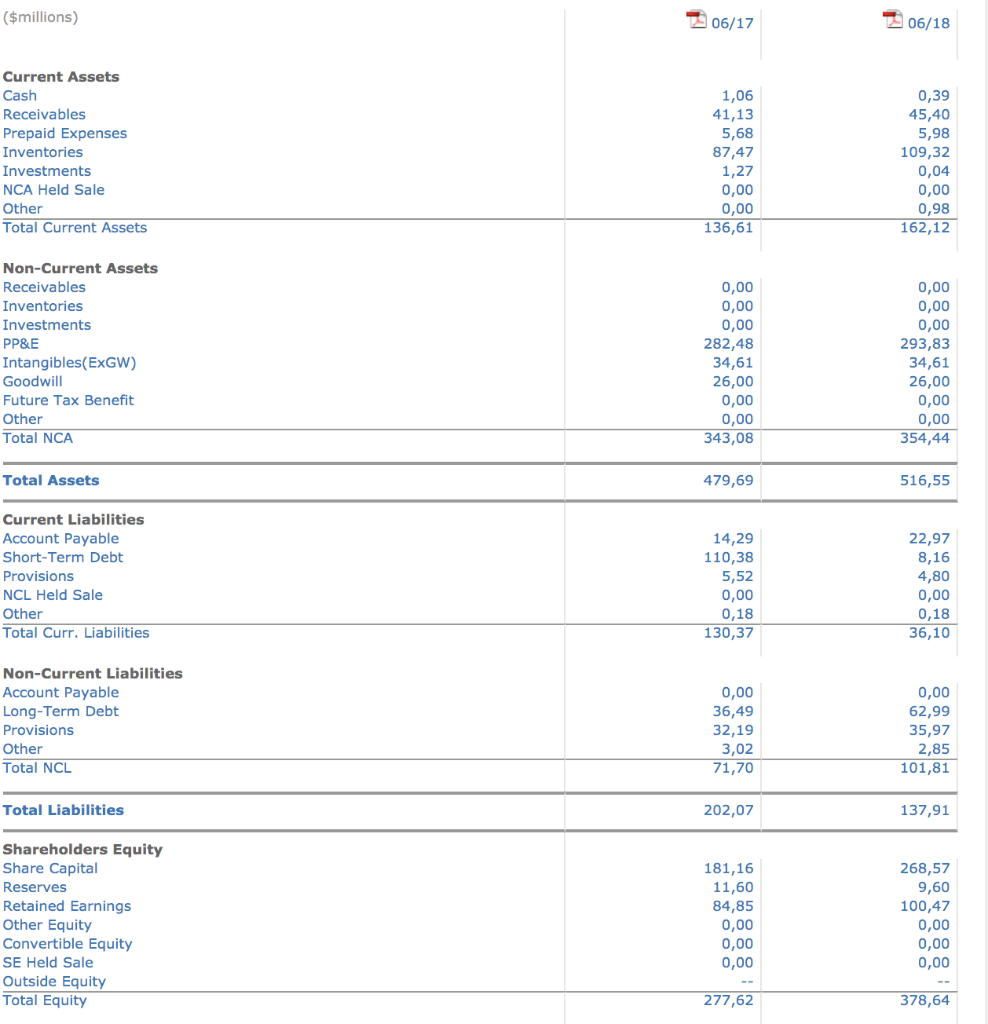

Select Harvests Limited information:

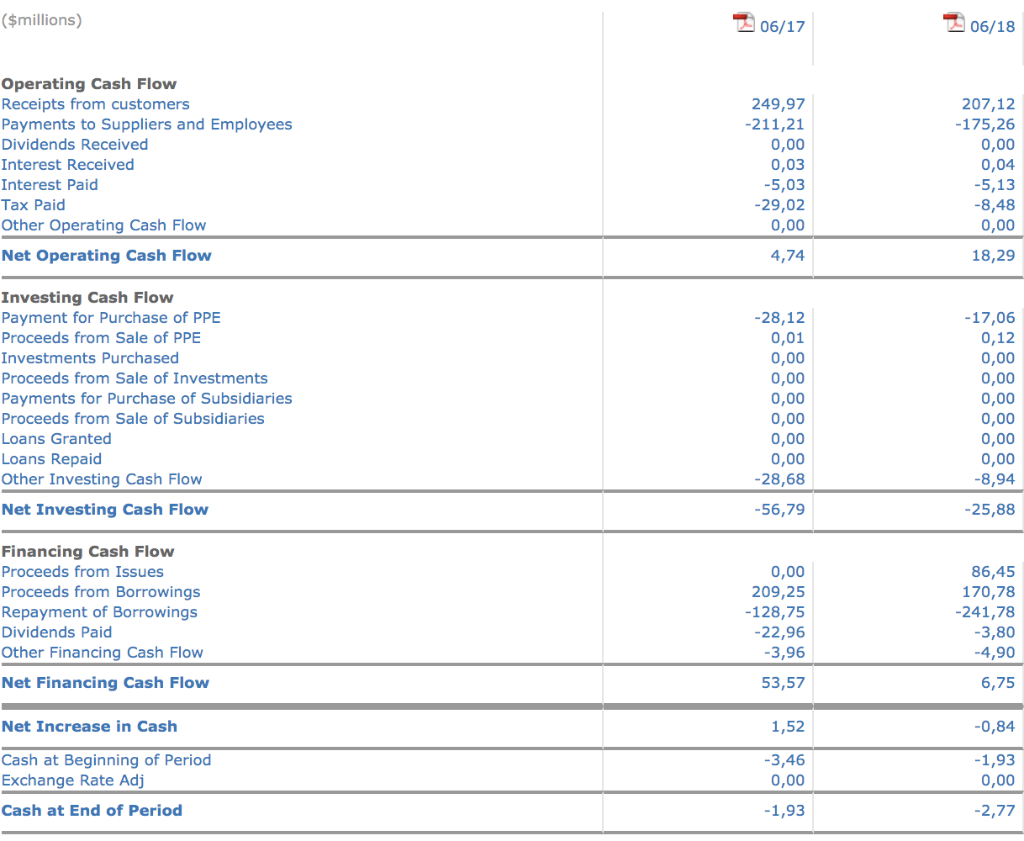

06/2018 Revenue $thousands) Gain/(Loss) On Sales Of PPE Gain on sale of assets 48.0 Operating Revenue (Sales) Sale of goods 202,370.0 Management services 4,179.0 Increase In Value Of Inventories (SGARA/Agriculture) Inventory fair value adjustment 13,391.0 Other Non-Operating Revenue (Ordinary Activities) Government grant and other revenue 3,689.0 Expense $thousands) Cost Of Goods Sold Cost of sales -172,623.0 Distribution Expenses Distribution expenses -3,543.0 Sales And Marketing Expenses Marketing expenses Staff And Employee Expenses Employee benefits -1,190.0 29,435.0 Occupancy Expenses Occupancy expenses -1,344.0 Administration Expenses 7,108.0 Administrative expenses Operating Lease Expense Operating lease rental minimum lease payments 2,986.0 Directors' Remuneration 1,714.0 Directors' remuneration Audit Fee Paid By Consolidated Entity To Main Auditor Including Related Firms PwC - Audit and review of financial statements -285.0 Other Operating Expenses 2,964.0 Other expenses Depreciation Depreciation - Plant and equipment 8,562.0 5,887.0 Depreciation - Bearer plants Depreciation Buildings Depreciation Plantation land and irrigation systems 391.0 -1,964.0 06/2017 Revenue $thousands) Gain/(Loss) On Sales Of Non Current Assets Gain on sale of assets 12.0 Operating Revenue (Sales) Sale of goods 232,120.0 7,861.0 Management services Increase In Value Of Inventories (SGARA/Agriculture) Inventory fair value adjustment Other Non-Operating Revenue (Ordinary Activities) Government grant and other revenue -14,250.0 2,161.0 $thousands) Expense Loss/(Gain) On Sales Of PPE Net (gain)/ loss on disposal of property, plant and equipment 12.0 Cost Of Goods Sold 194,240.0 Cost of goods & services sold Distribution Expenses Distribution expenses Sales And Marketing Expenses Marketing expenses Staff And Employee Expenses Employee benefits 3,972.0 -1,445.0 26,220.0 Occupancy Expenses Occupancy expenses -1,232.0 Administration Expenses Administrative expenses 7,014.0 Operating Lease Expense Operating lease rental minimum lease payments 3,225.0 Directors' Remuneration 1,410.0 Directors' remuneration Audit Fee Paid By Consolidated Entity To Main Auditor Including Related Firms Audit and review of financial statements PricewaterhouseCoopers Other Operating Expenses Other expenses -255.0 2,991.0 Depreciation 220.0 Depreciation - Buildings Depreciation Plantation land and irrigation systems Depreciation Plant and equipment Depreciation Bearer plants 1,644.0 7,115.0 5,887.0 ($millions) 06/18 Current Assets 1,06 41,13 5,68 87,47 1,27 45,40 Receivables 5,98 109,32 Prepaid Expenses Inventories Investments NCA Held Sale 0,00 0,00 136,61 Other Total Current Assets 162,12 Non-Current Assets Receivables 0,00 0,00 0,00 282,48 34,61 26,00 0,00 Inventories 0,00 Investments 293,83 34,61 26,00 PP&E Intangibles(ExGW) Goodwill Future Tax Benefit Other 0,00 354,44 343,08 Total NCA 479,69 Total Assets 516,55 Current Liabilities 22,97 Account Payable 14,29 110,38 5,52 0,00 Short-Term Debt Provisions NCL Held Sale Other 0,00 Total Curr. Liabilities 36,10 130,37 Non-Current Liabilities 0,00 36,49 32,19 Account Payable Long-Term Debt 62,99 35,97 Provisions Other 3,02 71,70 Total NCL 101,81 137,91 Total Liabilities 202,07 Shareholders Equity Share Capital 181,16 11,60 84,85 0,00 0,00 268,57 9,60 Reserves Retained Earnings Other Equity Convertible Equity 100,47 SE Held Sale 0,00 Outside Equity Total Equity 277,62 378,64 $millions) 06/18 Operating Cash Flow Receipts from customers Payments to Suppliers and Employees 249,97 211,21 207,12 -175,26 0,00 Dividends Received 0,00 0,03 5,03 29,02 0,00 0,04 5,13 8,48 0,00 Interest Received Interest Paid Tax Paid Other Operating Cash Flow 18,29 4,74 Net Operating Cash Flow Investing Cash Flow Payment for Purchase of PPE -28,12 0,01 0,00 0,00 -17,06 0,12 0,00 0,00 Proceeds from Sale of PPE Investments Purchased Proceeds from Sale of Investments Payments for Purchase of Subsidiaries 0,00 0,00 Proceeds from Sale of Subsidiaries 0,00 0,00 0,00 28,68 0,00 0,00 0,00 8,94 Loans Granted Loans Repaid Other Investing Cash Flow 25,88 -56,79 Net Investing Cash Flow Financing Cash Flow Proceeds from Issues 0,00 209,25 86,45 170,78 241,78 3,80 Proceeds from Borrowings Repayment of Borrowings -128,75 22,96 3,96 Dividends Paid Other Financing Cash Flow -4,90 53,57 6,75 Net Financing Cash Flow Net Increase in Cash 1,52 -0,84 3,46 0,00 Cash at Beginning of Perio Exchange Rate Adj 1,93 0,00 Cash at End of Period -1,93 -2,77 06/2018 Revenue $thousands) Gain/(Loss) On Sales Of PPE Gain on sale of assets 48.0 Operating Revenue (Sales) Sale of goods 202,370.0 Management services 4,179.0 Increase In Value Of Inventories (SGARA/Agriculture) Inventory fair value adjustment 13,391.0 Other Non-Operating Revenue (Ordinary Activities) Government grant and other revenue 3,689.0 Expense $thousands) Cost Of Goods Sold Cost of sales -172,623.0 Distribution Expenses Distribution expenses -3,543.0 Sales And Marketing Expenses Marketing expenses Staff And Employee Expenses Employee benefits -1,190.0 29,435.0 Occupancy Expenses Occupancy expenses -1,344.0 Administration Expenses 7,108.0 Administrative expenses Operating Lease Expense Operating lease rental minimum lease payments 2,986.0 Directors' Remuneration 1,714.0 Directors' remuneration Audit Fee Paid By Consolidated Entity To Main Auditor Including Related Firms PwC - Audit and review of financial statements -285.0 Other Operating Expenses 2,964.0 Other expenses Depreciation Depreciation - Plant and equipment 8,562.0 5,887.0 Depreciation - Bearer plants Depreciation Buildings Depreciation Plantation land and irrigation systems 391.0 -1,964.0 06/2017 Revenue $thousands) Gain/(Loss) On Sales Of Non Current Assets Gain on sale of assets 12.0 Operating Revenue (Sales) Sale of goods 232,120.0 7,861.0 Management services Increase In Value Of Inventories (SGARA/Agriculture) Inventory fair value adjustment Other Non-Operating Revenue (Ordinary Activities) Government grant and other revenue -14,250.0 2,161.0 $thousands) Expense Loss/(Gain) On Sales Of PPE Net (gain)/ loss on disposal of property, plant and equipment 12.0 Cost Of Goods Sold 194,240.0 Cost of goods & services sold Distribution Expenses Distribution expenses Sales And Marketing Expenses Marketing expenses Staff And Employee Expenses Employee benefits 3,972.0 -1,445.0 26,220.0 Occupancy Expenses Occupancy expenses -1,232.0 Administration Expenses Administrative expenses 7,014.0 Operating Lease Expense Operating lease rental minimum lease payments 3,225.0 Directors' Remuneration 1,410.0 Directors' remuneration Audit Fee Paid By Consolidated Entity To Main Auditor Including Related Firms Audit and review of financial statements PricewaterhouseCoopers Other Operating Expenses Other expenses -255.0 2,991.0 Depreciation 220.0 Depreciation - Buildings Depreciation Plantation land and irrigation systems Depreciation Plant and equipment Depreciation Bearer plants 1,644.0 7,115.0 5,887.0 ($millions) 06/18 Current Assets 1,06 41,13 5,68 87,47 1,27 45,40 Receivables 5,98 109,32 Prepaid Expenses Inventories Investments NCA Held Sale 0,00 0,00 136,61 Other Total Current Assets 162,12 Non-Current Assets Receivables 0,00 0,00 0,00 282,48 34,61 26,00 0,00 Inventories 0,00 Investments 293,83 34,61 26,00 PP&E Intangibles(ExGW) Goodwill Future Tax Benefit Other 0,00 354,44 343,08 Total NCA 479,69 Total Assets 516,55 Current Liabilities 22,97 Account Payable 14,29 110,38 5,52 0,00 Short-Term Debt Provisions NCL Held Sale Other 0,00 Total Curr. Liabilities 36,10 130,37 Non-Current Liabilities 0,00 36,49 32,19 Account Payable Long-Term Debt 62,99 35,97 Provisions Other 3,02 71,70 Total NCL 101,81 137,91 Total Liabilities 202,07 Shareholders Equity Share Capital 181,16 11,60 84,85 0,00 0,00 268,57 9,60 Reserves Retained Earnings Other Equity Convertible Equity 100,47 SE Held Sale 0,00 Outside Equity Total Equity 277,62 378,64 $millions) 06/18 Operating Cash Flow Receipts from customers Payments to Suppliers and Employees 249,97 211,21 207,12 -175,26 0,00 Dividends Received 0,00 0,03 5,03 29,02 0,00 0,04 5,13 8,48 0,00 Interest Received Interest Paid Tax Paid Other Operating Cash Flow 18,29 4,74 Net Operating Cash Flow Investing Cash Flow Payment for Purchase of PPE -28,12 0,01 0,00 0,00 -17,06 0,12 0,00 0,00 Proceeds from Sale of PPE Investments Purchased Proceeds from Sale of Investments Payments for Purchase of Subsidiaries 0,00 0,00 Proceeds from Sale of Subsidiaries 0,00 0,00 0,00 28,68 0,00 0,00 0,00 8,94 Loans Granted Loans Repaid Other Investing Cash Flow 25,88 -56,79 Net Investing Cash Flow Financing Cash Flow Proceeds from Issues 0,00 209,25 86,45 170,78 241,78 3,80 Proceeds from Borrowings Repayment of Borrowings -128,75 22,96 3,96 Dividends Paid Other Financing Cash Flow -4,90 53,57 6,75 Net Financing Cash Flow Net Increase in Cash 1,52 -0,84 3,46 0,00 Cash at Beginning of Perio Exchange Rate Adj 1,93 0,00 Cash at End of Period -1,93 -2,77

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts