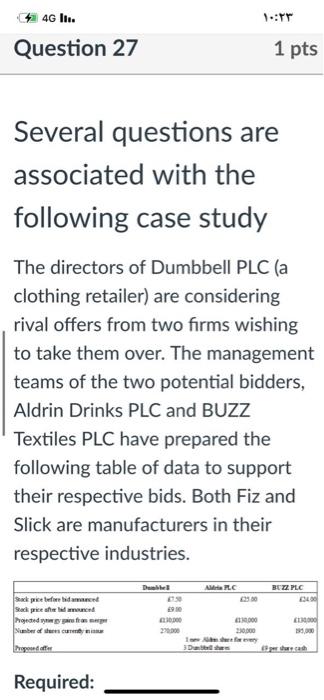

Question: FAST answer please just need option 46 Ils. : Question 27 1 pts Several questions are associated with the following case study The directors of

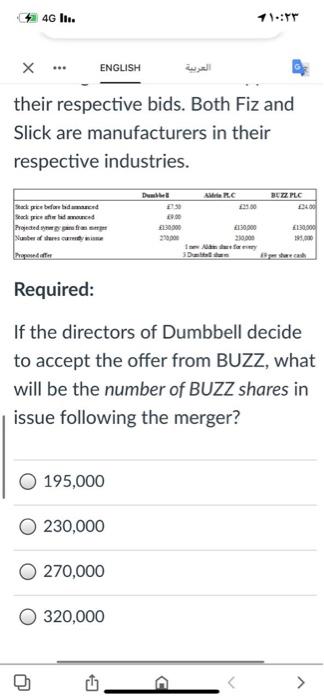

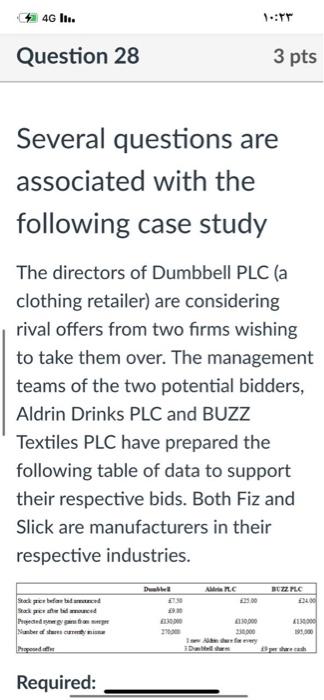

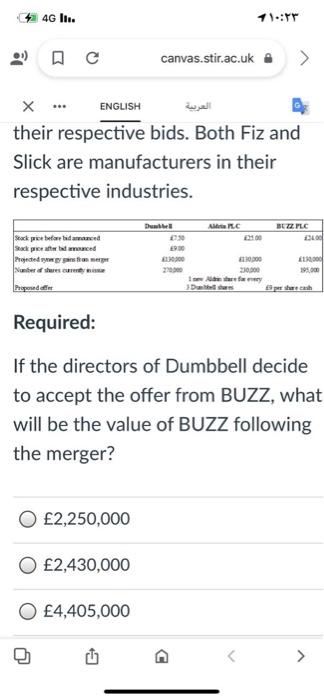

46 Ils. : Question 27 1 pts Several questions are associated with the following case study The directors of Dumbbell PLC (a clothing retailer) are considering rival offers from two firms wishing to take them over. The management teams of the two potential bidders, Aldrin Drinks PLC and BUZZ Textiles PLC have prepared the following table of data to support their respective bids. Both Fiz and Slick are manufacturers in their respective industries. AIC BEZPLC Sack before bide sal predumarant Projected from Number of the 0.000 000 20.000 3. 1 weer 3. Bpeharsth Required: 46 Ils. 1 : X ENGLISH their respective bids. Both Fiz and Slick are manufacturers in their respective industries. Dabbet ES Miele RC BLZ PLC Stack price before beiden Stack price www Procedura |Mustart Tropf 130.000 130.000 20.000 130.000 19.00 SD Required: If the directors of Dumbbell decide to accept the offer from BUZZ, what will be the number of BUZZ shares in issue following the merger? 195,000 230,000 270,000 320,000 U > 46 Ils. : Question 28 3 pts Several questions are associated with the following case study The directors of Dumbbell PLC (a clothing retailer) are considering rival offers from two firms wishing to take them over. The management teams of the two potential bidders, Aldrin Drinks PLC and BUZZ Textiles PLC have prepared the following table of data to support their respective bids. Both Fiz and Slick are manufacturers in their respective industries. ARC BUZZFLC 24 ES Shack preslufar bal Sack per te med Ppaard Number of Proud 20 10.000 1000 19.30 Required: 4G 11. 1 : canvas.stir.ac.uk ENGLISH Q their respective bids. Both Fiz and Slick are manufacturers in their respective industries. Dubbel ARC BEZPLC 13 Scock price before bid armamed Stack priced Projecten | Nomber sur ce Propound ES 000 20 230.000 sefy Danas Required: If the directors of Dumbbell decide to accept the offer from BUZZ, what will be the value of BUZZ following the merger? 2,250,000 2,430,000 4,405,000 46 Ils. : Question 28 3 pts Several questions are associated with the following case study The directors of Dumbbell PLC (a clothing retailer) are considering rival offers from two firms wishing to take them over. The management teams of the two potential bidders, Aldrin Drinks PLC and BUZZ Textiles PLC have prepared the following table of data to support their respective bids. Both Fiz and Slick are manufacturers in their respective industries. ARC BUZZFLC 24 ES Shack preslufar bal Sack per te med Ppaard Number of Proud 20 10.000 1000 19.30 Required: 4G 11. 1 : canvas.stir.ac.uk ENGLISH Q their respective bids. Both Fiz and Slick are manufacturers in their respective industries. Dubbel ARC BEZPLC 13 Scock price before bid armamed Stack priced Projecten | Nomber sur ce Propound ES 000 20 230.000 sefy Danas Required: If the directors of Dumbbell decide to accept the offer from BUZZ, what will be the value of BUZZ following the merger? 2,250,000 2,430,000 4,405,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts