Question: Farr Co. adopted the dollar-value LIFO inventory method on December 31, 2017. Farr's entire inventory constitutes a single pool. On December 31, 2017, the inventory

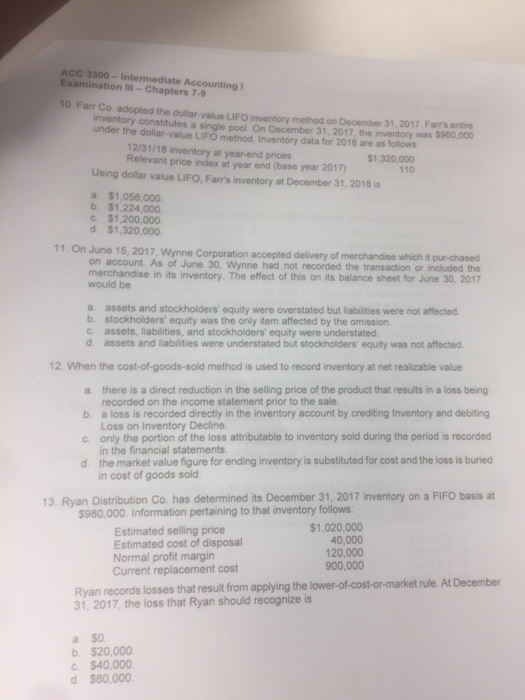

Farr Co. adopted the dollar-value LIFO inventory method on December 31, 2017. Farr's entire inventory constitutes a single pool. On December 31, 2017, the inventory was $960,000 under the dollar-value LIFO method. Inventory data for 2018 are as follows: Using dollar value LIFO, Farr's inventory at December 31, 2018 is a. $1, 056,000. b. $1, 224,000. c. $1, 200,000 d. $1, 320,000. On June 15, 2017, Wynne Corporation accepted delivery of merchandise which it purchased on account. As of June 30, Wynne had not recorded the transaction or included the merchandise in its inventory. The effect of this on its balance sheet for June 30, 2017 would be a. assets and stockholders' equity were overstated but liabilities were not affected. b. stockholders' equity was the only item affected by the omission. c. assets, liabilities, and stockholders' equity were understated. d. assets and liabilities were understated but stockholders' equity was not affected. When the cost-of-goods-sold method is used to record inventory at net realizable value a. there is a direct reduction in the selling price of the product that results in a loss being recorded on the income statement prior to the sale. b. a loss is recorded directly in the inventory account by crediting Inventory and debiting Loss on Inventory Decline. c. only the portion of the loss attributable to inventory sold during the period is recorded in the financial statements. d. the market value figure for ending inventory is substituted for cost and the loss is buried in cost of goods sold. Ryan Distribution Co. has determined its December 31, 2017 inventory on a FIFO basis at $980,000. Information to that follows: Ryan records losses that result from applying the lower-of-cost-or-market rule. At December 31, 2017, the loss that Ryan should recognize is a. $0. b. $20,000. c. $40,000. d. $80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts