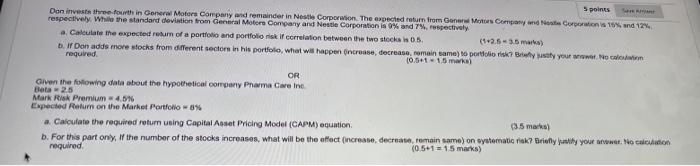

Question: fast please 5 points Den invests three fourth in General Motor Company and remainder in Nestle Corporation. The expected return from Gener Motor Company Coronis

5 points Den invests three fourth in General Motor Company and remainder in Nestle Corporation. The expected return from Gener Motor Company Coronis 1 and 12% respectively. While the standard deviation from General Motor Company and Nestle Corporation is 0% and 7 spectively a Calculate the expected return of a portfolio and portfolio nisk if correlation between the two stock 05. (12.5 3.5 mars . I Don adds more socks from different sectors in his portfolio, what will happen increase, decrease, romain same) to portfolio risk? Byty your row. No cal required 10.5+115 marka OR Given the following data about the hypothetical company Pharma Care Ine. Beta2.5 Mark Risk Premium 4.676 Expected Return on the Market Portfolio 0% a. Calculate the required return using Capital Asset Pricing Model (CAPM) equation (35 marks) b. For this part only. If the number of the stocks increases, what will be the effect (increase, decrease remain sama) on systematic risk? Briefly Wily your owwe. No con required (0.51 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts