Question: FAST answer please just need option Question 23 3 pts Several questions are associated with the following case study Zipwire PLC is considering whether to

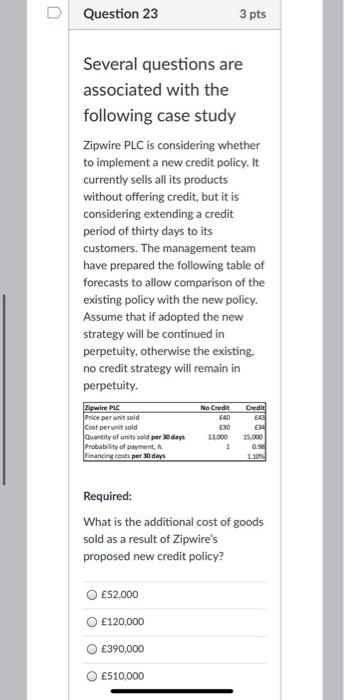

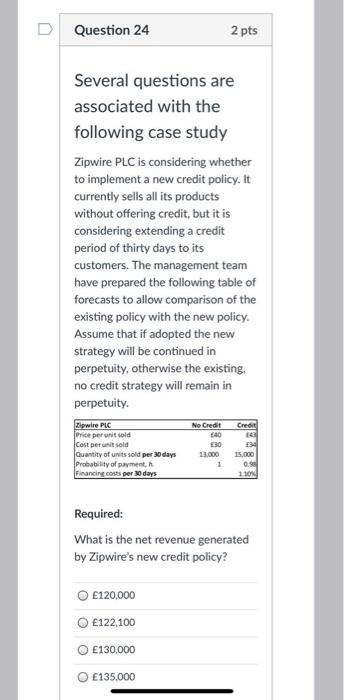

Question 23 3 pts Several questions are associated with the following case study Zipwire PLC is considering whether to implement a new credit policy. It currently sells all its products without offering credit, but it is considering extending a credit period of thirty days to its customers. The management team have prepared the following table of forecasts to allow comparison of the existing policy with the new policy. Assume that if adopted the new strategy will be continued in perpetuity, otherwise the existing. no credit strategy will remain in perpetuity. No Credit E40 030 Zipwire PLC Price per unit sold Cost per un sold Quantity of units sold per days Probability of payment, Financing costs per 30 days Credit 543 034 15.000 09 110 Required: What is the additional cost of goods sold as a result of Zipwire's proposed new credit policy? 52,000 120,000 O 390,000 510,000 D Question 24 2 pts Several questions are associated with the following case study Zipwire PLC is considering whether to implement a new credit policy. It currently sells all its products without offering credit, but it is considering extending a credit period of thirty days to its customers. The management team have prepared the following table of forecasts to allow comparison of the existing policy with the new policy. Assume that if adopted the new strategy will be continued in perpetuity, otherwise the existing, no credit strategy will remain in perpetuity. Zipwire PLC Price per un sold Cost per unit sold Quantity of units sold per 30 days Probability of payment, Financing costs per 10 days No Credit 440 530 13.000 1 Credit 14 34 15.000 110 Required: What is the net revenue generated by Zipwire's new credit policy? 120,000 122,100 130,000 135,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts