Question: fast!!!!!! Question 2 1 pts When using the indirect method, which of the following adjustments to convert net income to net cash provided by operating

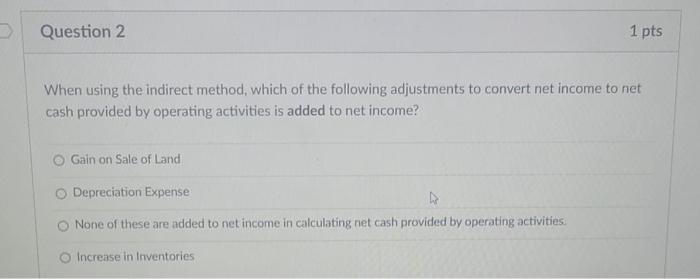

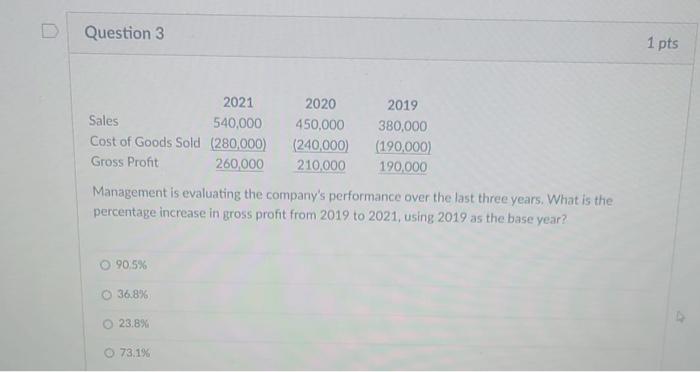

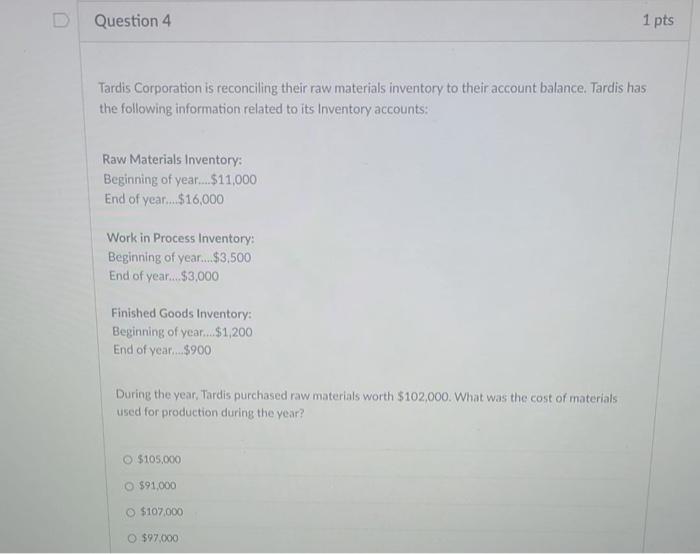

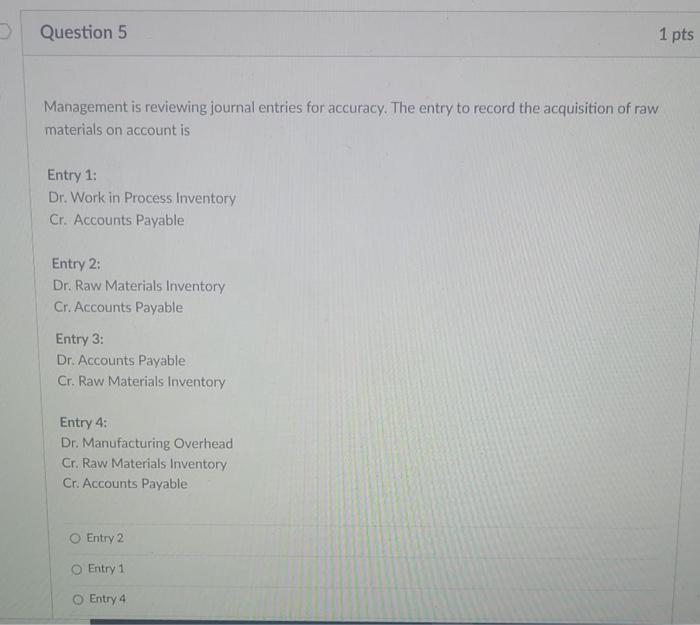

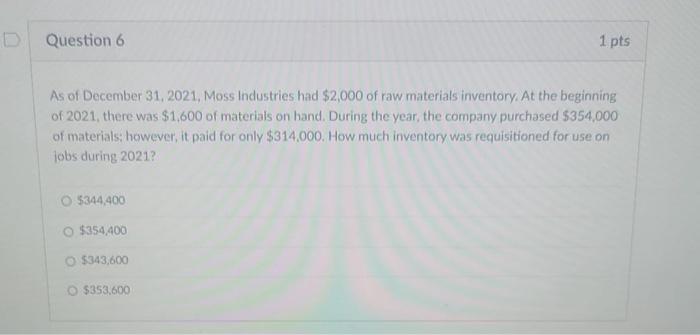

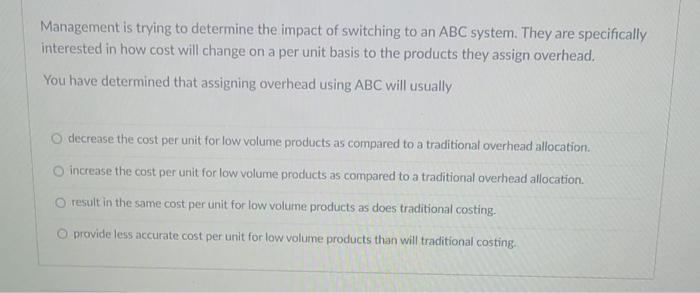

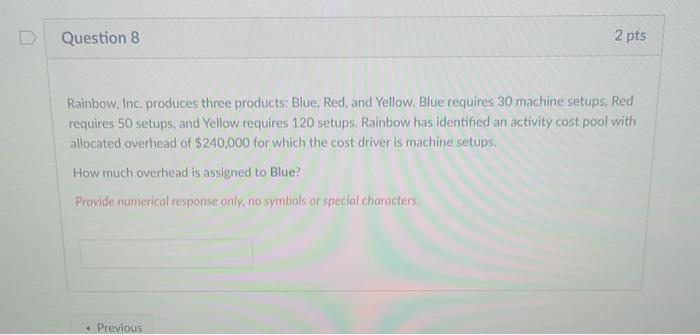

Question 2 1 pts When using the indirect method, which of the following adjustments to convert net income to net cash provided by operating activities is added to net income? Gain on Sale of Land Depreciation Expense None of these are added to net income in calculating net cash provided by operating activities Increase in Inventories Question 3 1 pts 2021 2020 2019 Sales 540,000 450,000 380,000 Cost of Goods Sold (280,000) (240,000) (190,000) Gross Profit 260,000 210,000 190,000 Management is evaluating the company's performance over the last three years. What is the percentage increase in gross profit from 2019 to 2021, using 2019 as the base year? 90.5% 36,8% 23.8% 73.1% D Question 4 1 pts Tardis Corporation is reconciling their raw materials inventory to their account balance. Tardis has the following information related to its Inventory accounts: Raw Materials Inventory: Beginning of year...$11,000 End of year... $16,000 Work in Process Inventory: Beginning of year. $3,500 End of year...$3,000 Finished Goods Inventory: Beginning of year...$1,200 End of year. $900 During the year, Tardis purchased raw materials worth $102,000. What was the cost of materials used for production during the year? $105.000 O $91.000 $107.000 O $97.000 Question 5 1 pts Management is reviewing journal entries for accuracy. The entry to record the acquisition of raw materials on account is Entry 1: Dr. Work in Process Inventory Cr. Accounts Payable Entry 2: Dr. Raw Materials Inventory Cr. Accounts Payable Entry 3: Dr. Accounts Payable Cr. Raw Materials Inventory Entry 4: Dr. Manufacturing Overhead Cr. Raw Materials Inventory Cr. Accounts Payable Entry 2 O Entry 1 Entry 4 D Question 6 1 pts As of December 31, 2021, Moss Industries had $2,000 of raw materials inventory. At the beginning of 2021, there was $1.600 of materials on hand. During the year, the company purchased $354,000 of materials: however, it paid for only $314,000. How much inventory was requisitioned for use on jobs during 2021? O $344,400 $354,400 $343,600 $353,600 Management is trying to determine the impact of switching to an ABC system. They are specifically interested in how cost will change on a per unit basis to the products they assign overhead. You have determined that assigning overhead using ABC will usually O decrease the cost per unit for low volume products as compared to a traditional overhead allocation. o increase the cost per unit for low volume products as compared to a traditional overhead allocation. O result in the same cost per unit for low volume products as does traditional costing- provide less accurate cost per unit for low volume products than will traditional costing. Question 8 2 pts Rainbow, Inc. produces three products: Blue, Red, and Yellow. Blue requires 30 machine setups, Red requires 50 setups, and Yellow requires 120 setups. Rainbow has identified an activity cost pool with allocated overhead of $240,000 for which the cost driver is machine setups How much overhead is assigned to Blue? Provide numerical response only, no symbols or special characters. Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts