Question: fast please ( i will give you more thumbs) ASAP just the answer mo detalis 20000-5000)(0.6)+(.4)(18000)= 16200 its ok but if you can refund please

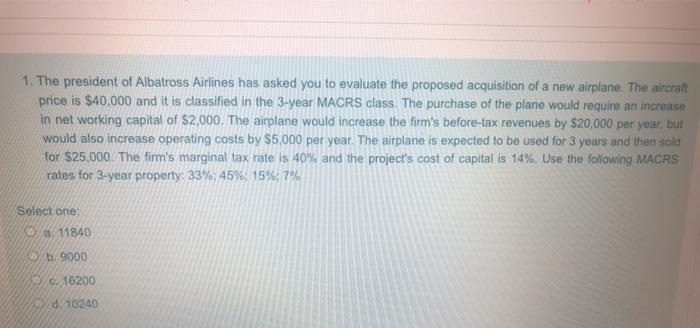

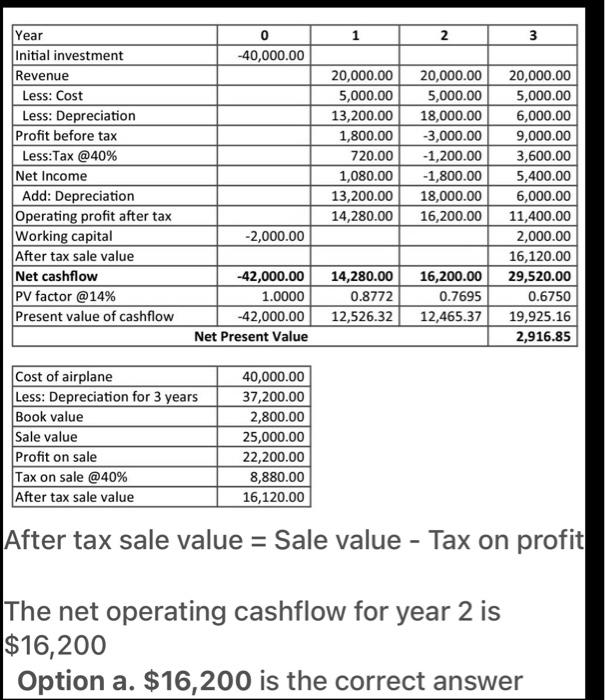

1. The president of Albatross Airlines has asked you to evaluate the proposed acquisition of a new airplane. The aircraft price is $40.000 and it is classified in the 3-year MACRS class. The purchase of the plane would require an increase in net working capital of $2,000. The airplane would increase the firm's before-tax revenues by $20,000 per year, but would also increase operating costs by $5,000 per year. The airplane is expected to be used for 3 years and then sold for $25,000. The firm's marginal tax rate is 40% and the project's cost of capital is 14%. Use the following MACRS rales for 3-year property: 33%; 45% 15%: 7% Select one: a. 11840 b. 9000 . 16200 10240 1 2 3 0 -40,000.00 Year Initial investment Revenue Less: Cost Less: Depreciation Profit before tax Less:Tax @40% Net Income Add: Depreciation Operating profit after tax Working capital After tax sale value Net cashflow PV factor @14% Present value of cashflow 20,000.00 5,000.00 13,200.00 1,800.00 720.00 1,080.00 13,200.00 14,280.00 20,000.00 5,000.00 18,000.00 -3,000.00 -1,200.00 -1,800.00 18,000.00 16,200.00 20,000.00 5,000.00 6,000.00 9,000.00 3,600.00 5,400.00 6,000.00 11,400.00 2,000.00 16,120.00 29,520.00 0.6750 19,925.16 2,916.85 -2,000.00 -42,000.00 1.0000 -42,000.00 Net Present Value 14,280.00 0.8772 12,526.32 16,200.00 0.7695 12,465.37 Cost of airplane Less: Depreciation for 3 years Book value Sale value Profit on sale Tax on sale @40% After tax sale value 40,000.00 37,200.00 2,800.00 25,000.00 22,200.00 8,880.00 16,120.00 After tax sale value = Sale value - Tax on profit The net operating cashflow for year 2 is $16,200 Option a. $16,200 is the correct answer Refund please the question 1. The president of Albatross Airlines has asked you to evaluate the proposed acquisition of a new airplane. The aircraft price is $40.000 and it is classified in the 3-year MACRS class. The purchase of the plane would require an increase in net working capital of $2,000. The airplane would increase the firm's before-tax revenues by $20,000 per year, but would also increase operating costs by $5,000 per year. The airplane is expected to be used for 3 years and then sold for $25,000. The firm's marginal tax rate is 40% and the project's cost of capital is 14%. Use the following MACRS rales for 3-year property: 33%; 45% 15%: 7% Select one: a. 11840 b. 9000 . 16200 10240 1 2 3 0 -40,000.00 Year Initial investment Revenue Less: Cost Less: Depreciation Profit before tax Less:Tax @40% Net Income Add: Depreciation Operating profit after tax Working capital After tax sale value Net cashflow PV factor @14% Present value of cashflow 20,000.00 5,000.00 13,200.00 1,800.00 720.00 1,080.00 13,200.00 14,280.00 20,000.00 5,000.00 18,000.00 -3,000.00 -1,200.00 -1,800.00 18,000.00 16,200.00 20,000.00 5,000.00 6,000.00 9,000.00 3,600.00 5,400.00 6,000.00 11,400.00 2,000.00 16,120.00 29,520.00 0.6750 19,925.16 2,916.85 -2,000.00 -42,000.00 1.0000 -42,000.00 Net Present Value 14,280.00 0.8772 12,526.32 16,200.00 0.7695 12,465.37 Cost of airplane Less: Depreciation for 3 years Book value Sale value Profit on sale Tax on sale @40% After tax sale value 40,000.00 37,200.00 2,800.00 25,000.00 22,200.00 8,880.00 16,120.00 After tax sale value = Sale value - Tax on profit The net operating cashflow for year 2 is $16,200 Option a. $16,200 is the correct answer Refund please the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts