Question: FastForwardAcademy rdacademy.com / lms / AFTR - 2 0 2 4 - Exam / 9 2 1 5 8 1 9 2 0 2 2

FastForwardAcademy

rdacademy.comlmsAFTRExam

CCHS Liv...

KDE Licensure

MyAccount Americ...

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

History Grant Pro

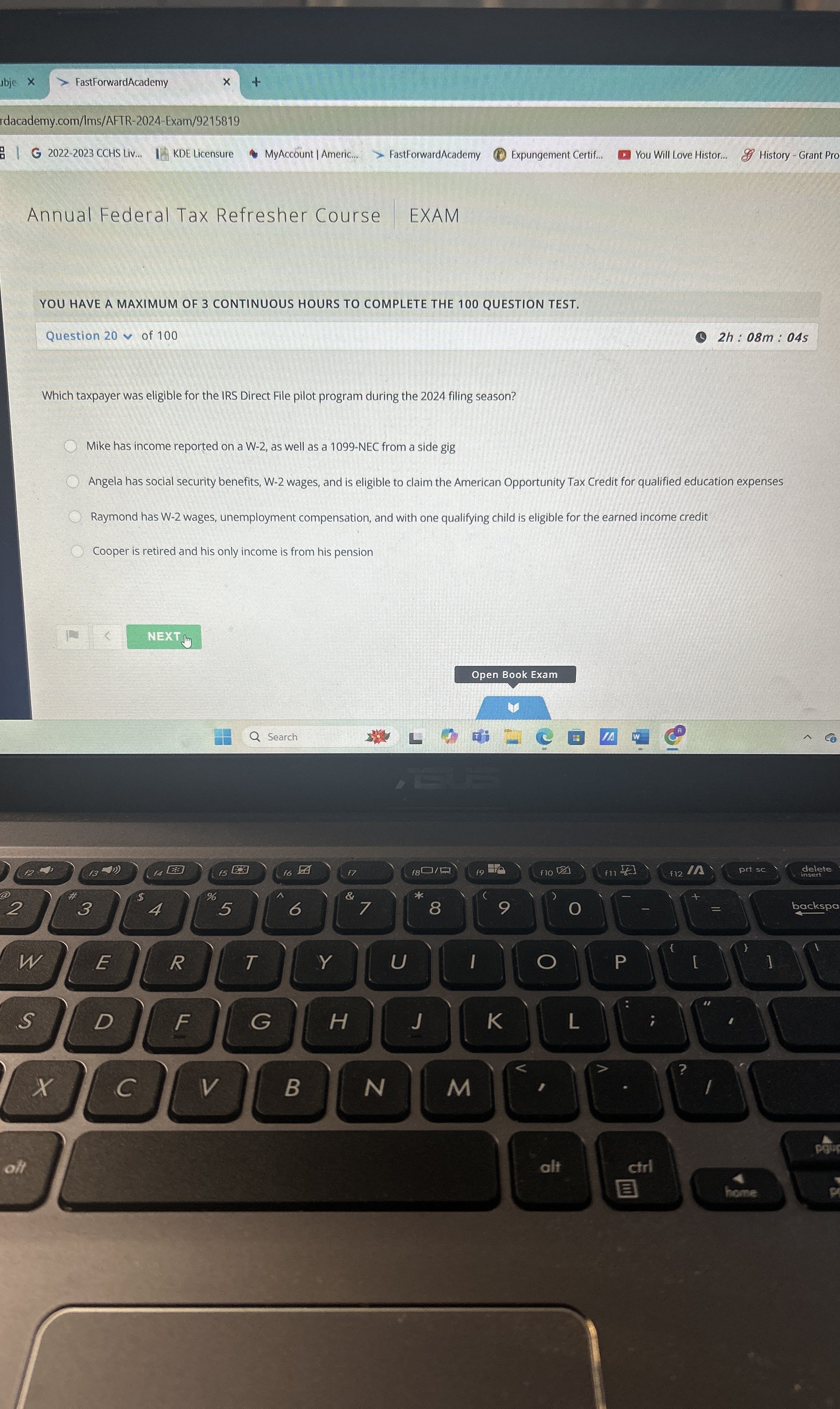

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

::

Which taxpayer was eligible for the IRS Direct File pilot program during the filing season?

Mike has income reported on a W as well as a NEC from a side gig

Angela has social security benefits, W wages, and is eligible to claim the American Opportunity Tax Credit for qualified education expenses

Raymond has W wages, unemployment compensation, and with one qualifying child is eligible for the earned income credit

Cooper is retired and his only income is from his pension

Open Book Exam

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock