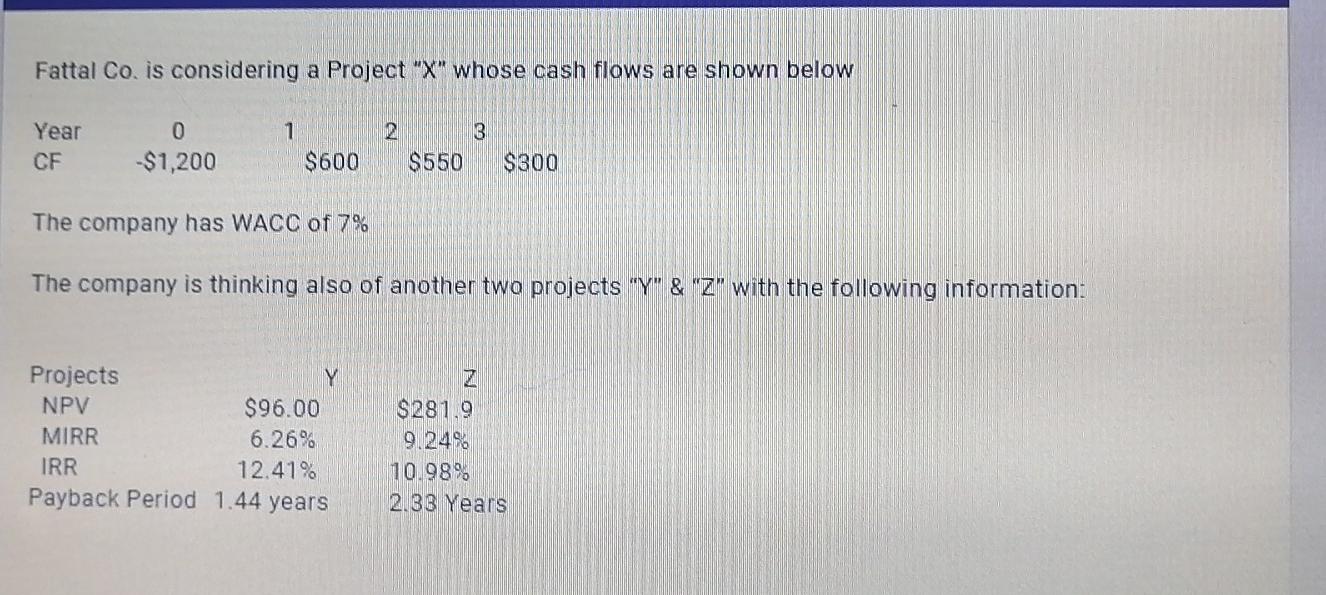

Question: Fattal Co. is considering a Project X whose cash flows are shown below 1 2 3 Year CF 0 -$1,200 $600 $550 $300 The company

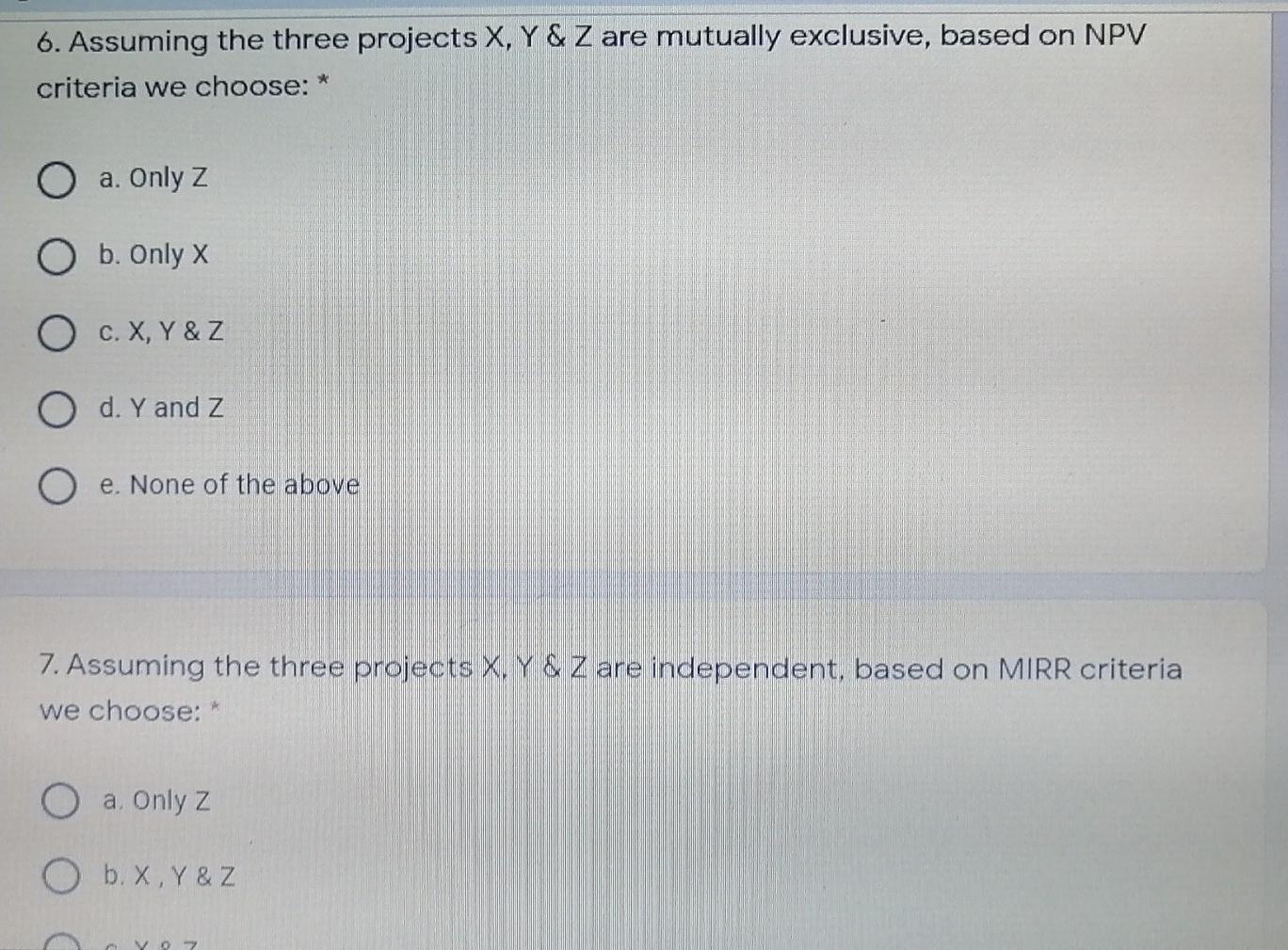

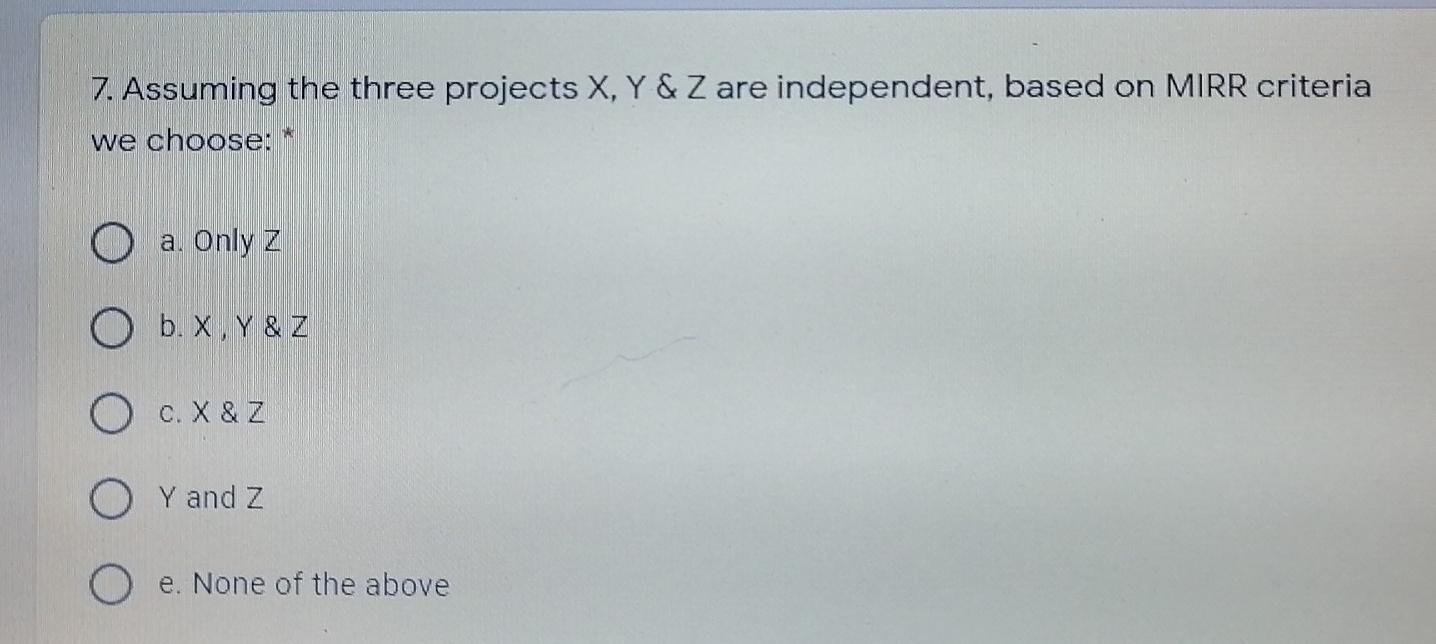

Fattal Co. is considering a Project "X" whose cash flows are shown below 1 2 3 Year CF 0 -$1,200 $600 $550 $300 The company has WACC of 7% The company is thinking also of another two projects "Y" & "Z" with the following information: Projects Y NPV $96.00 MIRR 6.26% IRR 12.41% Payback Period 1.44 years $281.9 9.24% 10.98% 2.36 Years 6. Assuming the three projects X, Y & Z are mutually exclusive, based on NPV criteria we choose: * O a. Only z b. Only X O c. X,Y & Z O d. Y and Z O e. None of the above 7. Assuming the three projects X,Y & Z are independent, based on MIRR criteria we choose: * O a Only z O b. x, r & Z y Oy 7. Assuming the three projects X, Y & Z are independent, based on MIRR criteria we choose: O a. Only z O b. X.Y&Z O c. X & Z O Y and Z O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts