Question: fastforwardacademy.com / lms / AFTR - 2 0 2 4 - Exam / 9 2 1 5 8 1 9 2 3 - 2 4

fastforwardacademy.comlmsAFTRExam

G CCHS Liv...

KDE Licensure

MyAccount Americ...

FastForwardAcademy

Expungement Certif...

You Will Love Histor.

History

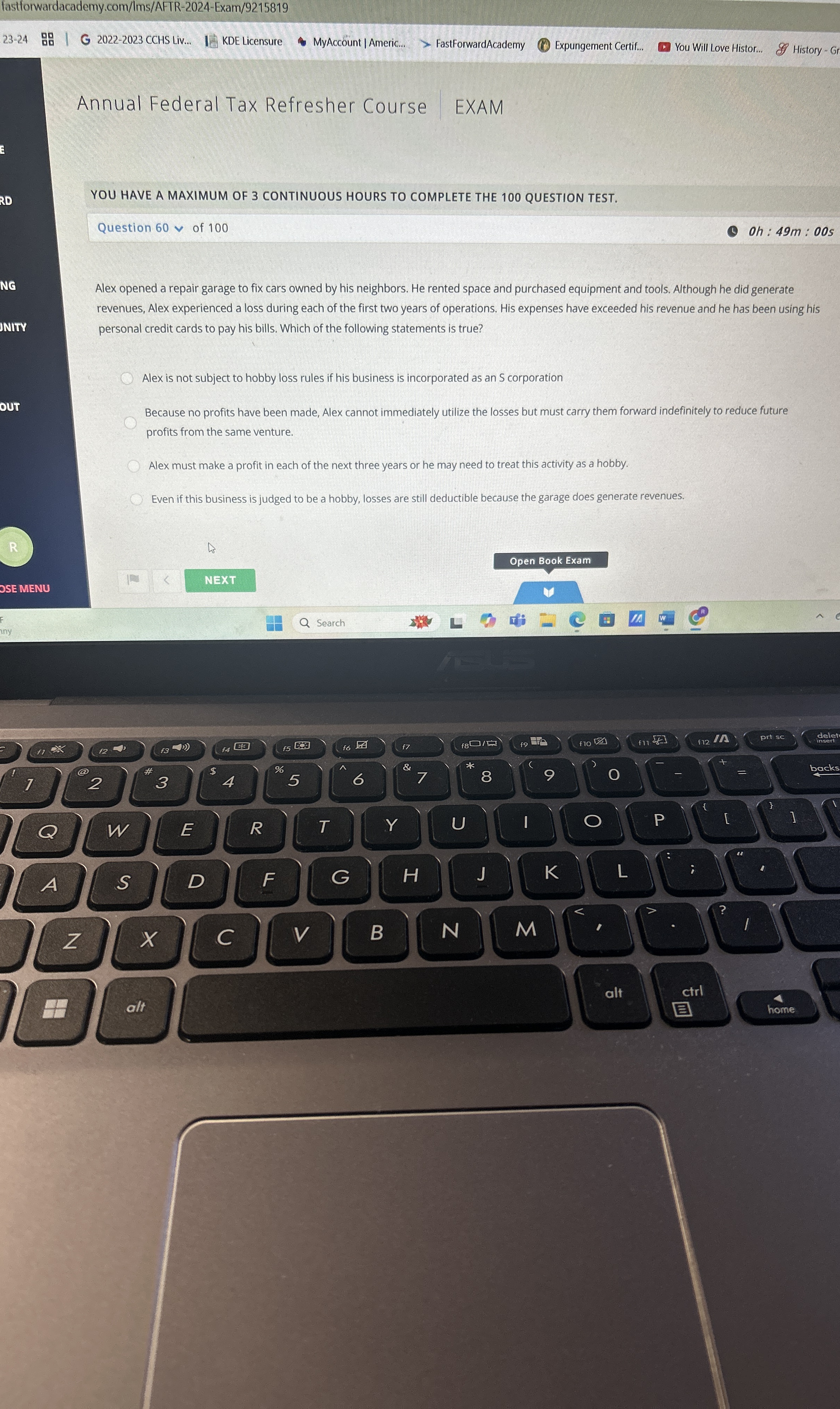

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

oh : :

Alex opened a repair garage to fix cars owned by his neighbors. He rented space and purchased equipment and tools. Although he did generate revenues, Alex experienced a loss during each of the first two years of operations. His expenses have exceeded his revenue and he has been using his personal credit cards to pay his bills. Which of the following statements is true?

Alex is not subject to hobby loss rules if his business is incorporated as an S corporation

Because no profits have been made, Alex cannot immediately utilize the losses but must carry them forward indefinitely to reduce future profits from the same venture.

Alex must make a profit in each of the next three years or he may need to treat this activity as a hobby.

Even if this business is judged to be a hobby, losses are still deductible because the garage does generate revenues.

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock