Question: fastforwardacademy.com / lms / AFTR - 2 0 2 4 - Exam / 9 2 1 5 8 1 9 hools 2 3 - 2

fastforwardacademy.comlmsAFTRExam

hools

CCHS Liv...

I. KDE Licensure

MyAccount Americ....

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

History Grant Prof...

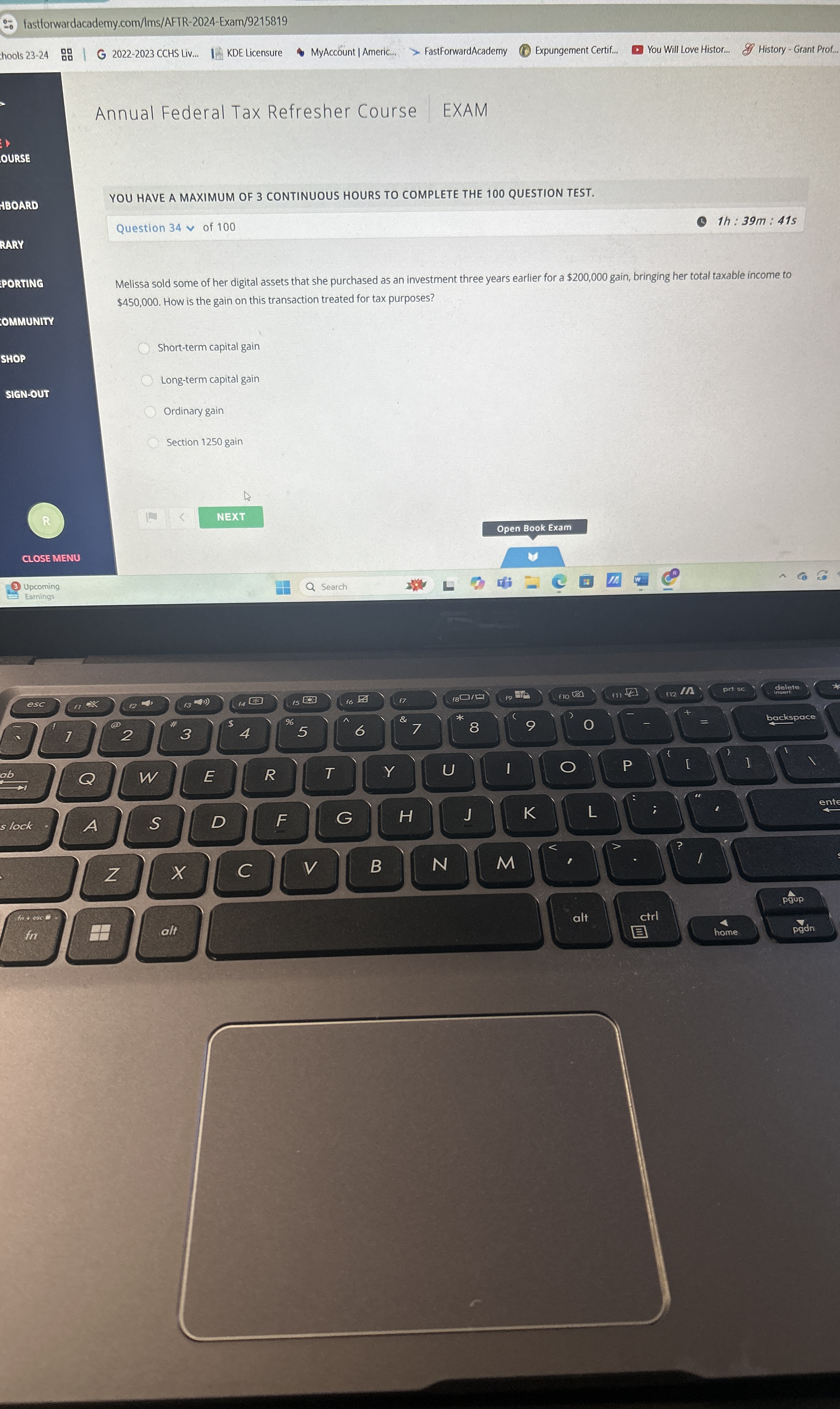

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

h : m : s

Melissa sold some of her digital assets that she purchased as an investment three years earlier for a $ gain, bringing her total taxable income to $ How is the gain on this transaction treated for tax purposes?

OMMUNITY

SHOP

SICNOUT

Shortterm capital gain

Longterm capital gain

Ordinary gain

Section gain

Open Book Exam

CLOSE MENU

Upcoming

Earnings

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock