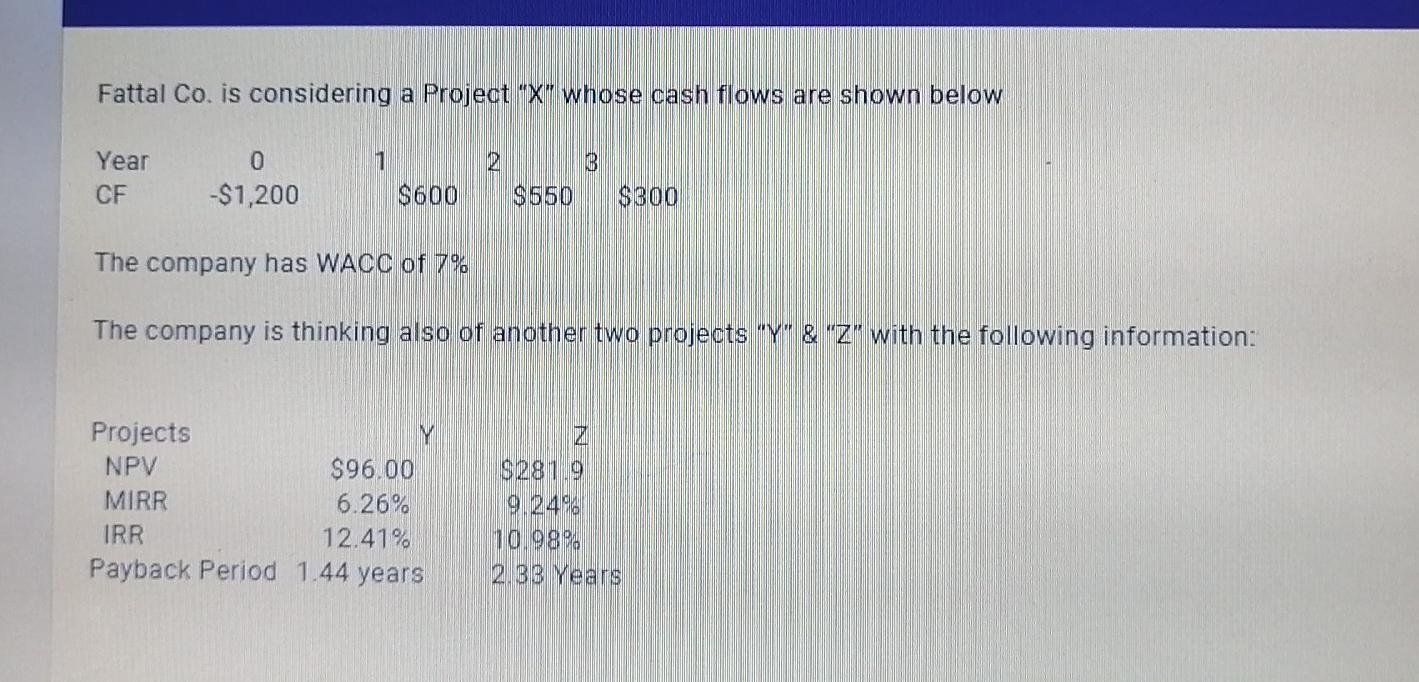

Question: Fattal Co. is considering a Project X whose cash flows are shown below 1 2 3 Year CF 0 -$1,200 $600 $650 $300 The company

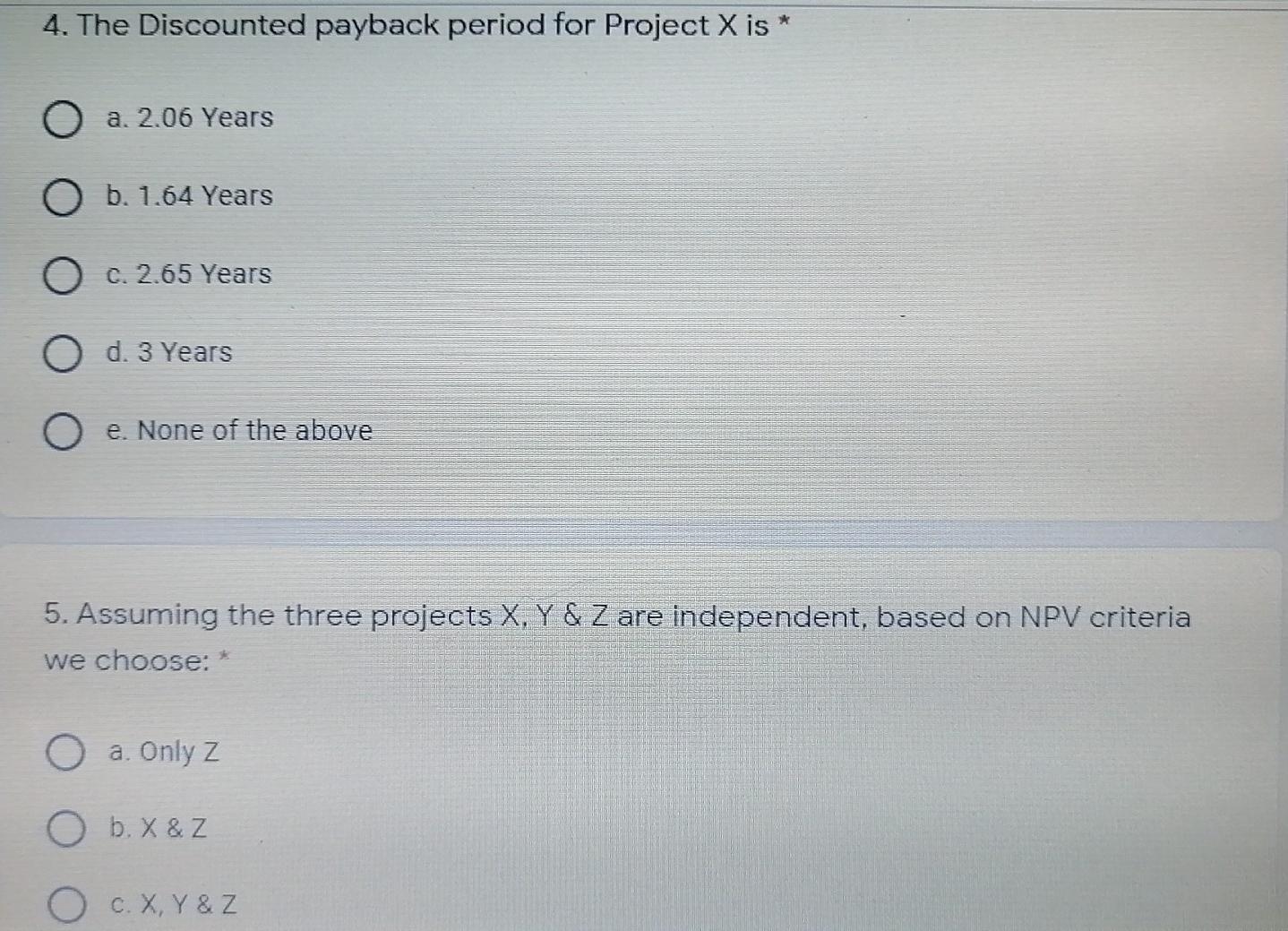

Fattal Co. is considering a Project "X" whose cash flows are shown below 1 2 3 Year CF 0 -$1,200 $600 $650 $300 The company has WACC of 7% The company is thinking also of another two projects "Y" & "Z" with the following information: Projects M NPV $96.00 MIRR 6.26% IRR 12.41% Payback Period 1.44 years 92819 9.246 10.98% 2.33 Years 4. The Discounted payback period for Project X is * O a. 2.06 Years O b. 1.64 Years O c. 2.65 Years O d. 3 Years O e. None of the above 5. Assuming the three projects X, Y & Z are independent, based on NPV criteria we choose: * O a. Only z O b. X & Z c. X, Y & Z 5. Assuming the three projects X, Y & Z are independent, based on NPV criteria we choose: a. Only z b. X & Z C. X, Y & Z d. None e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts